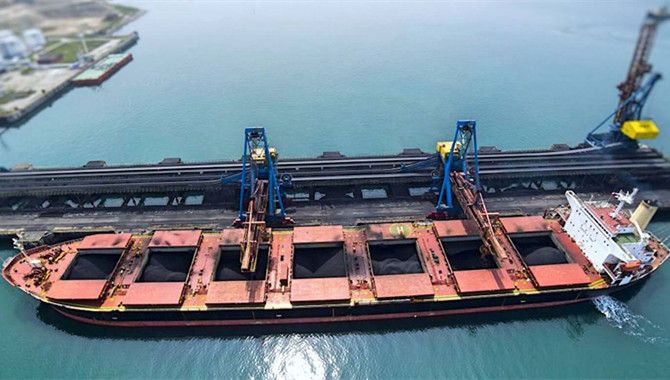

China's benchmark metallurgical coal and coke futures surged to record highs on Thursday, driven by fears of a prolonged tightness in supply of the steelmaking materials in the world's top steel producer.

The most-traded January metallurgical or coking coal on the Dalian Commodity Exchange DJMcv1 ended daytime trading 7.2% higher at 3,049.50 yuan ($472.00) a tonne, after touching a life-high of 3,071.50 yuan.

Coke DCJcv1 climbed 5.3% to 3,787.50 yuan a tonne, rising for a ninth straight session, but was off its peak of 3,838.50 yuan.

A coal supply crunch that China had expected to ease in July continued to rattle its mammoth steel sector as local mines face tougher environmental and safety restrictions. Imports, meanwhile, were dampened by a ban on Australian coal and COVID-19 curbs hampering shipments from Mongolia.

Analysts said coking enterprises, particularly in Shanxi and Shandong provinces, have been pummelled by tougher environmental protection and safety surveillance by authorities.

China said on Tuesday it was willing to buy more mineral and agriculture products from Mongolia and would work with it to ensure unimpeded trade across their border.

“China's coking coal prices have risen 90% over the past five months as supply concerns rise. A better trading relationship with Mongolia is expected to alleviate this somewhat,” analysts at London-based corporate finance firm SP Angel said in a note.

As coking coal and coke scale new peaks, iron ore – another steelmaking ingredient – remained under pressure amid a slowdown in China's steel production.

The most-active January Dalian iron ore contract DCIOcv1 dropped 2.7% to 730 yuan ($113) a tonne, after earlier hitting 717.50 yuan, its weakest since Feb. 4.

October iron ore on the Singapore Exchange SZZFV1 slumped 1.6% to $129.50 a tonne by 0710 GMT.

Rebar on the Shanghai Futures Exchange SRBcv1 rose 4.5%, while hot-rolled coil SHHCcv1 advanced 2.7%. Stainless steel SHSScv1 gained 1.2%.

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in