China's spot iron ore prices at ports stay stable. Most traders are in wait-and-see mode and are not eager to quote. Steel mills albeit have a certain demand are still in a cautious stance.

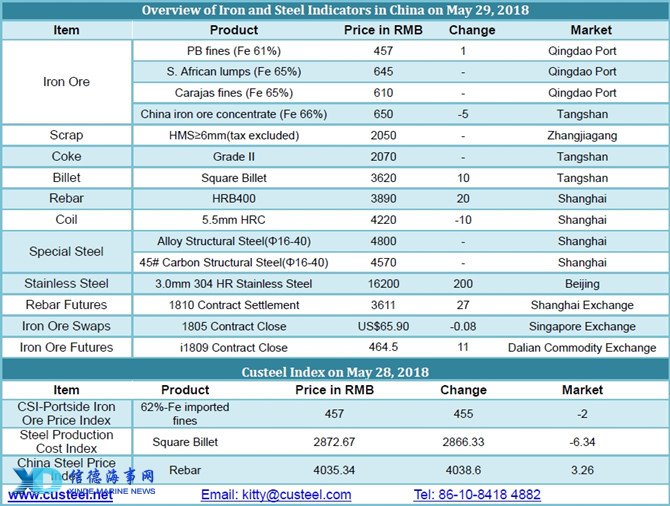

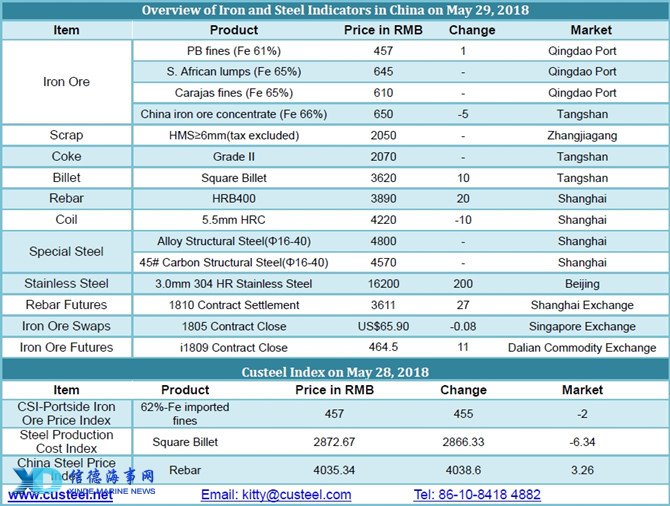

Spot price for 61.5%-Fe PB fines is set at RMB456/wmt at Qingdao Port, including RMB35/tonne port charge and 17% VAT.

In spite of inquiries for mainstream iron ore resources, transaction turned out slim. The trade was concentrated on Australian fines, and Brazilian and non-mainstream iron ore resources were in dull sales. Tangshan ports and Shandong ports saw relatively active trades in versus of low trading volumes at Yangtze River ports and Northeastern China ports. SSF was traded stable from last Friday at RMB278/tonne.

The inventory level at steel mills is little changed as compared with last session and keeps at about 22 days of use owing to good profits at mills. Iron ore inventory at Wu’an based mills have seen an increase in inventory as the operating rate is on the rise. Iron ore inventory at Henan based mills remains low, about 10 days or so, which drags down the average level.

Overall supply and demand was weak recently; partial large sized traders deemed the increasing arrivals of new cargoes and high inventories at mills will be unfavorable to iron ore market.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in