The 10 largest stock-listed container lines have higher emissions, sail longer, faster and further than the comparable 10 non-listed carriers, according to data from Maritime Strategies International.

Both groups have broadly similar fleets – the listed group having 1,490 ships with an average capacity of 7.9 k TEU and average age of 12.3 years, and the non-listed 1,688 ships with an average size of 8.2 k TEU and age of 11.9 years.

Using the MSI SEASCAPE platform it is possible to benchmark fleet operational performance by ownership.

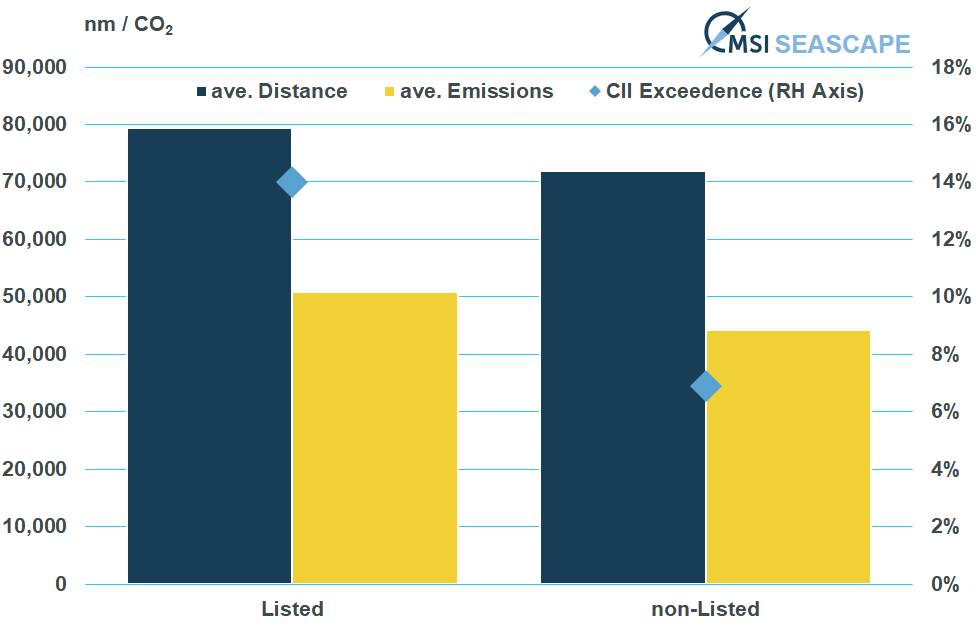

Although geographical deployment and time spent in port are broadly similar across the different vessel groups, ships under listed ownership tend to undertake slightly longer voyages - about 5% longer on average - and operate at marginally higher speeds, approximately 3% faster. Consequently, these vessels cover around 10% more distance annually.

More notably, the speed distribution differs between the groups. While both have a modal speed of 17.5 knots, the non-listed group exhibits a near bi-modal distribution, with a secondary cluster emerging around 13 knots, indicating a tendency toward slow steaming. This variation significantly affects emissions: vessels under listed ownership produce, on average, 15% more emissions than their non-listed counterparts.

When considering emissions efficiency in gCO2/Dwt.nm - which accounts for both emissions output and distance travelled - the listed group exceeds the CII reference line (‘Middle C’) by 14.0%. In contrast, the non-listed group demonstrates greater efficiency, surpassing the reference line by only 6.9%.

Chart: Emissions Efficiencies of Listed vs non-Listed Containership Owners (past 12 months)

Please Contact Us at:

media@xindemarine.com