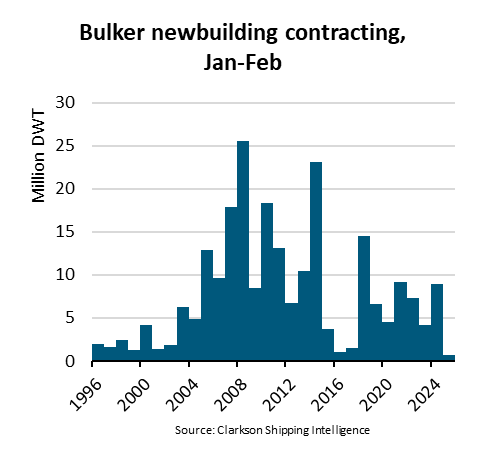

“During the first two months of 2025, bulker newbuilding contracting dropped 92% y/y to the lowest level in at least 30 years. While contracting in January was low, no new ships were ordered in February. Weak freight rates, high newbuilding prices, long lead times and uncertainty are likely discouraging contracting,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

Dry bulk contracting has been slowing since the second half of 2024. During this period, second hand prices for five-year-old ships fell by 12%, impacted by weakening freight rates, whereas newbuilding prices only dropped 1%. As of February 2025, a five-year-old ship, on average sold for 86% of the value of a newbuilt.

Strong contracting in other sectors such as container and tanker has kept newbuilding prices high, as they compete for the same limited slots in shipyards. This has also led to long lead times and smaller bulkers ordered today can only be delivered from 2027. Larger ships may only be delivered from 2028.

“The dry bulk medium-term market outlook is currently very uncertain, which could be affecting contracting. The outlook for iron ore and coal seems weak, while a potential return to normal Red Sea routings and burgeoning trade wars may further weaken demand,” says Gouveia.

The current dry bulk orderbook stands at 10% of the dry bulk fleet, which is sufficient to replace older ships in a stable market. The dry bulk fleet is still younger than the container and tanker fleets, and a smaller share of ships are nearing the normal age for recycling. Nonetheless, the fleet is gradually aging and approaching an average age of 13 years old.

At 34% of capacity, the panamax segment is the largest segment in the order book. It is also the segment with the largest orderbook to fleet ratio at 14%. While most ships ordered so far this year were in this segment, contracting was still down 83% y/y. Panamax contracting could remain low in the near term, as its freight rates have considerably worsened during the past eight months.

The capesize segment accounts for 29% of the orderbook and it has the lowest orderbook to fleet ratio at 8%. Capesize contracting strengthened in 2024, driven by a stronger market. However, no capesize ships have been ordered so far in 2025.

“Looking ahead, fleet renewal and decarbonisation are likely to be the key drivers for contracting, as demand growth is expected to remain low. Older bulkers are already less competitive, as climate regulations limit their sailing speeds. As regulations increasingly tighten in the medium to long term, recycling of older ships could be further incentivised,” says Gouveia.

source: BIMCO

Dry bulk contracting has been slowing since the second half of 2024. During this period, second hand prices for five-year-old ships fell by 12%, impacted by weakening freight rates, whereas newbuilding prices only dropped 1%. As of February 2025, a five-year-old ship, on average sold for 86% of the value of a newbuilt.

Strong contracting in other sectors such as container and tanker has kept newbuilding prices high, as they compete for the same limited slots in shipyards. This has also led to long lead times and smaller bulkers ordered today can only be delivered from 2027. Larger ships may only be delivered from 2028.

“The dry bulk medium-term market outlook is currently very uncertain, which could be affecting contracting. The outlook for iron ore and coal seems weak, while a potential return to normal Red Sea routings and burgeoning trade wars may further weaken demand,” says Gouveia.

The current dry bulk orderbook stands at 10% of the dry bulk fleet, which is sufficient to replace older ships in a stable market. The dry bulk fleet is still younger than the container and tanker fleets, and a smaller share of ships are nearing the normal age for recycling. Nonetheless, the fleet is gradually aging and approaching an average age of 13 years old.

At 34% of capacity, the panamax segment is the largest segment in the order book. It is also the segment with the largest orderbook to fleet ratio at 14%. While most ships ordered so far this year were in this segment, contracting was still down 83% y/y. Panamax contracting could remain low in the near term, as its freight rates have considerably worsened during the past eight months.

The capesize segment accounts for 29% of the orderbook and it has the lowest orderbook to fleet ratio at 8%. Capesize contracting strengthened in 2024, driven by a stronger market. However, no capesize ships have been ordered so far in 2025.

“Looking ahead, fleet renewal and decarbonisation are likely to be the key drivers for contracting, as demand growth is expected to remain low. Older bulkers are already less competitive, as climate regulations limit their sailing speeds. As regulations increasingly tighten in the medium to long term, recycling of older ships could be further incentivised,” says Gouveia.

source: BIMCO

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com