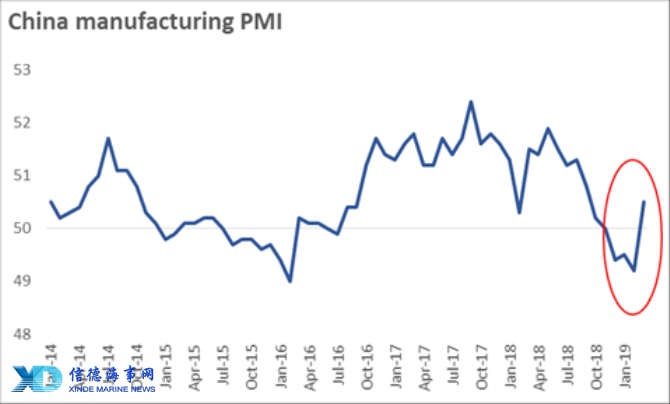

China’s manufacturing sector saw a stronger than expected rebound last month as the latest manufacturing PMI figures released by the National Bureau of Statistics on Sunday jumped from 49.2 in Feb to 50.2 in March. Almost all sub-indices, including the forward-looking indicator of new orders, increased substantially, suggesting that the Government’s supportive policies are starting to work.

It may be too early to call the recovery to be sustainable. However, other indicators also show improvement in activity levels. After falling for seven consecutive months, daily average coal burn at the six major power generation groups in China grew by 4.2% in March. Most major dry bulk imports also rose sharply during the first two months. Although imports of iron ore, thermal coal and soybeans were down for various reasons1, imports of industrial minerals such as manganese ore, copper ore and nickel ore as well as coking coal and bauxite surged by 27.9%, 24.9%, 25.0%, 25.7% and 28% respectively.

The Government has already announced around $350bn worth of infrastructure projects for 2019 earlier this year. The latest data show that investments are picking up. Local government special bond2 issuances soared during the first three months, rising from RMB76.9bn in 1Q18 to RMB671bn 1Q19. Special bond quotas were also raised from RMB1.35trn in 2018 to 2.15trn this year. Fixed asset investments in infrastructure rebounded as a result.

There are, of course, some headwinds. Property sector, which accounts for about 30-35% of steel demand in China is slowing down with the growth in new construction starts falling from 17% in 2018 to 6% in Jan-Feb 19. Auto sales3 also plunged during the first two months, dropping by 15% year on year.

As we said before, it is too early to get excited about the demand recovery. However, there is enough evidence that the Chinese economy may be turning around. The next few months will be critical; we will be watching the data closely.