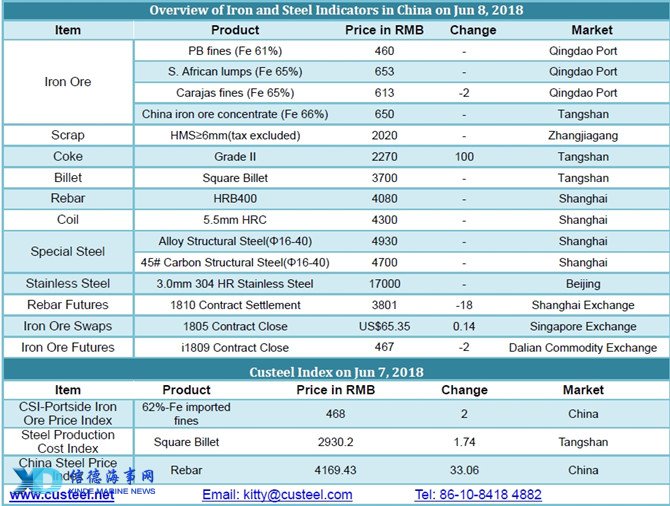

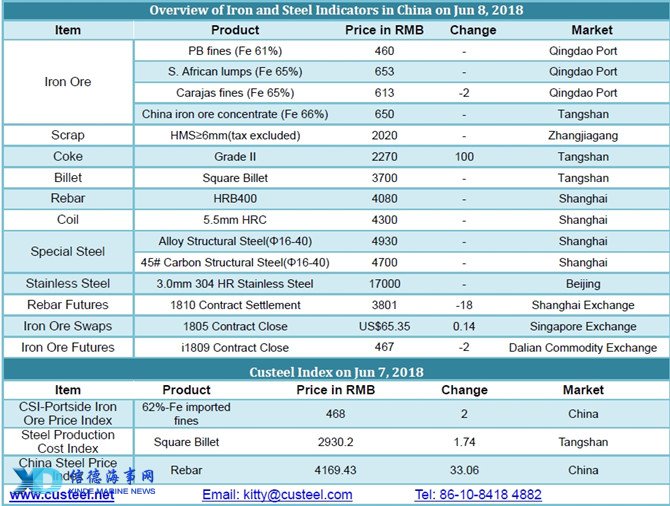

China's spot iron ore market is relatively active with most traders holding prices firm. Individual traders tend to raise prices for some high grade iron ore resources; steel mills sustain normal procurement. While market activity is dampened by the weakening of futures market in the afternoon, resulting in strong wait-and-see atmosphere. Iron ore transaction is relatively good, with trading prices robust in the morning and edging down later. Transaction is mainly concentrated on high grade resources, trading volumes of FB fines and carajas fines see large increases. It is learnt from a steel mill, currently, Brazilian iron ore is favored by steel mills. PB fines heard trade at RMB466/tonne and RMB469/tonne in Tangshan ports.

Despite of retreat in futures market in the afternoon, partial traders are still bullish on the coming market, stopping quote. Individual traders are eager to sell in a bid to make profit by hedging.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in