Greek Owners Retain Pole Position

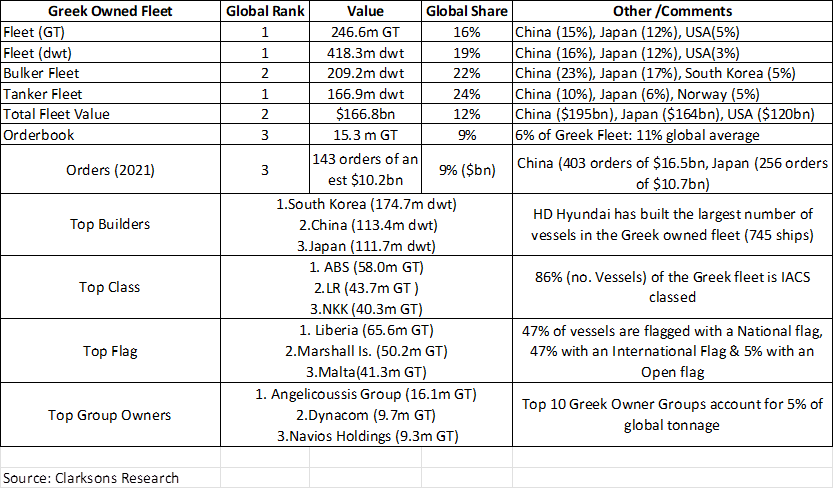

As the shipping community prepares for a return to Posidonia after a four-year break, in this analysis (see below and attached) extracted from the Shipping Intelligence Weekly report, Steve Gordon, Global Head of Clarksons Research, tracks the development of the Greek fleet and the pivotal role it continues to play in international shipping. And while the past four years have seen crisis, operational challenges, dramatic market change and widespread disruption, with 16.4% of global tonnage on the water (by GT, 19% basis dwt), Greek owners retain their pre-eminent market position. The market leading position is even more remarkable given Greek shipping's role as the ultimate “cross trader” (Greek imports / exports are <1% of global seaborne trade totals, compared to 23% and 5% imports for China (15.3% of global fleet by tonnage) and Japan (12.3% of global fleet by tonnage).

“Wet and Dry” Focus … and now Gas

In the four years since the last Posidonia, Greek shipping companies have retained their remarkable scale (adding 29m GT to reach 247m GT / 417m dwt on the water). A long-term focus on tankers (26% global fleet share, 2012: 22%), and bulkers (22% share, now behind China) has continued, with the volatility and asset play opportunities in these markets as attractive as ever. The Greek share in the global LNG fleet has seen the biggest recent increase, up to 21% today from 15% at the last Posidonia. And with LNG’s role in both energy transition and energy security, further growth opportunities seem likely. Some Greek owners have enjoyed the spectacular container markets, and while overall share declined to 8% of the box fleet, they are the second largest charter owner with 2m TEU behind only Germany. There has been a general reluctance for exposure in less liquid or project-based markets (the share of “Others” combined is less than <2%).

Sale & Purchase Strength

Greeks have remained the number one S&P player (involved in 36% of all sales activity as either buyers or sellers by tonnage) but their newbuild orderbook has trended down to only 6% of their fleet (its lowest ratio for ~20 years).

Profiling the Fleet

We have also queried our database to identify the top-class societies for the Greek “fleet” (ABS (58.0m GT), LR (43.7m), NKK (40.3m)), the top flags (Liberia (65.6m), Marshall Is. (50.2m) and Malta (41.3m)) and builders (42% of the fleet is Korean built, increasing to 60% for the orderbook). Nearly 80% of tonnage is privately owned, with the balance in stock listed vehicles, while the “average” owner still has only 5 ships. Aspects of the Green Transition have been embraced by Greek ship owners (outperforming fleet averages with 27% of the Greek fleet “eco”, 5.7% alternative fuelled and 26% with a major EST fitted) but, aligned with global trends, the average age of the fleet is trending upwards (13 yrs (for vessels over 1,000 GT), 12 yrs five years ago) and we estimate as much as 27% of the fleet may be D or E rated under CII. The top 10 Greek shipping companies alone account for 5% of global capacity, with the Angelicoussis Group leading the way (16m GT in fleet).

“Wet and Dry” Focus … and now Gas

In the four years since the last Posidonia, Greek shipping companies have retained their remarkable scale (adding 29m GT to reach 247m GT / 417m dwt on the water). A long-term focus on tankers (26% global fleet share, 2012: 22%), and bulkers (22% share, now behind China) has continued, with the volatility and asset play opportunities in these markets as attractive as ever. The Greek share in the global LNG fleet has seen the biggest recent increase, up to 21% today from 15% at the last Posidonia. And with LNG’s role in both energy transition and energy security, further growth opportunities seem likely. Some Greek owners have enjoyed the spectacular container markets, and while overall share declined to 8% of the box fleet, they are the second largest charter owner with 2m TEU behind only Germany. There has been a general reluctance for exposure in less liquid or project-based markets (the share of “Others” combined is less than <2%).

Sale & Purchase Strength

Greeks have remained the number one S&P player (involved in 36% of all sales activity as either buyers or sellers by tonnage) but their newbuild orderbook has trended down to only 6% of their fleet (its lowest ratio for ~20 years).

Profiling the Fleet

We have also queried our database to identify the top-class societies for the Greek “fleet” (ABS (58.0m GT), LR (43.7m), NKK (40.3m)), the top flags (Liberia (65.6m), Marshall Is. (50.2m) and Malta (41.3m)) and builders (42% of the fleet is Korean built, increasing to 60% for the orderbook). Nearly 80% of tonnage is privately owned, with the balance in stock listed vehicles, while the “average” owner still has only 5 ships. Aspects of the Green Transition have been embraced by Greek ship owners (outperforming fleet averages with 27% of the Greek fleet “eco”, 5.7% alternative fuelled and 26% with a major EST fitted) but, aligned with global trends, the average age of the fleet is trending upwards (13 yrs (for vessels over 1,000 GT), 12 yrs five years ago) and we estimate as much as 27% of the fleet may be D or E rated under CII. The top 10 Greek shipping companies alone account for 5% of global capacity, with the Angelicoussis Group leading the way (16m GT in fleet).

Profiling the Challengers

Work by our modelling team suggests Greek shipping companies will add a further 50m GT to their fleet by 2030 and while trend analysis (and proximity to trade, shipbuilding capacity & finance) would suggest that the Chinese fleet will overtake, the Hellenic community is unlikely to give way easily. For context the largest owning nations by aggregate GT after Greece, are China, Japan, the US and South Korea. A straw poll of reasons behind Greek success included: strong cash positions and low leverage, intuitive timing across market cycles (most, if not all the time!), quick decision making, heritage (but also concerns around management of generational change), a large “cluster” of commercial & technical expertise, flexibility and adaptability.

Market Reflection

As it often can be, Posidonia will also be a time to take stock. On the many difficulties of recent years, the exceptionally strong markets today, the structural opportunities from short orderbooks and potentially disruptive emissions policies and, despite some mitigating factors for shipping around tonne-miles and congestion, the building macro-economic headwinds.

Work by our modelling team suggests Greek shipping companies will add a further 50m GT to their fleet by 2030 and while trend analysis (and proximity to trade, shipbuilding capacity & finance) would suggest that the Chinese fleet will overtake, the Hellenic community is unlikely to give way easily. For context the largest owning nations by aggregate GT after Greece, are China, Japan, the US and South Korea. A straw poll of reasons behind Greek success included: strong cash positions and low leverage, intuitive timing across market cycles (most, if not all the time!), quick decision making, heritage (but also concerns around management of generational change), a large “cluster” of commercial & technical expertise, flexibility and adaptability.

Market Reflection

As it often can be, Posidonia will also be a time to take stock. On the many difficulties of recent years, the exceptionally strong markets today, the structural opportunities from short orderbooks and potentially disruptive emissions policies and, despite some mitigating factors for shipping around tonne-miles and congestion, the building macro-economic headwinds.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: