“Good progress on our transformation. Improved cash return on invested capital at 6.9% and synergies of USD 1bn realized earlier than expected. As we continue to build capabilities within logistics and services, growth in revenue and gross profit in Logistics & Services still need to improve . In Jan 2019, we have formed one company, with one global salesforce, customer service team and delivery organization across Ocean and Logistics & Services and focus is now on expanding the integrated customer experience to further strengthen our balance sheet and accelerate the transformation.”says Søren Skou, CEO of A.P. Moller – Maersk.

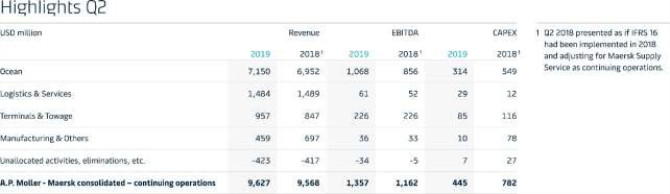

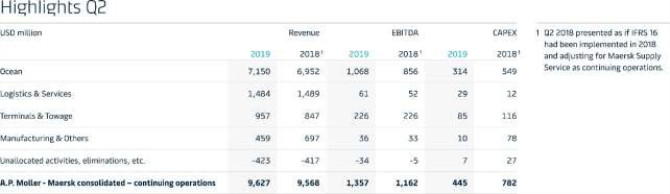

A.P. Moller – Maersk delivers a 17% increase in earnings before interest, tax, depreciation and amortization (EBITDA) to USD 1.4 bn in Q2 compared to the same quarter last year. Revenue grew slightly to USD 9.6bn, which is on par with last year, and the underlying profit increased to USD 134m from USD 15m in Q2 2018.

“Q2 was a quarter of solid progress. EBITDA was up 17% and cash flow improved 86% year on year, driven by continued recovery in Ocean,” says Søren Skou, CEO of A.P. Moller – Maersk.

On the back of the increases in volume and freight rates, Ocean EBITDA in Q2 increased 25% to USD 1.1bn. The Ocean business continued to recover with enhanced unit cost, utilization and reliability and revenue grew 2.9% to USD 7.2bn compared to Q2 2018.

Revenue in Terminals & Towage grew 13% to USD 957m compared to Q2 last year. In gateway terminals, volume in Q2 grew by 8.5% compared to last year, leading to higher utilization. EBITDA increased by 11%, partly offset by one-off items.

In Logistics & Services EBITDA grew to USD 61m in Q2 compared to USD 52m in the same quarter last year. Revenue was at USD 1.5bn, positively impacted by increased revenue in supply chain management, but offset by declining revenue from sea and air freight forwarding.

In Q2, A.P. Moller - Maersk distributed USD 615m in cash to shareholders through an ordinary dividend of USD 469m and USD 146m related to the first phase of the share buy-back programme announced in May 2019 of DKK 10bn (around USD 1.5bn) over a period of up to 15 months.

Progressing well on transformation

During the first half of 2019, A. P. Moller – Maersk formed one sales organisation. Its focus is now on giving customers an integrated experience and offering them even more products, thus improving the financial results across the business and accelerating the transformation.

“The transformation progressed further with an improved cash return on invested capital of 6.9% and synergies of USD 1bn realised earlier than expected. Growth in revenue and gross profit in Logistics & Services still need to improve as we continue to build capabilities within logistics and services,” Skou elaborates.

The latest example of a digital innovation to improve customer experience is Maersk Spot, which simplifies the buying process and offers increased visibility and reliability by enabling customers to search and get competitive rates online, while ensuring cargo gets on board the selected vessel. TradeLens, the blockchain platform developed together with IBM, also progressed with several new commitments from carriers and port authorities during the quarter.

Guidance for 2019

While EBITDA for the first half year improved by USD 500m to USD 2.6bn, A.P. Moller - Maersk reiterates it’s full-year guidance for 2019 of an EBITDA of around USD 5.0bn including effects from IFRS 16.

“We reaffirm our guidance for 2019, while the macro environment continues to be subject to considerable uncertainties,” says Skou.

The guidance continues to be subject to considerable uncertainties due to the weaker macroeconomic conditions and other external factors impacting container freight rates, bunker prices and foreign exchange rates.

Highlights Q2 2019

Sensitivity guidance Q2 2019

Sensitivity guidance Q2 2019

Source:Maersk

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

Dr. Harry S. Banga and Mr. Angad Banga of The Carav

Dr. Harry S. Banga and Mr. Angad Banga of The Carav  Liberian Registry Welcomes Kyle Hurst as Senior Vic

Liberian Registry Welcomes Kyle Hurst as Senior Vic  KATALIST: Accelerating Green Shipping through Innov

KATALIST: Accelerating Green Shipping through Innov  Revealing the risks: digital solutions for complian

Revealing the risks: digital solutions for complian  Beibu Gulf Port Chairman Zhou Shaobo Passes Away at

Beibu Gulf Port Chairman Zhou Shaobo Passes Away at  Exclusive Interview with Norsepower CEO: Bringing S

Exclusive Interview with Norsepower CEO: Bringing S