To mark the start of Capital Link Annual Greek Shipping Forum this week, we take a look at the Greek Maritime fleet using VesselsValue data. The infographic highlights the Greek fleet breakdown by vessel type, top owning nations, S&P transactions, top Greek owners, CII distribution and the most valuable Greek vessels.

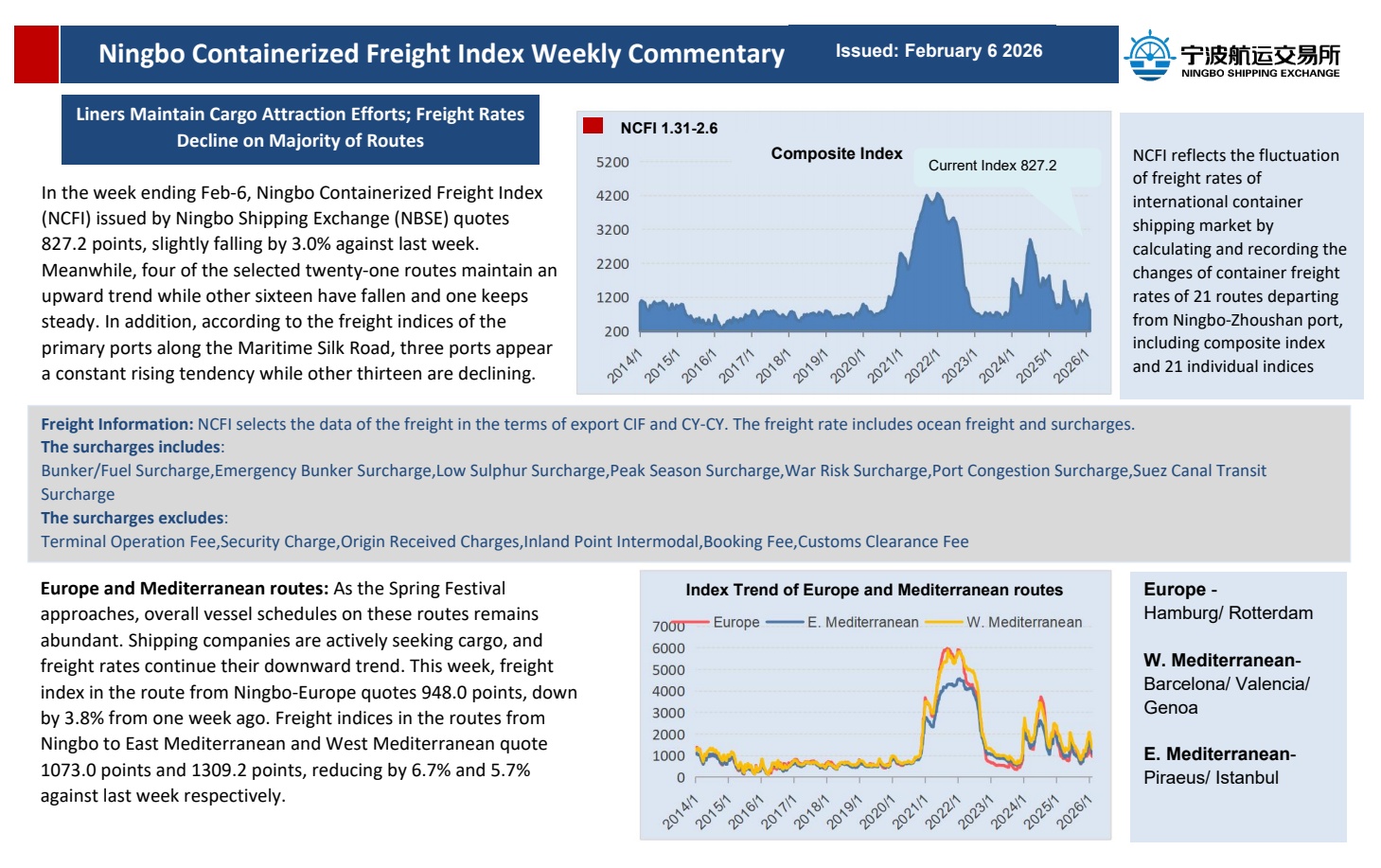

Greek Fleet Breakdown

Bulkers are the most popular vessels within the Greek fleet, with a total of 2,272 vessels, followed by Tankers with 1,450 vessels and Containers with 430 ships. Tankers are the most valuable sector for Greece, worth USD 61.03 bil. This sector has recently seen extraordinary increases in values, which have hit 13 year highs over the last year. The price of a 15 year old Aframax of 110,000 DWT has surged by c.144% year on year from USD 16.17 mil to USD 39.43 mil. This is due to improved demand fundamentals and increased opportunities that have resulted from the ongoing conflict between the Ukraine and Russia. Despite a relatively small fleet of 127 vessels, soaring global demand for LNG has sent the value of this fleet sky high, with the fleet value for LNG carriers at USD 30.50 bil.

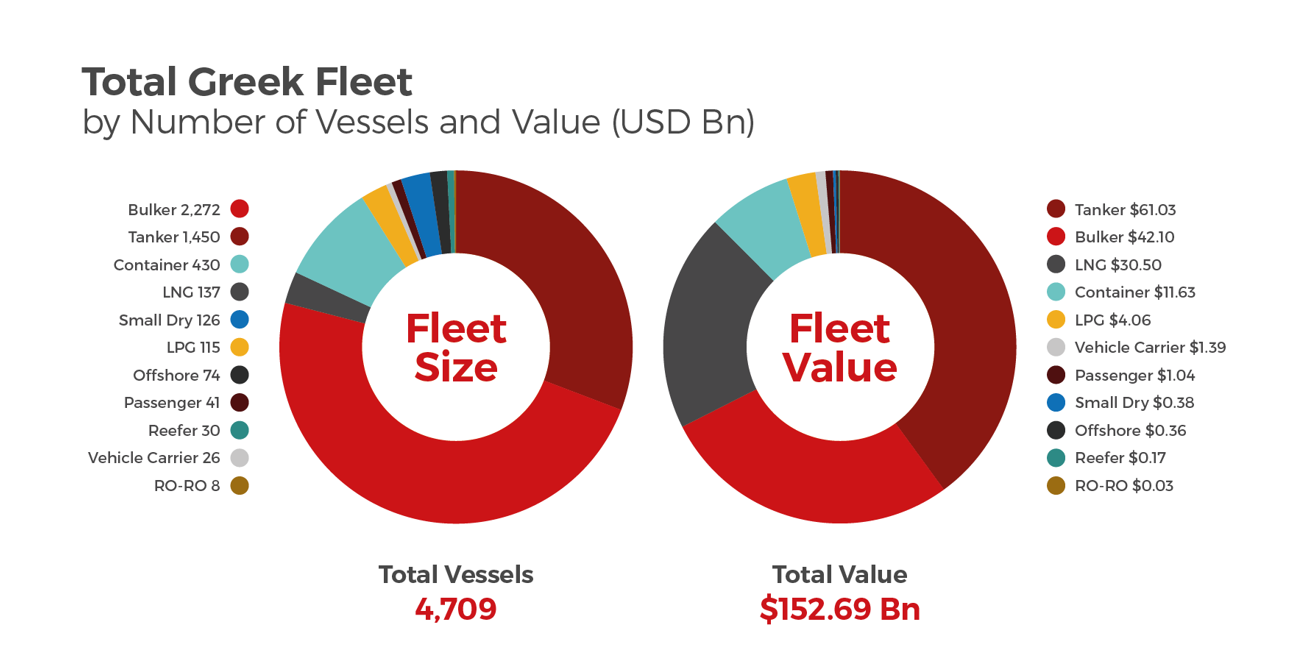

Greece Among Top Owning Nations

Of the top owning nations, the Greek fleet ranks third globally. This is both in number of vessels and total value, comprising of 4,709 vessels live and on order and a total value USD 152.69 bil. Overall, Japan tops the total value list with a fleet worth USD 193.64 bil, and China ranks first in terms vessel numbers with a fleet of 7,114 ships.

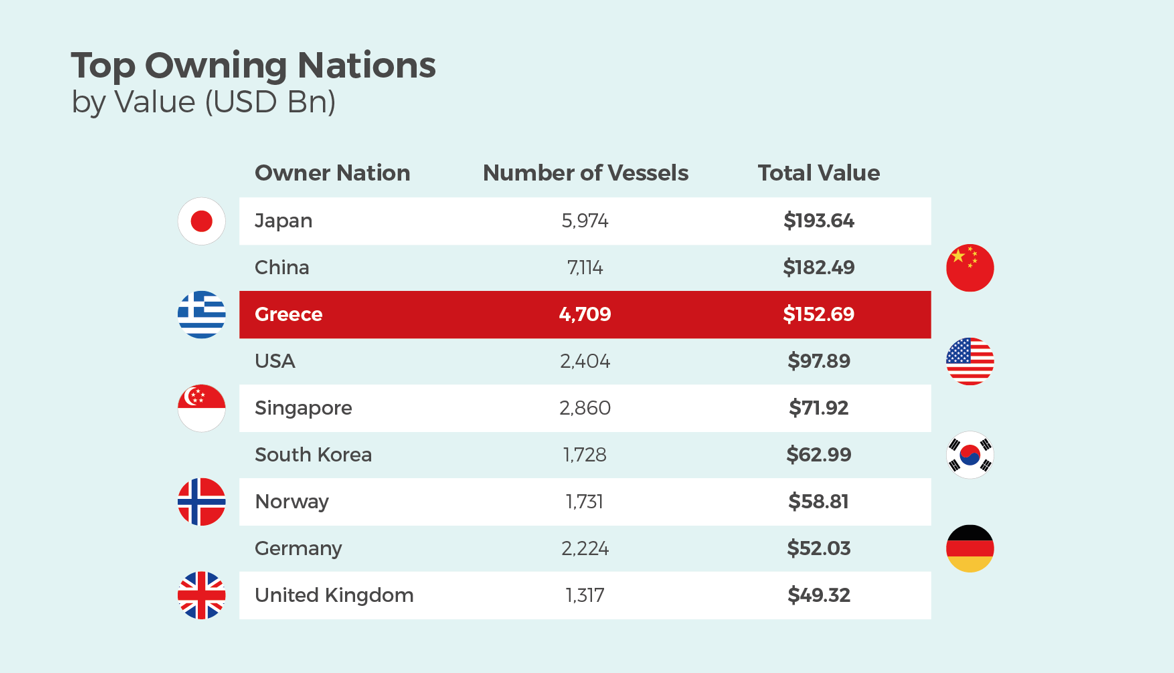

Greek S&P

In terms of S&P, Greece was the second top seller of secondhand vessels in 2022, with 428 vessels sold and a total value of USD 11.7 bil. Greece came behind China who sold 532 ships, receiving USD 12.93 bil. Greece was also the second biggest spender last year, splashing out USD 9.77 bil on a total of 376 vessels. Once again, Greece trailed behind China who spent an impressive USD 14.92 bil on 542 vessels. The UAE ranked third with USD 5.14 bil spent on 271 vessels.

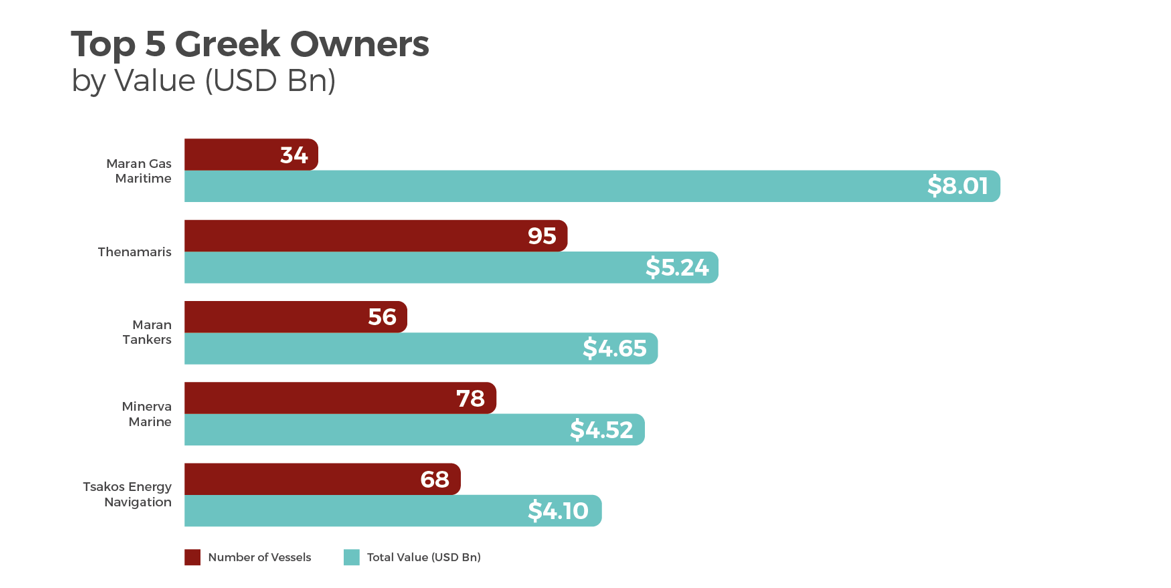

Greek Beneficial Owners

Maran Gas Maritime, the LNG arm of the Angelicoussis Group, is ranked first in a list of the top five Greek owners with a fleet value of USD 8.01 bil. Additionally, their fleet consists of 22 live vessels and a further 12 on order. Thenamaris have the largest fleet with 95 vessels both live and on order and a total value of USD 5.24 bil. Tankers make up the majority of their trading fleet, accounting for 60% while the remainder consists of Bulkers, Containers, LNG and LNG carriers. Maran Tankers, also part of the Angelicoussis Group, came in third with a value of USD 4.62 bil and 56 vessels, followed by Minerva Maritime with a total value of USD 4.52 bil and 78 vessels. New York listed Tsakos Energy Navigation is ranked fifth with a value of USD 4.1 bil and consists of 68 vessels.

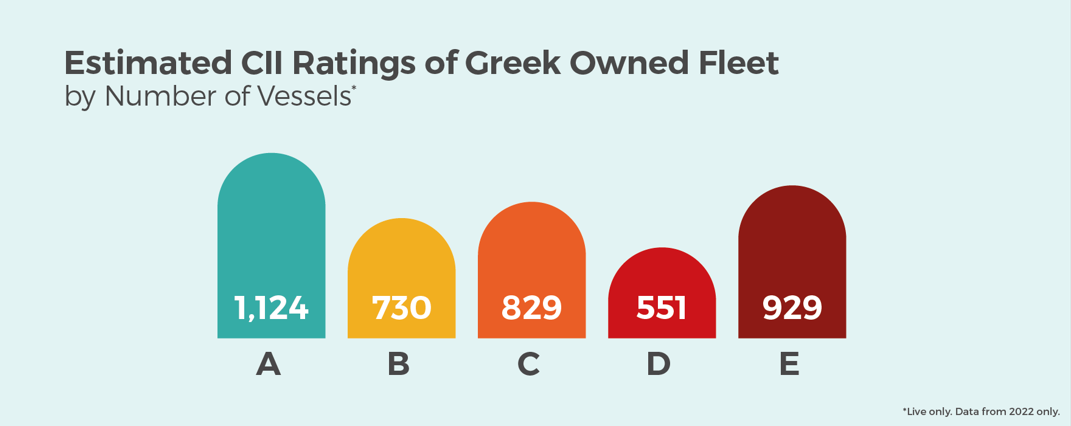

Estimated CII Distribution of Greek Fleet

Decarbonisation is an increasingly high priority to the Greek Shipping community; a large proportion of the Greek owned fleet ranks highly in the new mandatory energy efficiency ratings from the International Maritime Organisation (IMO). Over a quarter of the fleet have achieved an estimated CII rating of ‘A’, and 64% of the fleet have received an estimated rating between A-C.

Most Valuable Greek Vessels

The most valuable Greek owned cargo vessel is the recently delivered Clean Copano (199,830 CBM, Jul 2022, Hyundai Heavy Ind). Owned by Dynagas, this Large LNG carrier is valued at USD 286.11 mil. In the Ferry sector, the most valuable vessel is the Blue Star Patmos, owned Ropax Blue Star Ferries (18,498 GT, June 2012, Daewoo) and valued at USD 63.28 mil.

Source: VesselsValue

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: