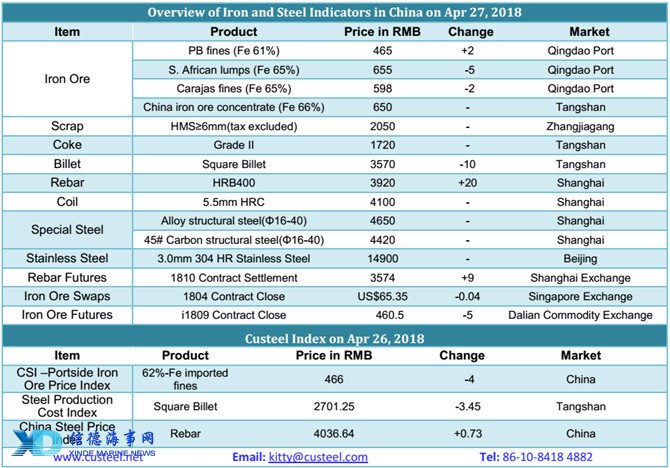

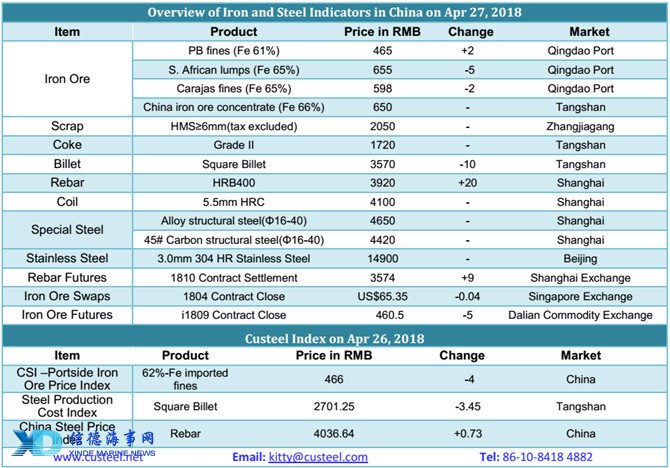

Iron ore spot market climbs down today influenced by weak futures and derivative market. Traders show strong wait-and-see attitude towards cargo shipments. Morning offers dropped by RMB5-10/tonne. Partial traders are pessimistic towards the following market and witness obvious desire to deliver cargos. Steel mills’ spot resources demand decreases influenced by continuous purchases of steel mills in recent days and high stocks. Market purchases focus on mainstream middle and high grade fines.

Iron ore spot market transaction volume keeps fair today and transactions focus on ports of Tangshan and Shandong. Transactions along the Yangtze River remain unfavorable. Mainstream middle and high grade Australian fines are favored. High grade lumps transactions edge up due to production limitation measures and rising capacity of steel mills

Traders are bullish towards the following market prices in recent days, which pushes up iron ore transaction volume. Steel mills are still on the fence and thought that policies will have intensified influence on the coming market. Steel mills hold enough stocks at present and their purchases mainly ensure the normal production.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in