China's domestic thermal coal demand will continue to weaken in the coming days because of rising spring temperatures, although demand will rebound by March when industries fully reopen after the lunar new year holiday.

China's week-long lunar new year holiday officially ended on 17 February. It usually takes around a month after the holiday for China's industries to fully reopen, although this is expected to be shortened to around two weeks because of government restrictions on inter-provincial travel over the holidays to curb the latest Covid-19 outbreak.

Temperatures in many parts of China, including the northeast of the country where heating demand had been particularly strong since late last year, are expected to rise by 10-20°C in the coming days, according to the country's meteorological administration. Parts of the country could experience temperatures more typical of the warmer months of April-May, the administration said. This will curtail heating demand, although the administration also warned of volatile weather conditions in the coming weeks.

"We expect some tenders to be issued by utilities soon for thermal coal, but it is not yet easy to gauge the level of market interest in seaborne cargoes from China," a Singapore-based trader said. "Spot prices of iron ore and coking coal have risen but thermal coal prices have fallen and we need to observe further before we can place any firm bids for March-loading seaborne coal."

Output increase

China's thermal coal prices also face downwards pressure from rising output, as some domestic producers take a longer term approach to raise capacity despite weaker short-term demand, so as to avoid the shortages faced by the country late last year when a severe cold snap boosted heating demand at a time when domestic output failed to compensate for import curbs.

State-owned coal producer Longmay Mining, which is based in northeast China's Heilongjiang province, produced 3.39mn t of all types of coal in January, an increase of 826,100t from a year earlier, the company said. Heilongjiang is expected to consume 120mn t of coal this winter, market participants predict, putting pressure on domestic producers to plan early to raise capacity.

China's national output for January-February has not yet been released by the national bureau of statistics.

Chinese coal producers will also be encouraged by a statement from the ministry of emergency of no mining accidents during the holiday. Safety inspections at mines are typically stepped up during the accident-prone winter period, discouraging producers from aggressively raising output. The statement from the ministry and the end of the peak winter demand season could be seen as signs that safety inspections on the coal sector will ease, encouraging producers to raise output.

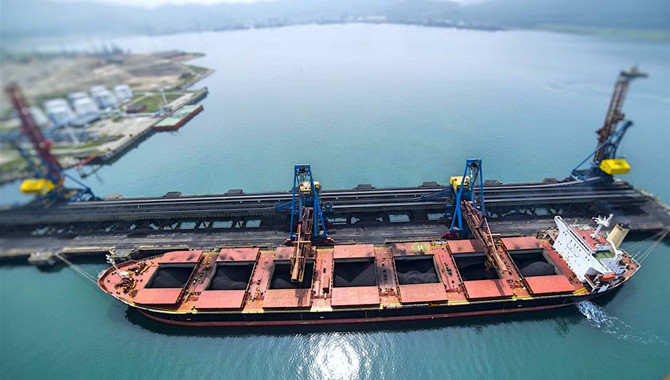

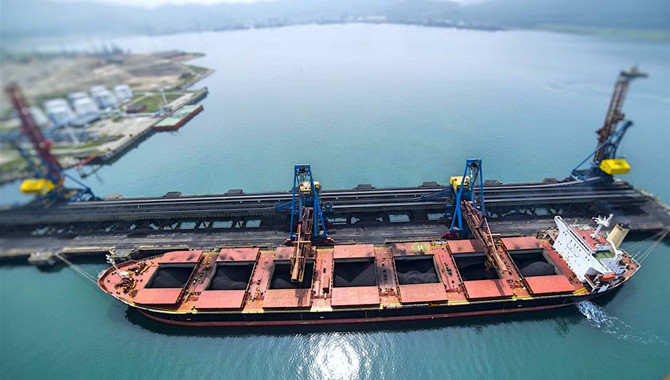

Some cargoes of seaborne coal recently bought by Chinese importers have arrived at Chinese ports and may have already received customs clearance, potentially weighing on spot prices by raising availability.

March rebound

China's demand for seaborne coal is centred on its heavily populated industrial coastline. Many coastal industries began resuming operations on 16 February. Some Chinese market participants expect industrial demand for electricity to fully resume by late February or early March.

But an abundance of stocks in China encourages importers to take a cautious approach to booking March-loading seaborne cargoes.

A possible resumption of cement production, which was suspended in many parts of China for environmental reasons in January, would spur the nation's appetite for coal by absorbing existing stocks as the cement sector is a large-scale coal consumer.

Source:Argus

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in