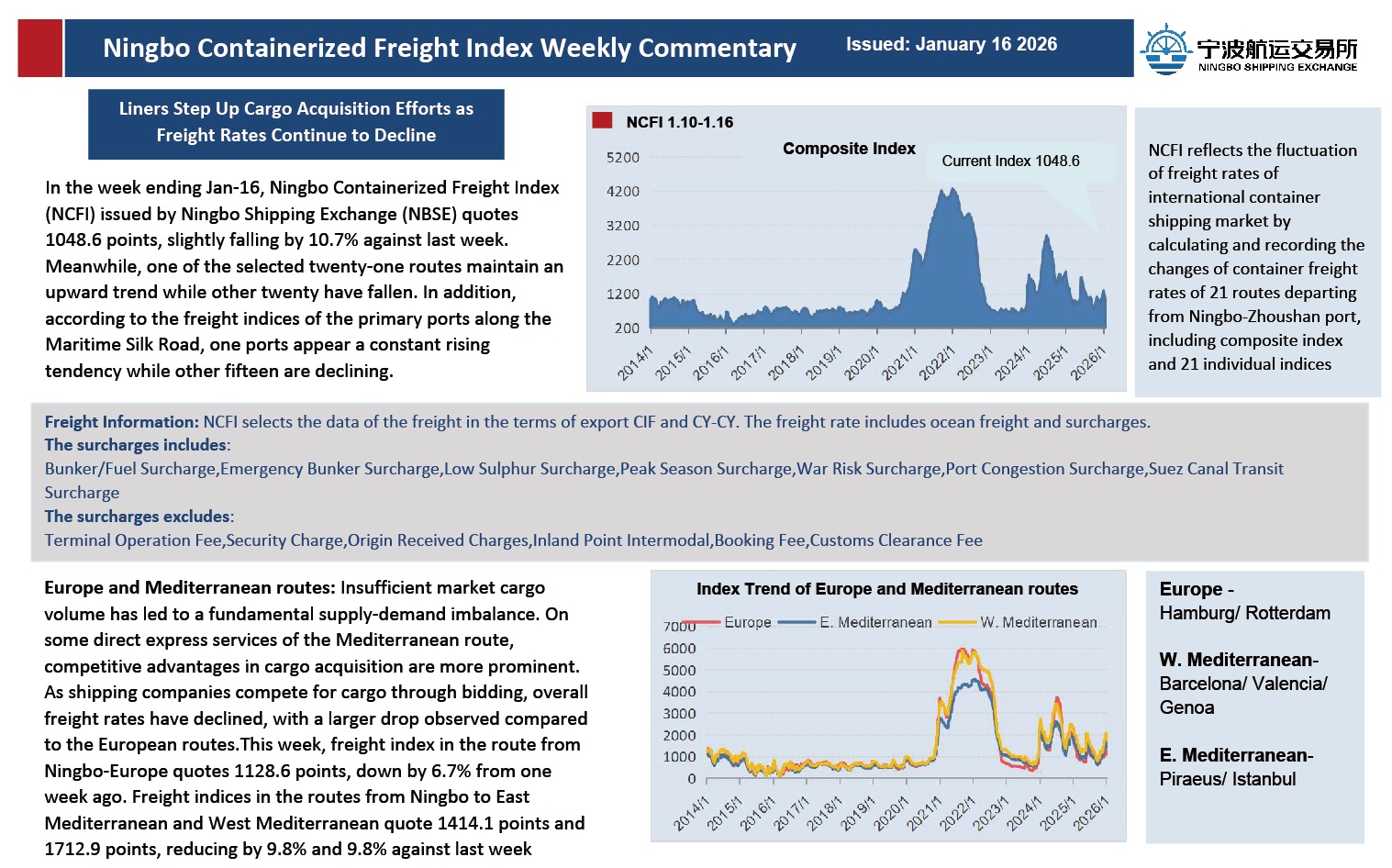

Large scale route diversions as a consequence of the Red Sea/Suez Canal crisis have seen deadweight demand for crude and product tankers increase by 5.5% and 4.5% respectively in 2024.

In its Q2 2024 report, MSI finds that the market is currently in an unfamiliar equilibrium after two years of extreme volatility. This has been supported by wider stability in oil markets and falling vessel deliveries.

Analysis of market movements in the first half of 2024 finds that deadweight demand growth far outstrips that of oil demand and trade. At close to 5% in 2024 it is about three times higher than growth in just cargo volumes. This is partly the ‘distance effect’ adding to cargo growth, driven by disruption to the Red Sea/Suez Canal.

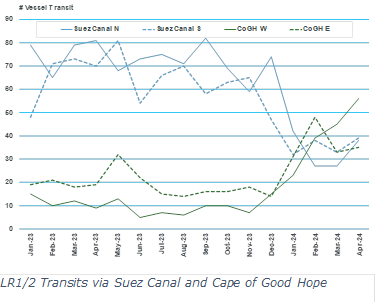

Vessel tracking shows that diversionary activity is not uniform across tanker segments. In the LR1/2 segment we see the most pronounced change in operating activity.

Here, vessels moving through the Suez Canal dropped by about two-thirds in the first four months of 2024, with a commensurate increase in Cape of Good Hope transits. This has translated into LR2 spot earnings being some of the best performing in Q2.

The duration of the Suez Canal disruptions remains a major uncertainty in forward analysis. MSI foresees conditions in the Red Sea normalizing in 2026, assuming a reversal in the escalation of conflict in the Middle East.

However if the conflict is not resolved, an extension of high-risk conditions will naturally drive tanker demand and earnings even higher. Under the MSI Base Case the expectation is that demand growth slows dramatically in 2025 and 2026.

Overall demand levels are being elevated. Other factors, such as long-haul crude trade from Americas to Asia are countering the ‘loss’ of the Red Sea/Suez Canal diversion effect in 2025.

“The latest MSI Base Case sees demand levels remain permanently higher, but this also contends with higher fleet levels, driven both by lower scrapping, and in the latter part of our forecast, higher deliveries as a consequence of increased ordering,” says Tim Smith, Director, MSI. “The combination of these factors pushes our employment rate higher in 2024 and though we see the utilisation rate flatten from 2025 onwards, this is at very high levels. This outlook remains very positive for the tanker sector.”

source: Maritime Strategies International (MSI)

Please Contact Us at: