Chinese liquefied natural gas (LNG) buyers have resumed spot purchases, drawn by easing prices and recovering domestic demand, potentially increasing competition with Europe for supplies.

Economic challenges and a slowdown in the country’s efforts to switch from coal to gas could limit demand growth of the cleaner fuel, however.

China could use between 385 billion and 400 billion cubic metres (bcm) of gas this year, at least 6% more than in 2022, as new terminals come online and economic recovery drives higher industrial and power demand, analysts say.

This comes after Chinese demand fell last year for the first time in two decades as stringent pandemic measures suppressed economic activity. Chinese spot buying largely ceased during winter.

But a warmer than expected winter sent spot prices LNG-AS lower. In response, Beijing Gas bought an April delivery cargo this month, and, after prices hit a near two-year low of $13.50 per million British thermal units last week, CNOOC bought another two, said industry sources.

But a warmer than expected winter sent spot prices LNG-AS lower. In response, Beijing Gas bought an April delivery cargo this month, and, after prices hit a near two-year low of $13.50 per million British thermal units last week, CNOOC bought another two, said industry sources.

An increase in Chinese spot purchasing could intensify competition of LNG supplies among buyers in an already tightglobal market potentially pushing up prices – especially since Europe will need to replenish gas stocks before the next winter season.

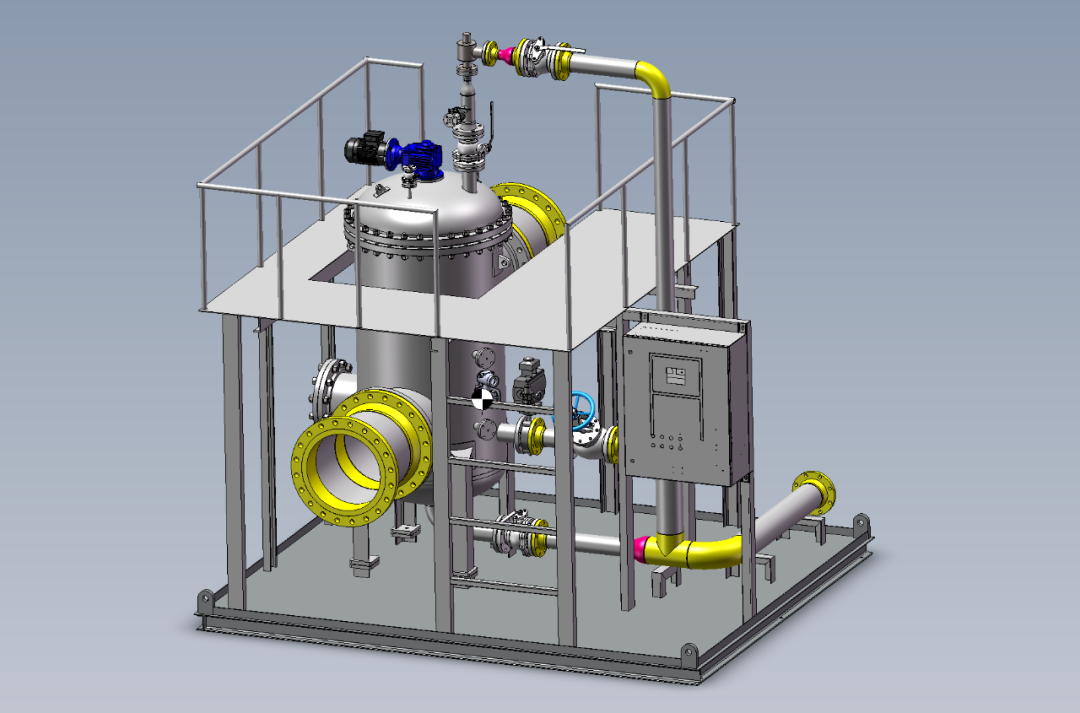

The anticipated start-up of six new import terminals this year would also contribute to increasing LNG arrivals, said JLC consultancy analyst Ricki Wang.

The new terminals include the 5-million-tonne-per-annum (mtpa) Tianjin Nangang terminal of Beijing Gas Group, Guangzhou Gas’s 1 mtpa Nansha terminal and the 6 mtpa Chaozhou terminal by Huaying Natural Gas. They will need supplies to begin operating.

However, analysts are not expecting a sharp rebound for LNG demand, because a supply shock that drove up LNG prices last year has prompted China to tone down its effort to replace coal with gas.

Increasing gas supply from domestic production and by pipeline from Russia could also LNG limit imports, especially spot purchases, say analysts.

“Large amounts of (long-term) contractual volumes are expected to meet most of China’s LNG import demand. Therefore, not much spot buying is required,” said Rystad Energy analyst Wei Xiong.

She added, however, that China’s gas demand recovery pace should be monitored.

“If it recovers faster than expected, contractual volumes may no longer be able to meet demand, then extra volumes from the spot market are needed.”

Meanwhile, because Russian supply is expected to rise, analysts forecast 2023 piped gas imports at 69 billion to 80 billion cubic metres (bcm), up from 63 billion cubic metres in 2022. With more volume due under long-term contracts, LNG arrivals are expected to rise to between 68 billion and 73 million tonnes from 63.4 million tonnes.

SLOWER GAS TRANSITION

China has been relying on gas – used largely in industrial and residential sectors – as a bridge fuel in its effort to reduce coal usage and reach peak carbon emissions before 2030 and carbon neutrality by 2060.

China has been relying on gas – used largely in industrial and residential sectors – as a bridge fuel in its effort to reduce coal usage and reach peak carbon emissions before 2030 and carbon neutrality by 2060.

It has managed to cut coal’s share of its energy mix to 56% last year from 70% in 2010.

But the curbing of gas imports amid high prices has slowed those efforts. Some local governments have installed more gas distribution capacity than can be used.

“The slowdown we’re seeing now is because the number of users that have pipelines laid to their homes don’t really have gas to use,” said an executive with a large private gas distributor.

China is also prioritising stability in economic growth and security in energy supply, said Jenny Yang, senior director, greater China gas research and analysis at S&P Global Commodity Insights.

“The coal-to-gas policy, the key driver behind Chinese gas demand growth in recent years, is no longer a top priority given the higher cost of natural gas compared with alternatives,” Yang said.

China’s state planner this month also underlined a greater role for coal in electricity supply. It called for an increase in reliable generation, such as that offered by coal-fired power stations. The agency also said it would “strictly control” the expansion of projects replacing coal with gas.

A slowing coal-to-gas shift would mean the share of coal in China’s energy mix will hold for longer, said Kpler analyst Ryhana Rasidi.

“However, we should not ignore the fact that natural gas demand and production will still grow alongside coal,” she said.

Source: Reuters

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: