Benchmark iron ore futures in China jumped to their highest level in over nine and a half months on Wednesday, driven by higher demand for the steelmaking ingredient as steel mills ramped up output amid improving profit margins.

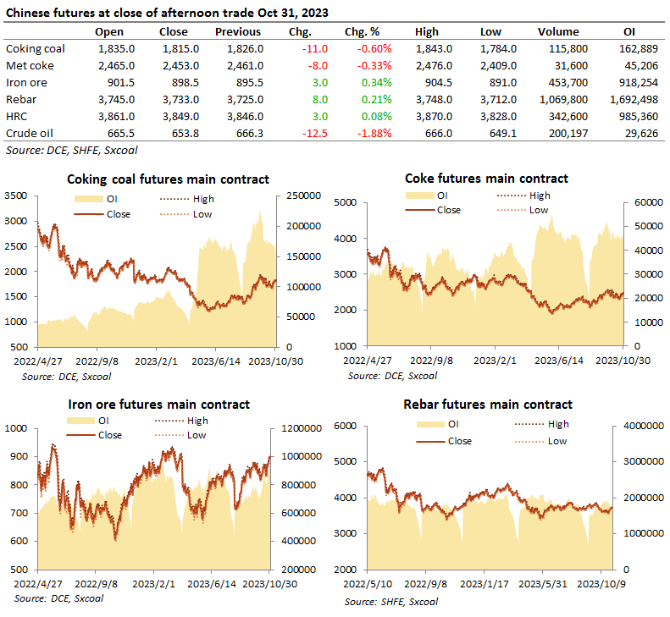

The most active iron ore futures on the Dalian Commodity Exchange, for September delivery, climbed as much as 2.4% to 647 yuan ($91.22) per tonne. The contract closed up 2.1%, its highest level since Aug. 1.

“The margins are improving over the last 15 days in China’s ferrous industry, this motivates the mills to ramp up their production and also use high-grade iron ore,” Singapore-based steel and iron ore data analytics company Tivlon Technologies wrote in a note.

Spot prices of iron ore with 62% and 65% iron content for delivery to China have both jumped 5% so far in May, and stood at $88.8 and $105.5 per tonne, respectively, on Tuesday.

Tivlon Technologies however warned that with rising utilisation rates at blast furnaces and electric arc furnaces, profit margins might narrow, leading to lower interest in high-grade iron ore.

Coking coal futures on the Dalian exchange rose 1.4% to 1,113 yuan a tonne, while coke fell 0.5% to 1,726 yuan a tonne.

FUNDAMENTALS

* The October contract of construction rebar on the Shanghai Futures Exchange moved 0.3% higher at 3,464 yuan a tonne.

* Hot-rolled coil ended up 0.3% to 3,337 yuan a tonne.

* Shanghai stainless steel dropped 0.6% to 13,505 yuan per tonne.

* More than 4.28 million people have been reported to be infected by the novel coronavirus globally and 290,868 have died, according to a Reuters tally.

* BHP Group, will stick with its capital allocation framework despite the impact of the pandemic while Rio Tinto is eyeing M&A, the chief executives of the miners said on Tuesday.

* Brazilian iron ore miner Vale SA is “on the right track” to begin paying dividends again, the company said, without offering further details.

* JFE Holdings Inc signalled plans to shore up cash flow, as higher raw materials costs and weaker demand from a global economy that was slowing even before the pandemic drove it to a record net loss.

Source:Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: