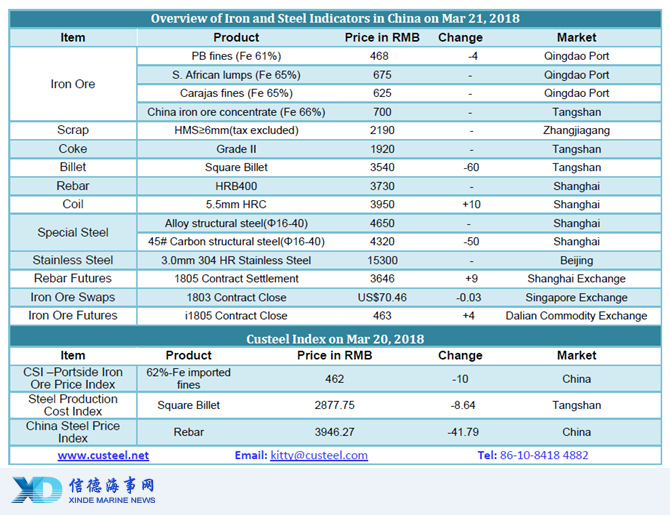

Morning offers of traders decreased by RMB5/tonne on a daily basis today, with obvious decline in mainstream fines. Most traders are willing to deliver cargos and partial small traders continue to stop their sales under cost pressures. Steel mills have purchasing expectation, while they still take wait-and-see attitude towards the following market.

Market transaction: Iron ore spot market stands fair, however transaction prices fall obviously. Specifically, transaction price of PB fines and FB fines stand at RMB465/tonne and RMB320/tonne respectively, down by RMB10/tonne and RMB5/tonne. Based on transaction data recently, SSF prices may drop further after breaking RMB300/tonne. IOCJ and Jimblebar fines show relatively large downturn influenced by demand.

Market supply and demand: Production curb policies and measures continue in steel mills and market demand is not good. Small-sized traders start to stop sales under falling prices and both market supply and demand stand weak.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com