Global steel production figures were as shocking as the rest of the macro data released for April. Output was down 13% year on year during the month. Ex-China figures were even worse with production falling by 28.5%. May figures are not released yet, but they are likely to be similarly bad if not worse.

China,by contrast, managed to raise its output marginally by 0.2% in April, after a 1.7% drop in March. Total production during the first four months of the year was up 1.1%. High-frequency data suggests that production recovered further in May.

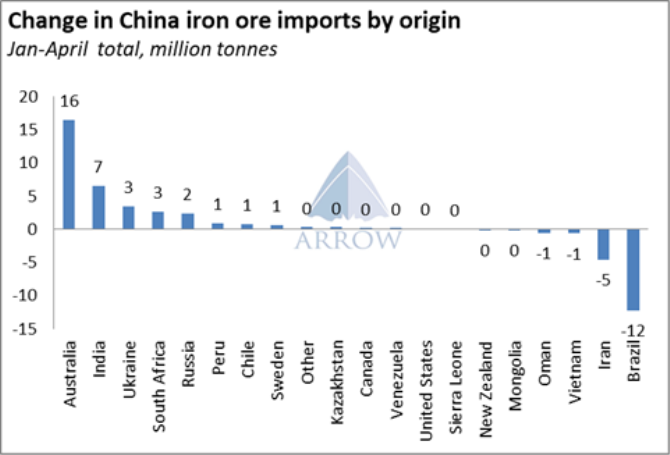

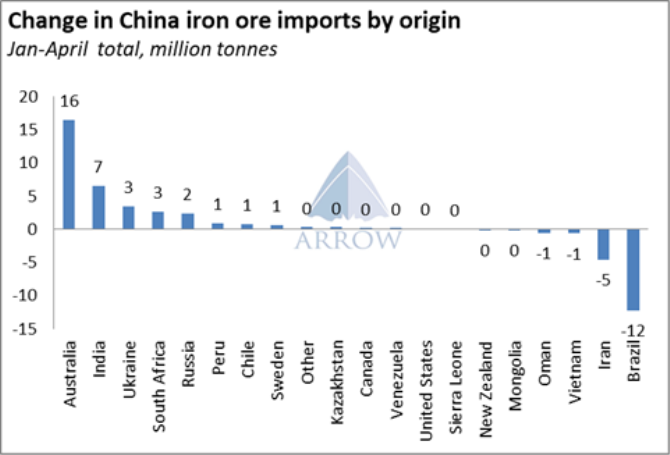

Depressed ex-China steel demand and underperforming Brazilian supply saw some of the producers that typically ship iron ore to Europe and Northeast Asia divert cargos to China. Ukraine, Canada and Russia benefitted the most from the trade diversion with their exports to China rising 166%, 77% and 12% year-on-year during the first five months. Their shipments in May were particularly strong, partly due to the lacklustre volumes out of Brazil.

We think that this trade diversion will continue in the coming weeks, but it has likely peaked. We estimate about 50-70mt of ex-China iron ore demand could be lost during the rest of the year and China would probably absorb most of the displaced tonnes.

However, there are also signs that we have now probably moved past the lowest point of the global demand cycle. Spot steel prices ex-China appear to have bottomed out already, signalling a demand recovery.

Brazilian shipments have also been improving over the past three weeks. It is unclear whether the recovery in shipments can be sustained. However, Vale reiterated its production guidance of 310-330mt earlier this week, implying a strong pick up in exports for the rest of the year.

Source:Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in