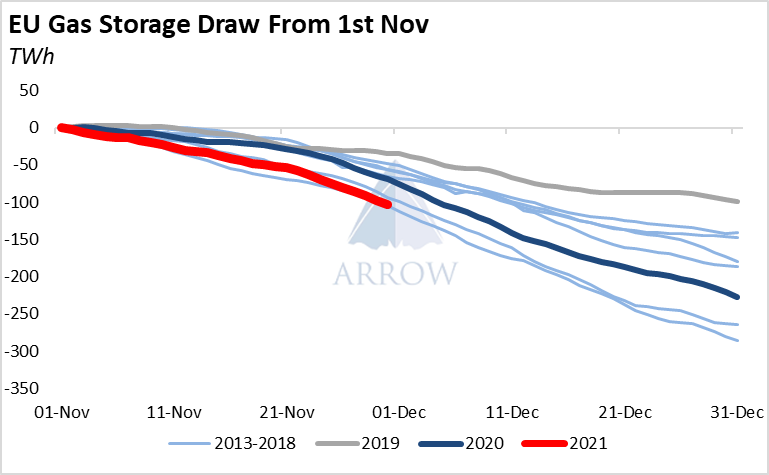

EU gas storage levels are starting the heating season with a sharp draw, both on a percentage and an absolute level. Insufficient Russian pipeline flows alongside fierce competition for seaborne LNG has meant demand is outstripping supply faster than usual.

During November, power, gas and carbon prices have marched higher. Hopes of significant Russian gas flows have faded whilst COP optimism has bolstered carbon. Coal has notably sold off in the past week, however strong clean dark spreads show how coal remains very favourable in the power stack.

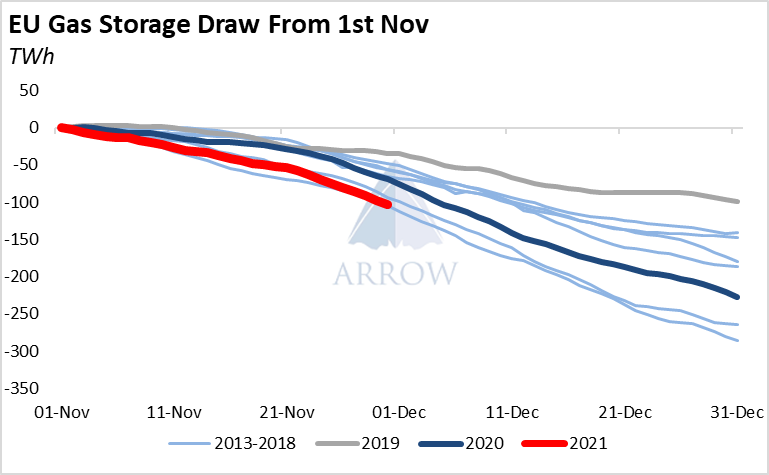

Strong clean dark spreads over the past few months are now feeding into EU coal imports which have rocketed higher during November.

Due to the shutdowns of coal plant capacity in Europe, coal imports will not hit previous highs, however this higher level of imports is sustainable over the coming winter, and to a lesser extent next winter too. Forward prices indicate coal will be more profitable to burn than gas during the whole of next winter as the gas tightness cascades into the next storage season.

The global energy shortage is not showing signs of swiftly resolving itself, and Europe is falling victim. Industry is struggling to absorb high power prices, with some facilities slowing production. China has been facing similar issues for months and has ramped up domestic coal supply alongside imports which is easing the supply-demand mismatch. However as the EU is heavily reliant on coal imports, we can expect import volumes will stay elevated for some time.

Source: Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in