A worker patrols the steel coil repository at HBIS Group's Hansteel Co. [Photo/Xinhua]

Domestic demand is fueling a rise in steel prices as China reports solid economic data.

An increase in heavy truck manufacturing, excavators and robots in the first half of this year has helped drive up consumption.

"With the recovery of the Chinese economy, steel demand has continued to grow, causing steel products and even iron ore prices to rise," said Chen Kexin, chief analyst at Lange Steel Information Research Center.

This fits in with data reflecting stable growth in China during the first half of the year.

Official government figures showed gross domestic product, or GDP, increased 6.9 percent in the first six months, up 0.2 percentage point compared to the same period in 2016.

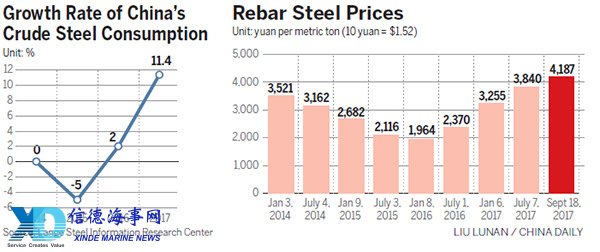

Last year, consumption of steel jumped to 709 million metric tons, up 2 percent from 2015, marking a turning point for the industry.

In the first seven months of this year, it surged by 14.3 percent year-on-year, statistics from Lange Steel Information Research Center highlighted.

Chen is now expecting China's steel consumption to increase by more than 8 percent in 2017, stoked by the rise in infrastructure projects across the country.

Manufacturing industries such as the heavy truck sector, excavators and robotic equipment are driving demand for steel.

At the same time, inventories have declined steadily.

By August, total stocks of five different steel products in 20 cities had fallen for six consecutive months to historical levels, signifying strong demand.

"Cutting capacity has (helped boost) steel demand," Chen said. "But without a strong need for steel, strict environmental protection policies cannot account for the price rise."

During the past few years, the government has rolled out tough environmental laws and regulations for the iron and steel industries. But prices have continued to remain low.

Part of the reason for the increase has been market speculation, one academic stressed.

Last month, the China Iron and Steel Association reported that spiraling steel prices were due to speculative trading by market players.

"Speculators began to disrupt the market by forcing up the prices after noticing strong market demand and reduced supply," said Zhou Yusheng, a professor at the Central Iron and Steel Institute in Beijing.