Australian coal, gas and iron ore exports to China have surged as Beijing threatens economic retaliation for the Morrison government's pursuit of an independent inquiry into the coronavirus.

New figures also show China is increasingly pursuing business interests elsewhere as investment in Australia plummets by more than 200 per cent over four years and it threatens trade strikes on more vulnerable sectors.

The data shows China is using Australian resource exports to power its post-coronavirus economy at the same time as it targets less valuable but politically sensitive areas such as beef and barley to put pressure on the Australian government.

After weeks of being accused by Beijing of being a puppet for the United States and pushing a politically motivated probe, the Australian government will lobby strongly for the global COVID-19 inquiry to be established at the World Health Assembly on Sunday.

Prime Minister Scott Morrison rejected Beijing's threats in Canberra on Thursday. “What we will never do is trade our values,” he said.

Former prime minister Malcolm Turnbull accused China of being a bully. “When you're dealing with imperial powers, you've got to stand your ground, make your case, conduct yourself in a way that is courteous and play a straight bat,” he told the McKell Institute on Thursday.

This came as former opposition leader Bill Shorten and Labor’s foreign affairs spokeswoman Penny Wong backed the Australian Workers' Union's national secretary Daniel Walton, who called on the Prime Minister to “stand up to Chinese [government’s] threats and trade cheating.”

“All countries should play by the rules,” Mr Shorten tweeted in support of his old union. “No exceptions just because they’re big.”

New Foreign Investment Review Board figures show Chinese investment in Australian agriculture, resources and real estate has fallen from $47 billion in 2015-16 to $15 billion in 2018-19. The 213 per cent drop comes follows rising political animosity between Australia and China under both the Turnbull and Morrison governments and tighter foreign investment rules.

The period covers the introduction of foreign interference legislation, a ban on Chinese telco firm Huawei and rising diplomatic tension.

That tension peaked this week when China launched two trade strikes on Monday and Tuesday of up to $1 billion in Australian beef and barley exports. Australia is the only country in the world to have two trade hits in a row. As of Thursday afternoon, Trade Minister Simon Birmingham still has yet to have direct contact with his Chinese counterpart Zhong Shan.

The federal government and industry figures believe other agriculture sectors including wine, dairy and seafood remain vulnerable to further trade strikes, but Australia's largest exports coal, iron ore and LNG, worth $80 billion a year, remain relatively secure with few other competitors outside of Brazil.

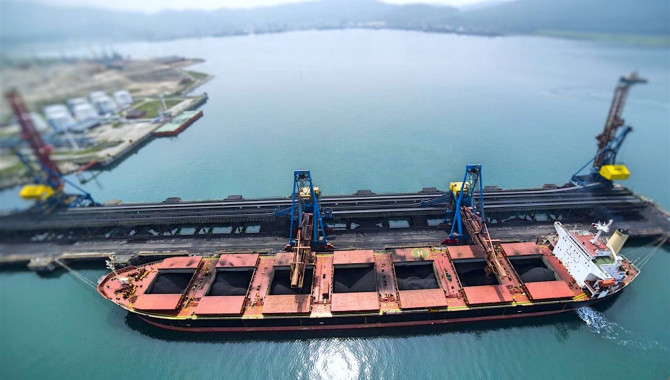

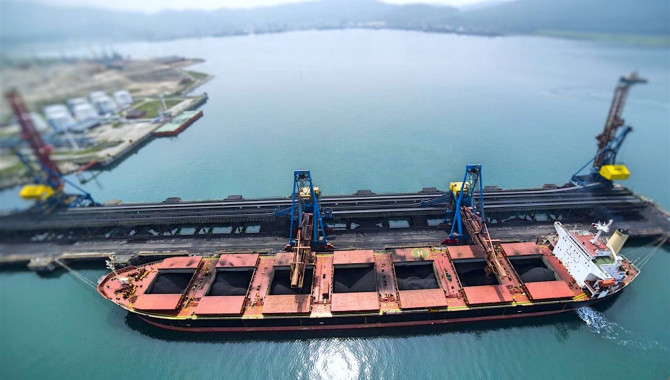

In March, imports of Australian coal rose sharply as China looked to reboot its economy from the pandemic and the price of coking coal dropped. Chinese customs data shows imports of Australian coking coal hit 4.3 million tons in March, an increase of 105 per cent from March 2019. Imports from Australia accounted for more than three quarters of all Chinese coking coal imports.

LNG exports are also increasing. The sector has longer terms contracts but Australian projects delivered 40 cargoes to China in April, up from 29 in March and 36 in April 2019, according to figures released on Thursday by Energy Quest.

Department of Foreign Affairs and Trade figures show iron ore rebounded by more than 32 per cent in March, after falling by 9 per cent at the peak of the pandemic and Australia’s introduction of a China travel ban on February 1. The ban on all non-Australian residents travelling from China was condemned by Beijing and kicked off the latest round of diplomatic sparring.

The jump in exports came before Chinese state media warned on Wednesday that “Australia is not necessarily the only option for China” and that Brazil could “supply huge amounts of iron ore, coal or LNG to China” if it did not prevent bilateral relations from deteriorating further.

But analysts believe that the level of post-pandemic demand from China is likely to override any temporary political stoush. Australian National University research shows that over 30 years trade has dropped by an average of 1.6 per cent before returning to normal three months after each political dispute.

Commonwealth Bank economist Joseph Capurso said the increase in resources exports was likely to continue as the Chinese government focuses on an infrastructure led economic stimulus package that will be reliant on iron ore to make steel and coal and gas to power the country.

“The Chinese government’s fiscal easing has focused on traditional commodity heavy infrastructure,” he said.

In the two sectors already hit by trade strikes, beef and barley, China has begun pivoting away from Australian imports. It announced US barley had been cleared for import on Thursday, while it is also pursuing agreements with Kazakhstan and Uruguay. Russia has begun importing hundred of tonnes of beef into China.

In Beijing, consumers and shopkeepers said they were not fazed by the trade dispute as Australian wine, beef and cheese continues to stock the shelves of global supermarket giants and local chains. Beef from Kilcoy abattoir in Queensland, one of the facilities targeted in the trade dispute over packaging claims, was on sale at Carrefour supermarket in east-Beijing on Wednesday.

A saleswoman at Yonghui Superstore in Tongzhou district said customers only asked whether it’s domestic or imported beef, rather than which country it is from.

“I’ll look at the price, freshness, and origin of the beef,” said Yonghui customer Mr Zhang, who declined to give his last name. “But as an ordinary customer, I won’t put international relations into consideration when buying goods.”

Source:Sydney Morning Herald

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in