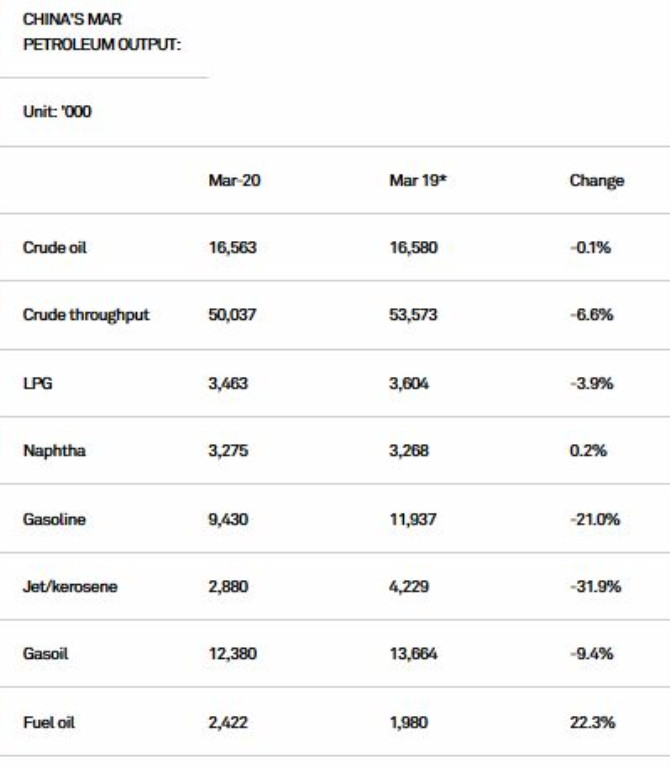

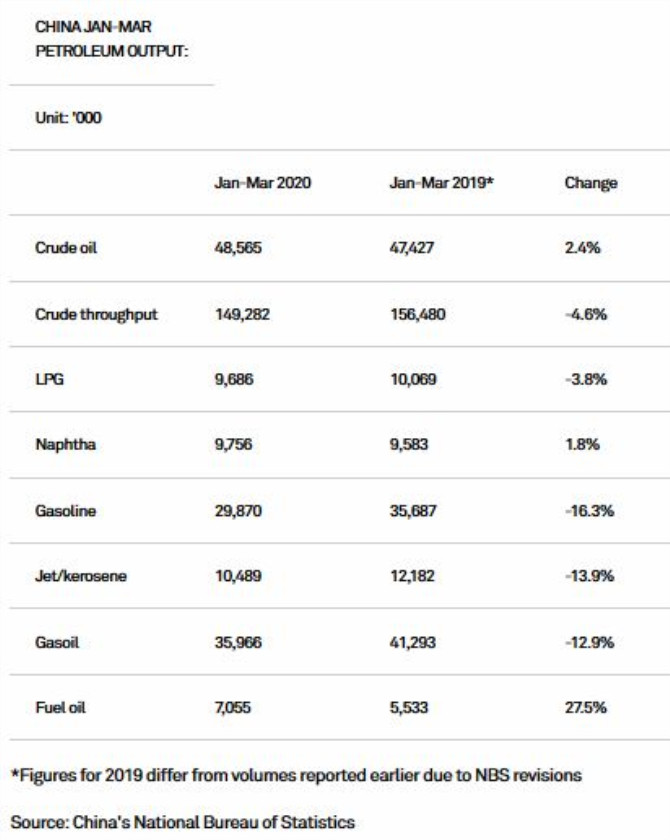

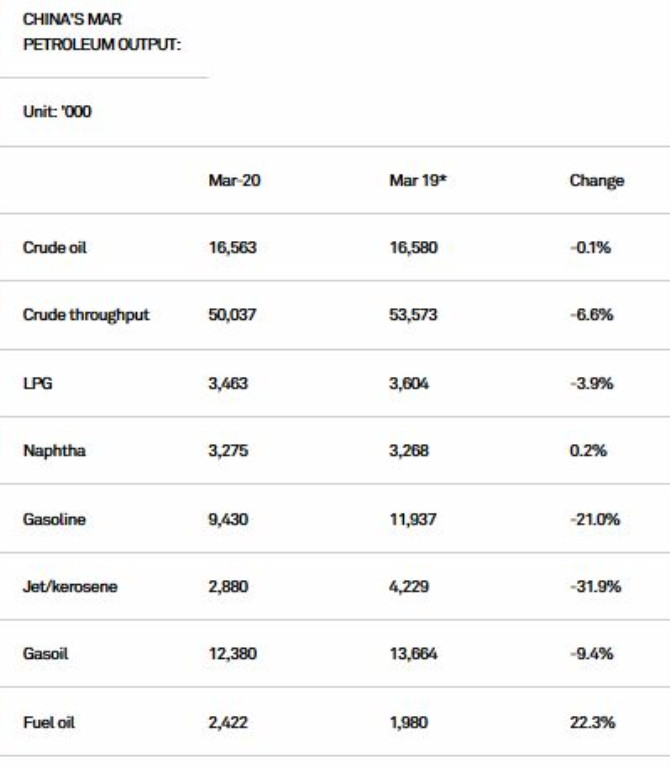

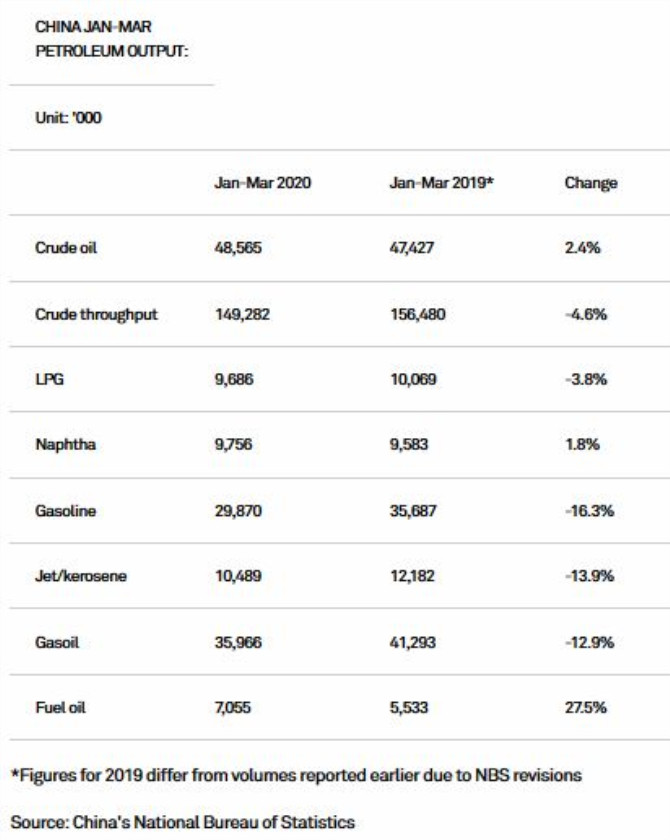

China’s overall output of six major oil products — LPG, naphtha, gasoline, jet/kerosene, gasoil and fuel oil — fell by an average of 12.5% year on year at 33.85 million mt in March, the lowest monthly output since October 2014, and heavier than the 6.6% decline in crude throughput during the month, latest data from the National Bureau of Statistics, or NBS, showed Tuesday.

NBS did not release the monthly output data for January and February.

The total volume of the six major oil products accounted for 67.6% of total crude throughput in March, down from 72.2% a year ago, NBS data showed.

The low product output combined with the second-highest ever oil product exports of 7.26 million mt in the month suggested a high product inventory in March given the slow recovery in demand as the resumption in economic activity has been gradual. In a bid to offset prevailing high inventories, oil product exports from China has been climbing.

That said, S&P Global Platts Analytics estimated China’s total oil demand slumping 12% year on year in the first-quarter, with declines of 21.3% for gasoline, 10.5% for gasoil and 34.5% for kerosene/jet fuel. Meanwhile, it expects the decline in China’s oil demand to ease to 7.2% year on year in Q2. For 2020, it estimated the country’s oil demand at 14.41 million b/d, down 2% year on year.

JET/KEROSENE SLUMPS 32% ON YEAR

Jet fuel/kerosene production accounted for the bulk of the decline in net output, which recorded the biggest year on year decline of 31.9% to 2.88 million mt as the barrels failed to find alternative homes amid the nationwide travel restrictions.

In March, the Civil Aviation Authority of China issued a new policy to curb the spread of the coronavirus pandemic. Under the new policy, all Chinese airlines may maintain no more than one international route per country and operate no more than one frequency per route per week. Similarly, foreign airlines may operate no more than one route to China and one frequency per route per week, Sydney based consultancy CAPA said.

“Demand [for jet fuel] is still not there … flights are still being grounded, and there will be an overhang of this fear of flying, even if the virus situation improves overnight,” a Singapore-based trading source said.

Looking ahead, Chinese refineries will continue to minimize jet fuel output in April as demand from the aviation sector remains sluggish given their high inventory.

The number of daily flights, comprising both domestic and international, averaged 5,548 so far in April, around a third of the 16,135 flights recorded in January, but slightly higher from the 5,303 flights in February, VeriFlight data showed.

GASOLINE FALLS 21% ON YEAR

In the light distillates arena, gasoline output dropped significantly as driving activity slowed in line with tepid economic activity.

Although the Chinese government had incrementally opened up cities in since mid-March, the country’s main transportation hub of Wuhan – which also is the epicenter of COVID-19 – remained in lockdown until April 8. Coupled with lower run rates from Chinese refineries, gasoline output dipped 21% on the year at 9.43 million mt in March, according to NBS data.

Meanwhile, naphtha output in China posted a slight 0.2% year-on-year increase in March, the data showed.

Chinese end-users CNOOC and Unipec had sought spot March delivery naphtha cargoes due to limited domestic supply. This has continued into the May-delivery market, sources said.

“In Q1 operations were very low, so I think Chinese crackers will keep running higher to [catch up],” said a source with a Chinese petrochemical producer.

China has been working to ramp back up its downstream industry operations after first lockdowns from COVID-19, however, it still faced obstacles like congestion of up to two weeks at some ports and limited global demand for Chinese exports due to lockdown measures elsewhere, said market sources.

FUEL OIL OUTPUT UP

However, fuel oil was the only product which registered a strong year-on-year growth of 22.3% despite gasoline and gasoil falling 21% and 9.4%, respectively, in March.

Chinese refineries have been steadily ramping up production of IMO-compliant low sulfur marine fuel since Beijing implemented on February 1 a rebate on value added tax and consumption tax for domestically produced low sulfur marine fuel used as bonded bunker.

Sinopec has supplied 1.61 million mt of IMO-compliant marine fuel as bonded bunker fuel in Q1, up 38% year on year, Sinopec Fuel Oil Sales Co., a wholly-owned subsidiary of the state-owned refining behemoth, saild last week.

Sinopec is expected to produce about 6.5 million mt of compliant fuel over February-December, while PetroChina is likely to produce 200,000-250,000 mt/month from February-March onwards, market participants with direct knowledge of the matter said.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in