Since the beginning of this year, the dry bulk shipping market has ushered in a strong recovery. The BDI index hit a ten-year high. The market is getting better, and shipowners' willingness to invest in bulk ships has increased significantly.

On Aug. 5, BDI rose 1.75% to a one-month high of 3,376; BCI jumped 2.6% to a three-month high of 4,414, with the average daily rate rising $933 to $36,608. BPI climbed 1.79% to 3,418 points, with average daily rates rising $536 to $30,758. BSI rose 0.44% to 2,996 points.

Data shows that the average daily chartering price of capesize bulk carriers in July was $30,400, compared with $25,000 in the first seven months. The average panamax chartering price in July was $34,100 per day, compared with $24,000 in the first seven months; In July, the average daily chartering price of handysize ships was $31,600, compared with $22,600 in the previous July, which maintained an increase, and small and medium-sized ships carrying grain, coal and steel were able to win over large vessels.

China, Australia and other major countries have suffered serious port congestion due to the strengthening of epidemic prevention. It is estimated that 2,000 to 3,000 bulk carriers have blocked ports in the world, equivalent to a loss of 26% of transport capacity. This further pushed up the freight rate index and daily chartering price.

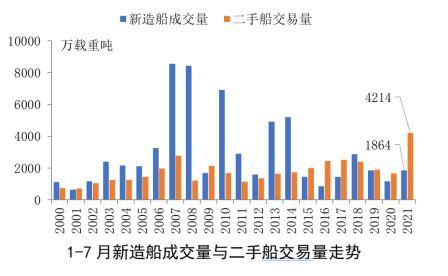

At the same time of freight rates rise, the investment willingness of bulk carriers increases significantly. In the first seven months, the second-hand trading volume of global bulk carriers reached 42.14 million dwt, up 151% year on year, hitting a record high; New ship orders reached 18.64 million dwt, up 58% year on year.

It is particularly noteworthy that European and American shipowners, as the industry's vane, have ordered a total of 5.52 million dwt of bulk carriers since the beginning of this year, accounting for 30% of the market, compared with less than 8% in the same period last year.

Source: Sarah Yu, XINDE MARINE NEWS

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: