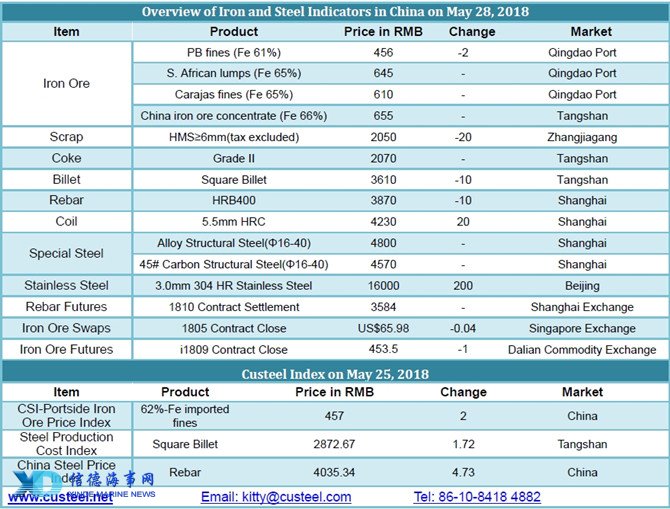

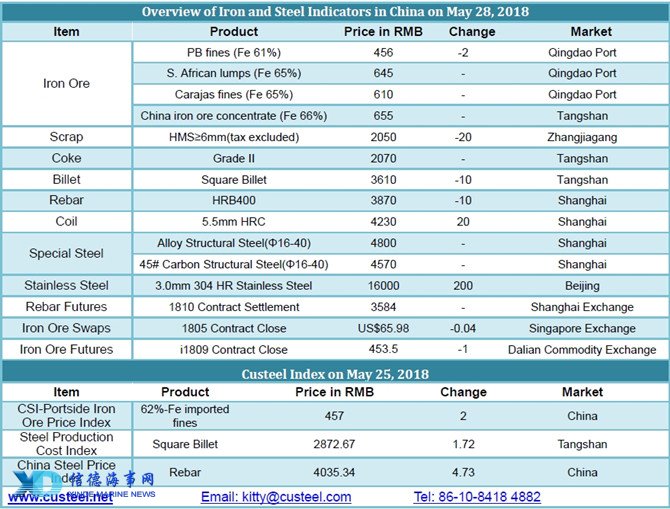

China's spot iron ore prices at ports edged up by RMB5-10/tonne in the morning. Steel mills were relatively active in procurement coupled with the backup of buoyancy in futures and derivative markets.

However, the downtrend of futures market in the afternoon weighed down mainstream iron ore prices. Australian fines still sold well and high grade Brazilian fines saw higher trading volumes from previous days, in particular Carajas fines. Tangshan ports, Tianjin port and Shandong ports were faced with active trades, while those at Northeast China ports, Yangtze River ports were in poor performance.

Most traders were in strong intention to boost sales considering the impact on iron ore market from weather and policy factors, and partial tended to avoid risks. Steel mills sustained normal restocking but the volume was limited owing to high stocks at mills. Some blast furnaces in partial mills in North China were projected for maintenance, which would curb iron ore demand to some extent.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in