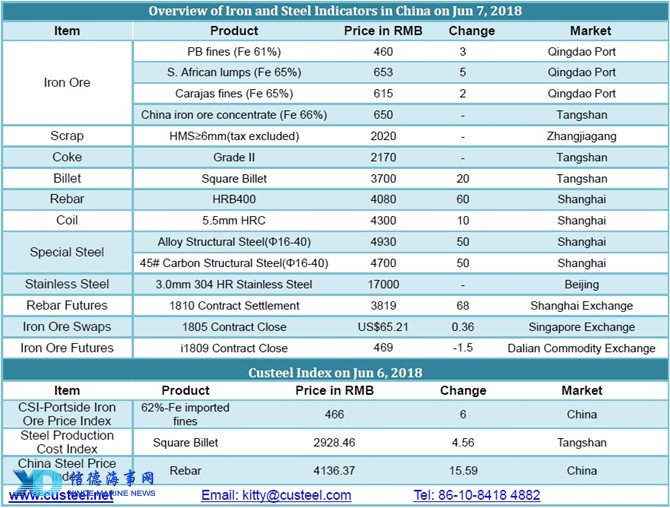

China's spot iron ore prices at ports edge up by RMB5-10/tonne shored up by buoyant futures market. Steel mills tend to wait and watch, with some buying interest for mainstream high grade iron ore resources. Spot iron ore market is relatively active along with a RMB5-10/tonne in transaction prices. Transactions are mainly concentrated on Australian fines, while iron ore from BHP sees flat trade due to ample supply. Iron ore lumps eye increased trading. PB fines transaction prices prevail at RMB463/tonne in Tangshan and Shandong ports.

It is learnt that most small-sized traders have intention to stock up mainstream iron ore resources, but the sales prices remain relatively high, thus they seek for low priced resources instead. Steel mills’ demand is not strong due to wait-and-see mode.