Dalian coking coal scaled a contract high on Monday while coke futures hit a six-week peak, as a recent flooding in China's top coal-producing Shanxi province intensified supply fears.

Worries about production and transportation of coal from Shanxi added to lingering concerns over an energy crunch that has gripped the world's biggest steel producer and hampered operations of many industries, including coal mining.

The northern province of Shanxi had shut 27 coal mines last week as heavy rain caused flooding.

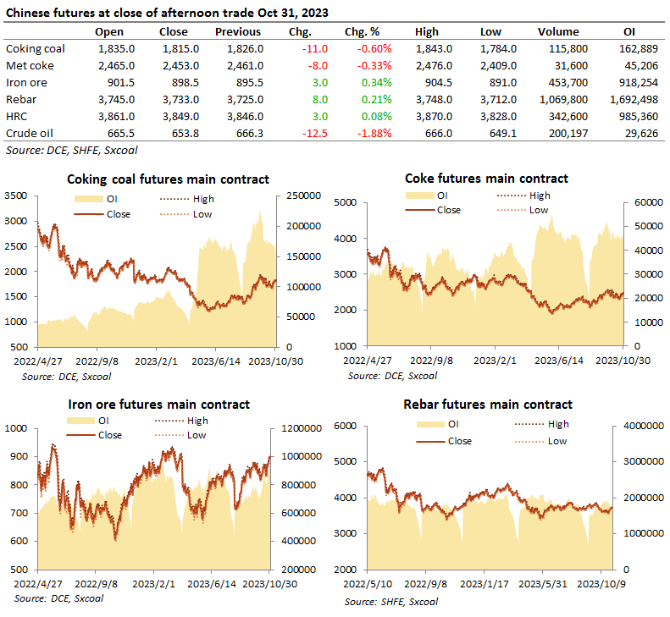

Coking coal's most-active January contract on China's Dalian Commodity Exchange DJMcv1 rose as much as 6.9% to 3,428 yuan ($532.80) a tonne. Coke DCJcv1 advanced 5.4%% to 3,728 yuan a tonne, its strongest since Sept. 10.

“The main coke production areas in the country are still facing varying degrees of production restrictions,” Sinosteel Futures analysts said in a note, citing the Shanxi flooding and power shortages.

Last week, Shanxi and Inner Mongolia, another major coal mining region, ordered more than 200 mines to expand production capacity.

Coke, the processed form of coking or metallurgical coal, is the primary reducing agent of iron ore, the main steelmaking ingredient.

Dalian iron ore ended daytime trading 6.5% higher at 797.50 yuan a tonne, just below a session-high 799.50 yuan, its loftiest since Sept. 1.

Iron ore on the Singapore Exchange SZZFX1 climbed 10.1% to $137.25 a tonne by 0708 GMT.

Spot iron ore SH-CCN-IRNOR62 has also been supported since Chinese traders returned and mills resumed operations on Friday after the Golden Week holidays.

“Steel rebar import demand is expected to be relatively robust given significant steel production curbs through the next two quarters,” said Atilla Widnell, managing director at Singapore-based Navigate Commodities.

Higher costs of raw materials could also push steel prices higher, he said.

Rebar on the Shanghai Futures Exchange SRBcv1 rose 0.8%, while hot-rolled coil SHHCcv1 gained 0.3%. Stainless steel SHSScv1 slumped 1.9%.

Source: Reuters

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: