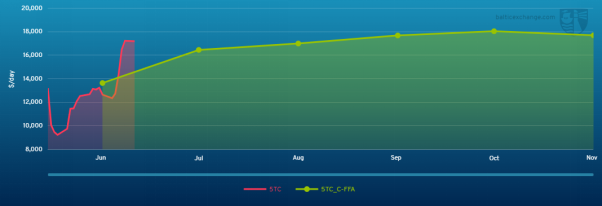

Actual freight rates and FFAs for 5TC Capesize routes since beginning of May

It’s been a mixed week across the various shipping sectors. In the Capesize market, there was a slow start, but rates picked up later in the week, especially in the Pacific region where two major players re-entered the market and drove rates higher.

The Atlantic market also showed signs of improvement, with increased activity from Brazil and West Africa. The Panamax sector experienced a subdued week, with limited demand and softening rates in the Asian market. The Ultramax/Supramax sector saw increased activity in East Coast South America and South Africa, while Asia experienced a slowdown due to various public holidays in some countries in the region. The Handysize sector had limited visible activity, but some positive pockets emerged, particularly in East Coast South America.

Freight Forward Agreements

This week’s report will consider Freight Forward Agreements (otherwise known as FFAs) and their role in hedging.

FFAs are financial contracts that allow participants to manage their risk in the volatile world of shipping. They provide a means for market participants to mitigate the uncertainty of freight rates and protect themselves against adverse price movements.

We will look at how FFAs work, their significance in hedging, and the role of the Baltic Exchange in facilitating these agreements.

To understand FFAs, let’s first delve into the concept of freight rates. Freight rates are the prices at which cargo is transported from one place to another. They are influenced by various factors, such as supply and demand, vessel availability, fuel costs, geopolitical events, and economic conditions. However, these rates can fluctuate dramatically, leading to significant financial risks for shipping companies, charterers, and owners.

This is where Freight Forward Agreements come in to play. FFAs are derivative contracts that enable market participants to hedge or speculate against future freight movements. They allow parties to fix the rate at which they will buy or sell shipping contracts for a specified period in the future, thereby reducing their exposure to price volatility.

Open FFA positions are marked against the Baltic daily settlement price for their respective product and expiry. The clearing exchange and clearing member then calculates a daily mark-to-market calculation which is used for margining.

The Baltic only publishes forward curves for those contracts listed by a clearing house. Clearing houses which list and clear dry FFAs are the European Energy Exchange (EEX) and Singapore Exchange (SGX), while tanker FFAs are handled by the Chicago Mercantile Exchange (CME) and Intercontinental Exchange (ICE).

The Baltic Exchange provides daily and weekly FFAs and options trading volumes as well as weekly open interest data.

FFA trade volumes are published every day and the information is based on figures collected at the end of the prior business day.

Weekly trade volumes and open interest data are published every Monday, and this information is based on figures collected at the end of the business day of the preceding Friday.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: