Dalian iron ore futures climbed to a 10-month high on Monday, as shrinking stocks of the steelmaking ingredient at Chinese ports added fuel to a rally spurred by optimism around demand in the world's top steel producer.

Coking coal, another steelmaking input, also extended gains to hit a six-week peak following a flurry of recent news about China's resolve to stimulate its slowing economy and moves to ease its COVID-19 restrictions.

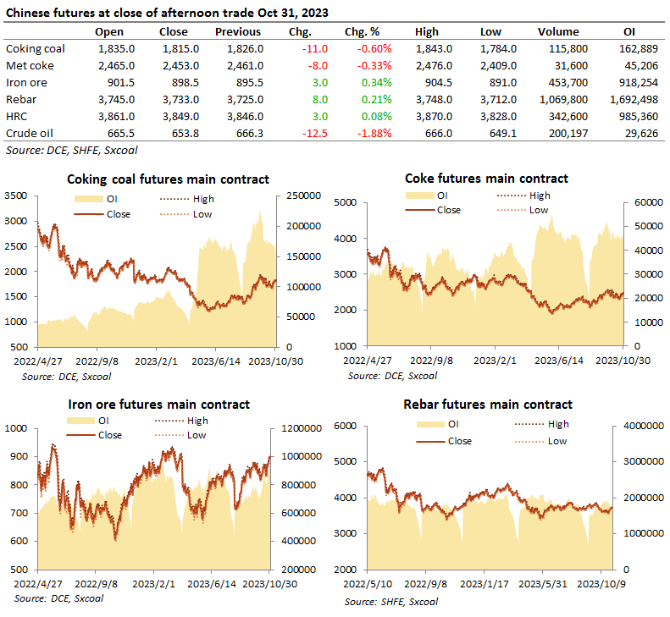

Benchmark September iron ore on China's Dalian Commodity Exchange 1ended daytime trading 0.7% higher at 925 yuan ($139.02) a tonne, after touching 948 yuan earlier in the session, its loftiest since the first week of August.

On the Singapore Exchange, the most-traded July contract was steady at $142.70 a tonne by 0735 GMT.

Dalian coking coal DJMcv1 rallied 4.1%, while coke jumped 1.8%.

“Fundamentals look relatively strong,” said Atilla Widnell, managing director at Navigate Commodities in Singapore, citing slower arrivals of imported iron ore in China and a week-on-week decline of 1.1 million tonnes in Australian and Brazilian shipments.

“Slower arrivals and a continuation of robust blast furnace capacity utilisation rates and daily offtakes should result in portside iron ore inventories depleting by a further 2.0-3.0 million tonnes this week.”

Portside iron ore inventory in China shrank to 132 million tonnes last week, the lowest since late September, SteelHome consultancy data showed.

Benchmark 62%-grade iron ore's spot price for the China-bound material stood at $142.50 a tonne on June 2, the highest since May 5, according to SteelHome data.

With COVID-19 cases falling in Beijing, the Chinese capital will further relax curbs by allowing indoor dining.

“If China can sustain this level of ‘openness’, we anticipate this will release pent-up and ravenous national steel demand,” Widnell said.

Construction steel rebar on the Shanghai Futures Exchange SRBcv1 gained 0.4%, hot-rolled coil added 0.2%, and stainless steel rose 0.6%.

Construction steel rebar on the Shanghai Futures Exchange SRBcv1 gained 0.4%, hot-rolled coil added 0.2%, and stainless steel rose 0.6%.

China imported iron ore stockpiles shrinkhttps://tmsnrt.rs/3aIX496

Source: Reuters

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: