The Legislative Council passed the government bill to amend the Inland Revenue Ordinance (IRO) to introduce a new tax regime to promote ship leasing (tax rate: 0%) and ship leasing management (tax rate: 8.25%, i.e. half of corporate profits tax rate of 16.5%) in Hong Kong.

Implications for traditional shipowners and operators

-"A traditional ship owner operator may continue to enjoy the tax concessions under s.23B of the IRO in respect of the charter hire derived from the business of operating ships irrespective of whether the charter party exceeds one year or not because s.23B does not have any provision that specifies the term of a charter-party."

-"On the other hand, the new regime, which targets the ship lessors that are not ship operators, only applies to an operating lease (other than a sublease in respect of which no lease term is specified) or a funding lease with a term exceeding one year"

"s.23B works independently from, and is not affected by, the new regime. When determining whether s.23B or the new regime is applicable, the crux of the matter is whether the ship owner is a ship operator or a ship lessor"

Criteria to qualify as a ship lessor under the new tax regime

- "The eligibility for s.23B or the new regime hinges on whether: the person is a ship operator carrying out chartering activity incidental to the business of operating ships; or the person is a ship lessor carrying out ship leasing activities solely. This is a questions of facts to be considered with regard to all relevant circumstances of each case, including the functions performed and risks assumed by the person. However, the new regime only applies to leases (other than a sublease which is an operating lease ) with a term exceeding one year.”

- "In order to be eligible to elect for the new regime, a ship owner or ship operator carrying out other businesses may set up a standalone corporation as a special purpose vehicle engaging solely ship leasing activities."

Practice guidelines for the industry

The government has taken note of the Association suggestions for clear, practical tax reporting guidelines for the shipping industry, including certain information for ease of comparison between s.23B and the new tax regime.

The Inland Revenue Department will provide technical and practical guidance in relation to the ship leasing regime in its Departmental Interpretation and Practice Notes (DIPNs).

The 20% tax base concession

The proposed 20% tax base concession for ship lessors has been worked out with reference to not only the aircraft leasing regime, but also the rates of depreciation allowances (including initial allowance and annual allowance) for ships as stipulated in the IRO. It is considered that "the 20% tax base concession could reasonably and adequately compensate a ship lessor for the loss of depreciation allowances under the new regime".

"All in all, the new ship leasing regime and the current s.23B regime provide profits tax exemption respectively to the eligible ship lessors or ship operators. In any case, a traditional ship operator, if so eligible, can continue to enjoy tax exemption under the current s.23B regime."

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Reporting Requirements for Foreign-flagged Ships En

Reporting Requirements for Foreign-flagged Ships En  Shipping Carriers Move to Prevent Deadly Charcoal F

Shipping Carriers Move to Prevent Deadly Charcoal F  KR, HD KSOE, HD HHI, KSS Line, and Liberian Registr

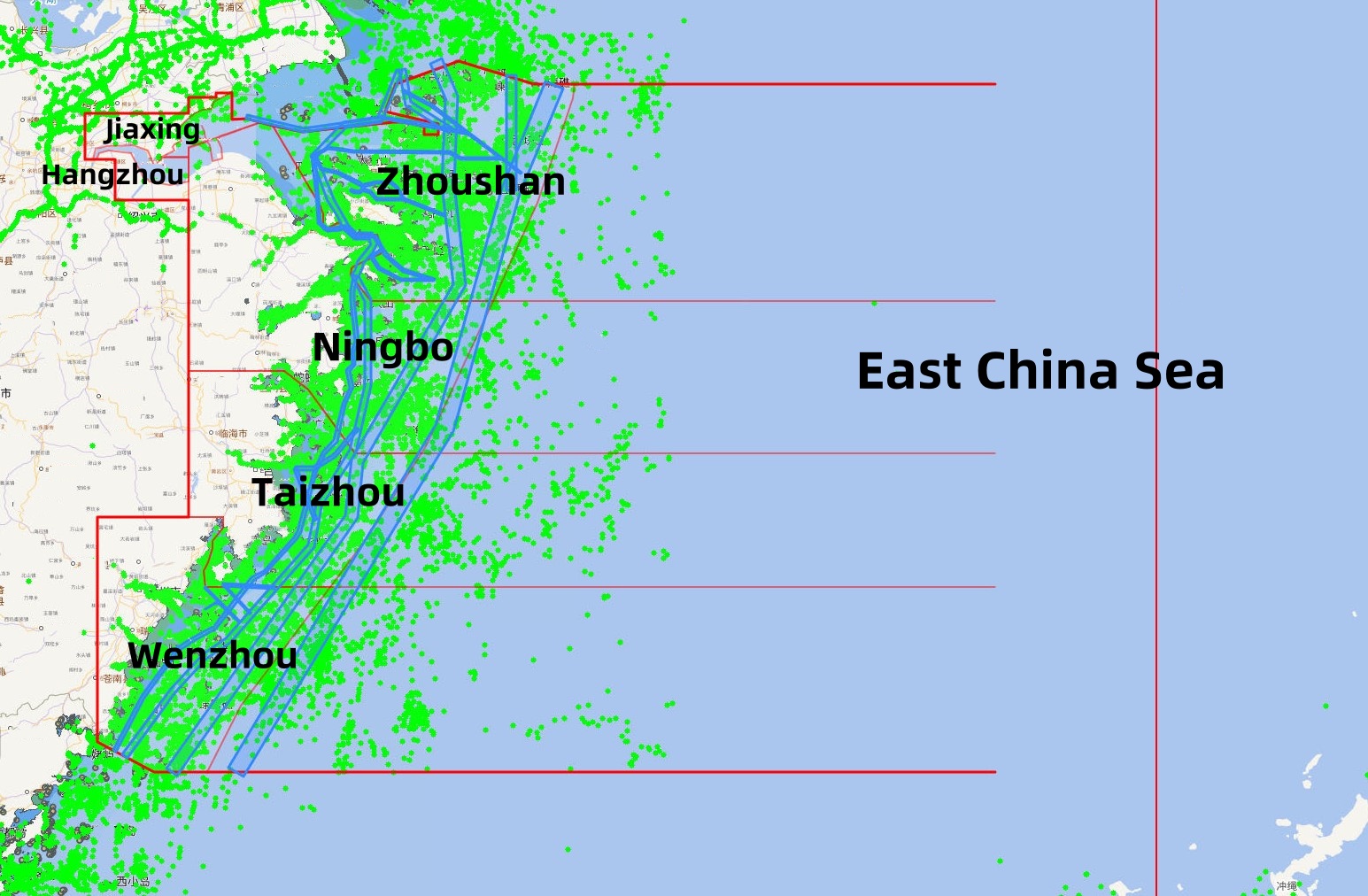

KR, HD KSOE, HD HHI, KSS Line, and Liberian Registr  Zhejiang Maritime Safety Administration Issues the “

Zhejiang Maritime Safety Administration Issues the “  RightShip Updates Age Trigger for Vessel Inspection

RightShip Updates Age Trigger for Vessel Inspection  KR Publishes Report on Safe Maritime Transport of E

KR Publishes Report on Safe Maritime Transport of E