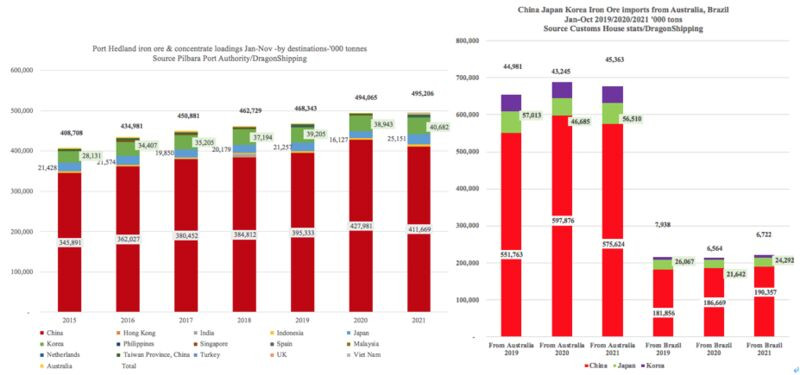

Port Hedland is the largest iron ore export port, which serves BHP and FMG in WA. The annual loadings in 2020 amounted to 540 million tons which took up 62% of whole Aussie's export, 47% of global ocean shipping volume as per Bancosta Research (Refinitiv).

The first 11 months 2021 saw the port's whole iron ore volume rising by 0.2%, namely 1.14 million tons as per Pilbara Port Authority, reaching 495.206 million tons. But China destination was reduced by 16.31 million tons, roughly 90 shipments (average shipment from Port Hedland is 184,000 mts per ship in 2021), making China destination down to 411.67 million tons.

Then the question is who are on the list of increase?

Stats show in the first 11 months, China share reduced from peak 86.62% 2020 to 83.13% this year, the second lowest since 2015.

Japan did 25.151 million tons by adding 9.024 million tons on top of last year's; Vietnam shows more aggressive to iron ore commodity, it bought 4.378 million tons this year which are 4.121 million tons more than that of last year; Korea added 1.739 million tons on top of 2020 reaching 40.682 million tons; Indonesia added 0.89 million tons.

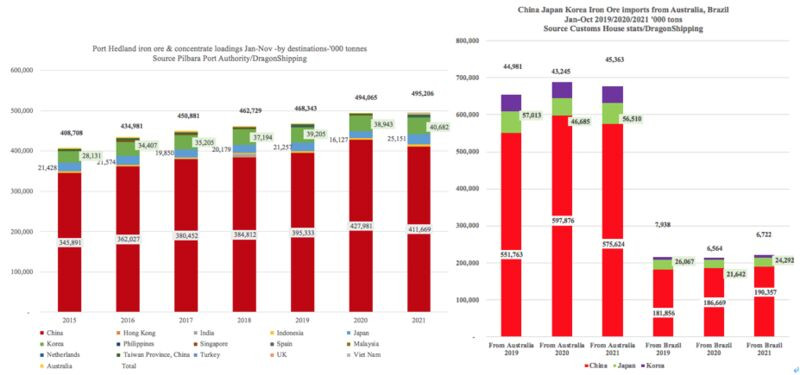

As per detailed customs stats, in the first 10 months, China took 575.624 million tons from Australia; Japan bought 56.510 million tons from Australia and Korea did 45.363 million tons, which makes the total Aussie sales to the three majors to 677.497 million tons, 10.309 million tons less than same period of last year.

But Brazil did more to all the three major buyers. China bought 190.357 million tons of Brazilian ore, Japan did 24.292 million tons and Korea got 6.722 million tons, the aggregate of the three buyers shows 6.497 million tons more than same period of last year, which is pretty good for ton-miles.

Source: Simon Young

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in