The China maritime story last decade has been all about expansion. What have Chinese financial institutions done to the rise of China in ship finance over last decade?

Smarine Advisors recently conducted an annual survey and collected data from major Chinese ship finance institutions. This is the fourth year in a row that Smarine conducts annual survey of Chinese ship finance. The survey questionnaires were sent to nearly 20 ship finance institutions in China, who are either active or interested in providing ship finance. The survey questions include the drawdown in 2019, new deal amount in 2019 and the portfolio at the year end, each item with breakdown by ship type. Thanks for the quick response from all participants, Smarine summarized the results in time. Hereunder is a summary of selected survey result, which shed some light on the Chinese ship finance market in 2019.

1. Total shipping portfolio reached $59 billion

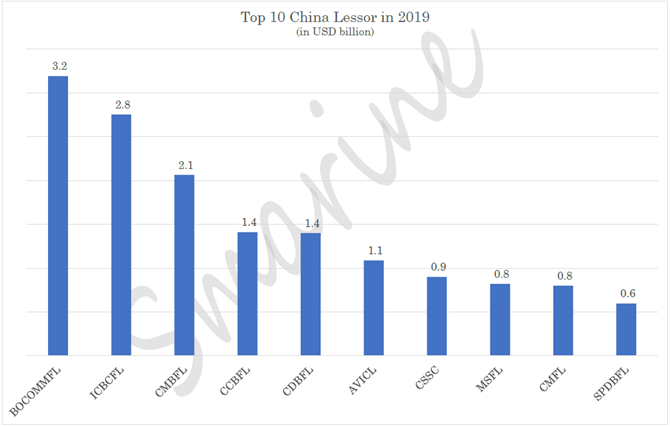

As of end of 2019, total shipping portfolio under China Lessors grew by 13% to $59 billion. The growth rate outpaced 2018's growth rate of 9%. It indicates China Lessors have established significant market shares in global ship finance market.

2. Drawdown of $15.8 billion from China Lessors in 2019

China Lessors as a whole accelerated growth in 2019 with total drawdown of $15.8 billion, which excludes transactions of around $1.0 billion between China Lessors. The number indicates that China Lessors achieved 26% annual growth against the backdrop of trade war, slow-down of Chinese economy and tightened banking regulations. The total drawdown of $15.8 billion include finance amount under financial lease and investment amount under operating lease. While a few lessors have made their own investment through operating lease structure, the investment amount should be deducted from the drawdown.

3. Not all firms achieved year-on-year growth

Although the market achieved significant growth in 2019, not all firms kept growing. While 7 lessors entered one-billion-dollar club in 2018, only 6 lessors invested more than $1.0 billion each in 2019. Although the entry barrier to Top 10 list remains $600 million, two new institutions entered the Top 10 list in 2019. It reflects that lessors applied different approaches in 2019 when Chinese domestic economy slowed down, and the banking supervision & regulations became stricter. Clearly, all lessors have refined their strategy respectively and coordinated the resources more cautiously in 2019. The data of portfolio by ship type also confirms that the differentiation of respective strategy will continue.

While European banks withdrew from ship finance market in the 2010s, China Lessors have achieved significant growth and meanwhile contributed to the rise of China over last decade. Looking forward, China Lessors has well prepared to embrace the new decade with the largest ever shipping portfolio.