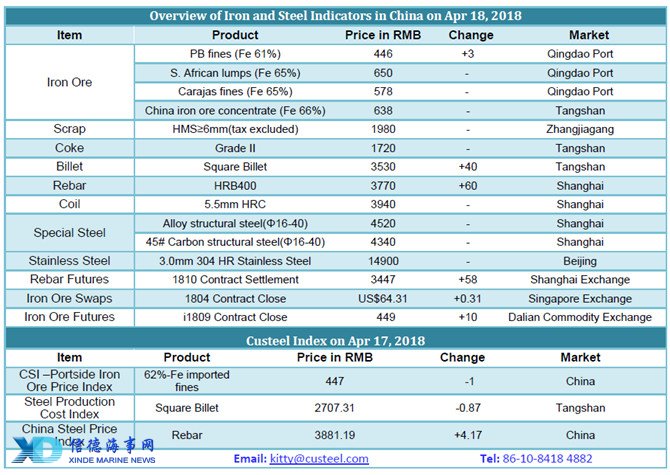

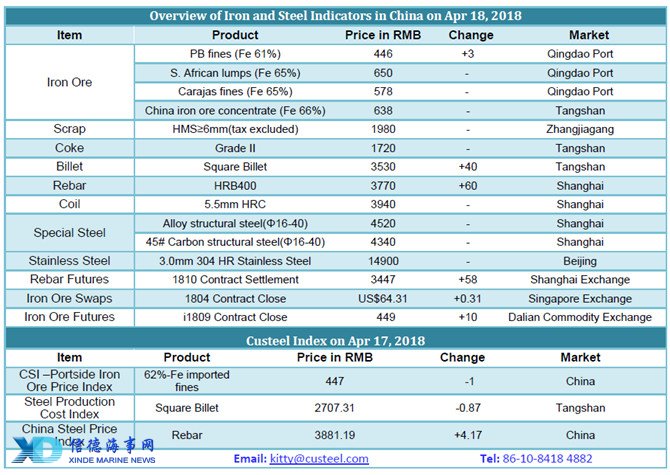

Spot market transaction volume and prices saw obvious downturn yesterday compared with that of last week. Market participants have no obvious purchasing desire and their spot market demand is hard to increase. As steel mills have raised their purchases previously, iron ore spot market stocks increase. Moreover, iron ore futures market stands weak, resulting in a wait-and-see attitude among most traders.

Market Transactions: Spot market witnesses fair performance today. Market transactions focus on middle and high grade resources. However, transactions of non-mainstream cargos, pellet and lumps keep unfavorable because imported pellet cost keeps high and steel mills show weak purchasing desire. PB fines transaction prices stay at RMB452/tonne and RMB440/tonne respectively at Tangshan and Shandong.

Market Supply and Demand: Iron ore spot market transactions remain brisk and large traders are active to deliver cargos. Small traders are willing to raise the prices, while the transactions are unfavorable. Iron ore spot resources are mainly concentrated at Tangshan and Shandong. There are small purchases from traders. Traders thought that spot market transactions are improving and market prices start to rebound. Thus, they start to lift their offers and their spot resources deliveries also decrease.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in