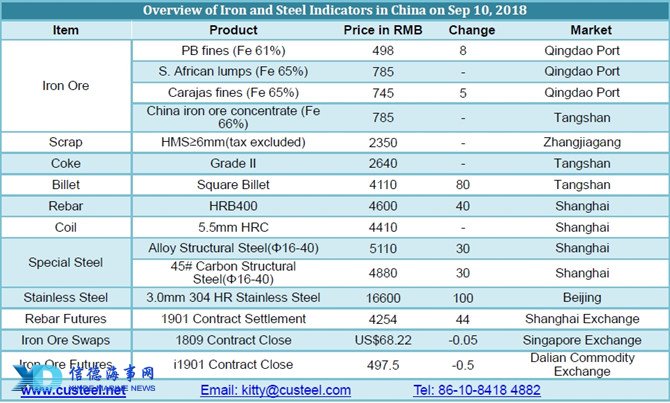

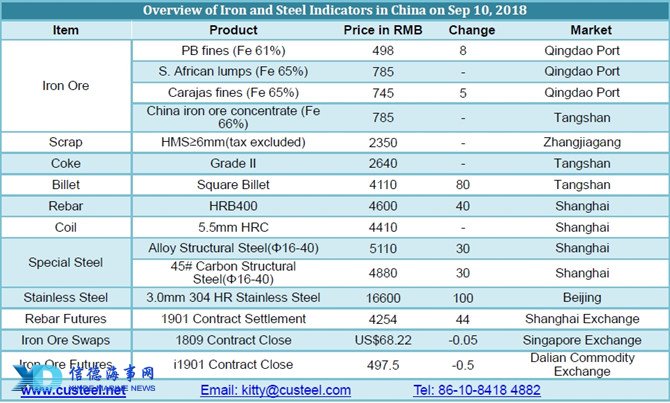

China’s iron ore futures market saw large fluctuations before closing today. Traders quotations in the morning remained unchanged from that of yesterday and they had willingness to held lump and pellet prices firm. In Shandong, prices of PB fines, Yandi fines, Jimblebar fines and MAC fines quoted at RMB505/tonne, RMB455/tonne, RMB465/tonne and RMB495/tonne. While in Tangshan, prices for Chile pelleting concentrate, Yandi fines and PB lump settled at RMB705/tonne, RMB470/tonne and RMB710/tonne. Traders said that there were high quotations but no sales today as steel mills hold tepid buying sentiment. As for steel mills, they expressed that iron ore prices today were higher than expected and will delay the procurement to next week due to the abundant stocks currently.

Generally speaking, transactions remained normal today. In Shandong, 61.9%-Fe PB fines traded at RMB498/tonne and the trading prices for SSF and Robe River fines were RMB309/tonne and RMB345/tonne respectively. In Tangshan, PB fines, SSF and FB fines traded at RMB515/tonne, RMB310/tonne and RMB378/tonne separately. In a short term, the imported iron ore prices are expected to go up due to the dropping port stocks as well as slipping shipment of foreign mines. As heating season approaches, iron ore prices will face pressure to increase then.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in