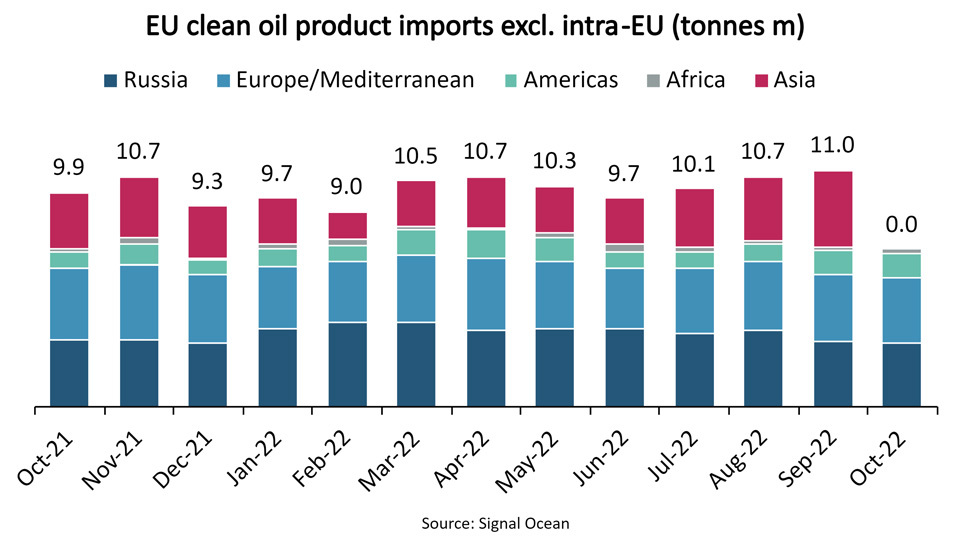

Excluding intra-EU trade, the European Union’s average monthly clean oil product imports amounted to 10.0 million tonnes in 2019 but declined to 9.3 million tonnes in 2020 and 2021. Due to the high import volumes in July to October, the 2022 year-to-date average monthly volumes have reached 10.3 million tonnes, exceeding 2019 volumes.

Latest early February 2023, the EU will need to have found new suppliers for nearly 35% of its clean oil product import volumes as the bloc’s sanctions against Russian oil take effect. Russia, on the other hand, must attempt to find new buyers for approximately 60% of their exports.

Despite the upcoming sanctions, the EU’s average monthly imports from Russia have year-to-date reached 3.5 million tonnes and increased 10.3% over last year. However, during September and October, the average monthly Russia to EU volumes reduced to 3.0 million tonnes although total EU import volumes increased to 11.0 and 11.8 million tonnes in September and October respectively.

The increase in clean oil product imports from Asia to the EU have more than replaced lost volumes from Russia. The volumes from Asia to the EU have increased since July and in October hit 4.4 million tonnes, up from the recent monthly average of 2.1 million tonnes. Asia has therefore been the main supplier of the EU’s clean oil product imports since September, overtaking Russia.

While Russia remains the single largest supplier of clean oil products to the EU, it appears that buyers in the EU have already begun the process of finding new suppliers. So far, Saudi Arabia has delivered most of the increase in Asian volumes, but India, China, and South Korea are also contributing.

As mentioned in our Shipping Number of the Week in week 40, the newly increased export quota for Chinese refineries should increase availability of clean oil products in Asia. Reacting to the new export quotas, China’s crude oil imports rose 30% m/m and 24% y/y in October, hitting the highest level since July 2020.

As the remaining clean oil product volumes from Russia to the EU are replaced, average haul for product tankers into the EU will continue to increase. The muted 2023 growth prospects for the global economy, and particularly the EU, will weigh on demand but as effective capacity supply growth will be very minimal (and possibly negative), we still expect further improvement in trading conditions for product tankers.

Source: BIMCO

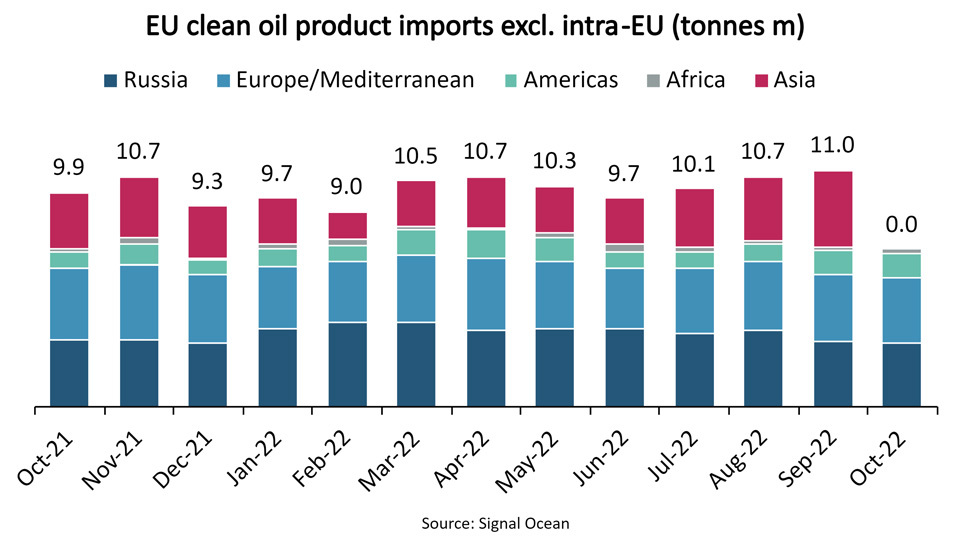

Latest early February 2023, the EU will need to have found new suppliers for nearly 35% of its clean oil product import volumes as the bloc’s sanctions against Russian oil take effect. Russia, on the other hand, must attempt to find new buyers for approximately 60% of their exports.

Despite the upcoming sanctions, the EU’s average monthly imports from Russia have year-to-date reached 3.5 million tonnes and increased 10.3% over last year. However, during September and October, the average monthly Russia to EU volumes reduced to 3.0 million tonnes although total EU import volumes increased to 11.0 and 11.8 million tonnes in September and October respectively.

The increase in clean oil product imports from Asia to the EU have more than replaced lost volumes from Russia. The volumes from Asia to the EU have increased since July and in October hit 4.4 million tonnes, up from the recent monthly average of 2.1 million tonnes. Asia has therefore been the main supplier of the EU’s clean oil product imports since September, overtaking Russia.

While Russia remains the single largest supplier of clean oil products to the EU, it appears that buyers in the EU have already begun the process of finding new suppliers. So far, Saudi Arabia has delivered most of the increase in Asian volumes, but India, China, and South Korea are also contributing.

As mentioned in our Shipping Number of the Week in week 40, the newly increased export quota for Chinese refineries should increase availability of clean oil products in Asia. Reacting to the new export quotas, China’s crude oil imports rose 30% m/m and 24% y/y in October, hitting the highest level since July 2020.

As the remaining clean oil product volumes from Russia to the EU are replaced, average haul for product tankers into the EU will continue to increase. The muted 2023 growth prospects for the global economy, and particularly the EU, will weigh on demand but as effective capacity supply growth will be very minimal (and possibly negative), we still expect further improvement in trading conditions for product tankers.

Source: BIMCO

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: