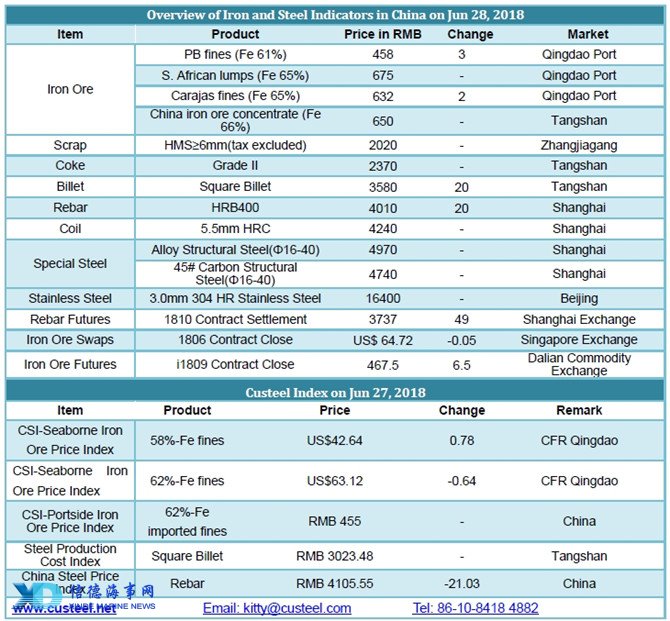

The imported iron ore market remains unchanged today. Iron ore futures market was buoyant overnight and extends an upward trend in the morning, thus traders tend to hold prices and focus on sales. Partial steel mills expressed that they mainly buy the resources according to the real demand affected by the environmental inspection. While traders are more willing to sale with normal transactions.

Most of the transactions were mainstream resources. Due to the high price of high-grade ore from Brazil, steel mills choose to use more SSFG and Brazilian fines instead of Carajas fines to cut the costs. As predicted, the iron ore price is predicted to keep the trend currently.

Seaborne iron ore market was active in high-grade fines and lumps. There were 3 trading transactions by the end of Jul 27 and the premium price of PB lumps and Newman lumps is very close to the highest point of US$0.3/dmt. While Carajas fines price was still at the high level with the trading price was US$90.7/dmt. As for the medium-grade ore price, it hard to go up further because partial traders expressed that they have sufficient resources currently.