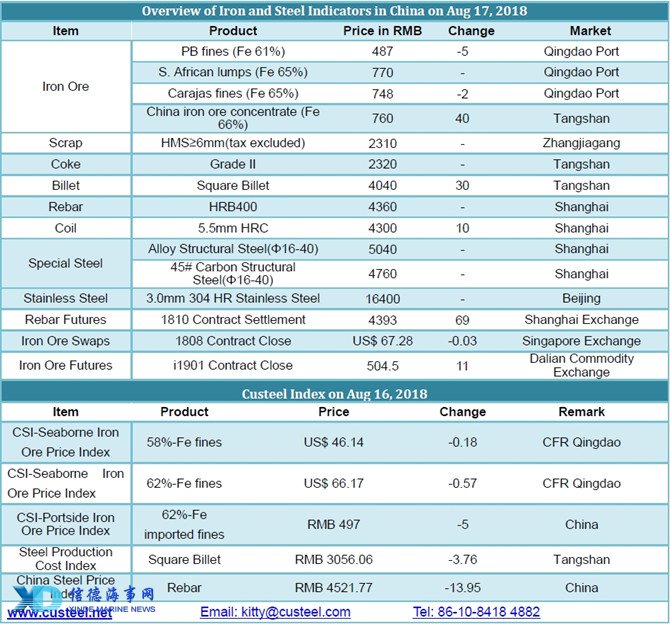

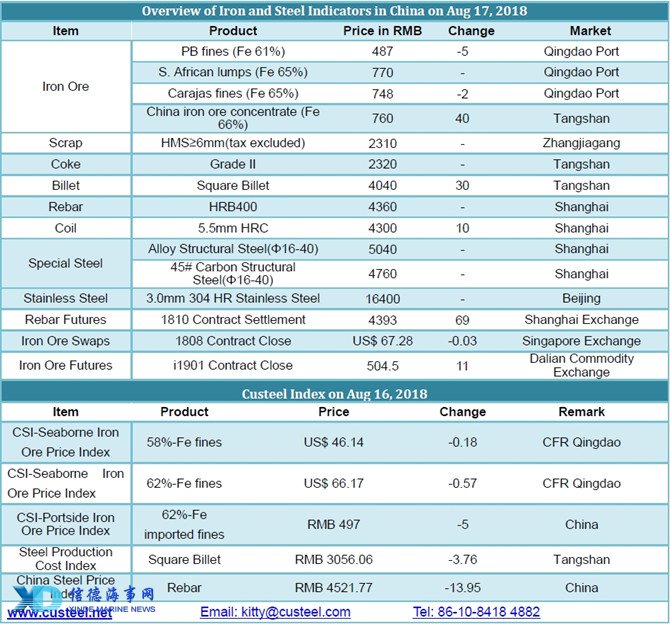

China’s imported iron ore market is to weaken amid uncertainties. The escalation of global trade dispute aroused concerns and dampened global stocks and bulk commodities market. Iron ore and steel futures market dived during yesterday overnight session and continues to move downwards today. Traders are active in offering and transactions remain smooth today as steel mills are willing to replenish in light of price decline at ports. According to a steel mill based in northern China, iron ore inventories have been low due to continuous price hikes and they are eager to stock up when prices move down slightly.

PB fines are traded at RMB485/tonne in Shandong and at RMB500/tonne in Tangshan, presenting a slight decline from a day ago. Global trade dispute and China’s pollutant control weigh down iron ore prices, thanks to favorable demand at steel consuming industry, which helps support raw materials prices.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in