Benchmark Dalian iron ore rose for a third straight session on Thursday, as spot prices in China stabilised after a recent sell-off following improved demand and easing worries about production cuts in the country's steelmaking hub.

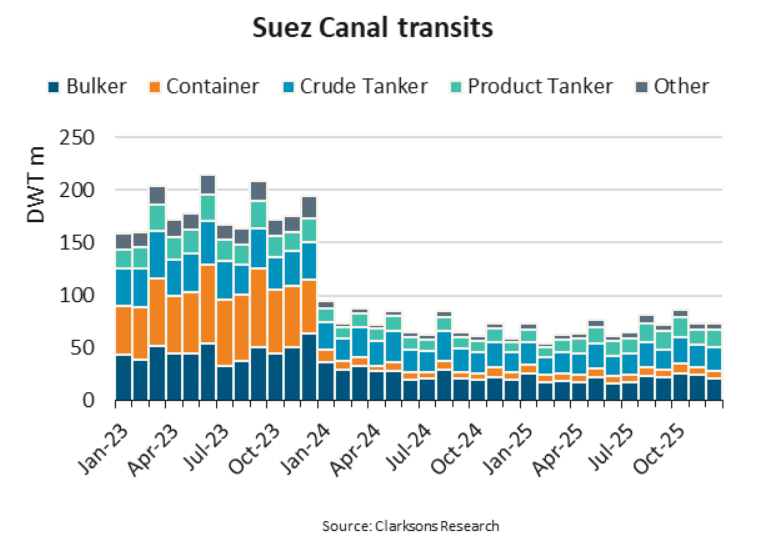

Market participants are also eyeing developments that could fuel concerns about tight global supply of the steelmaking ingredient, such as the flooding in top exporter Australia and the Suez Canal blockage, analysts said.

Iron ore on China's Dalian Commodity Exchange ended the daytime trading session up 2.7% at 1,067.50 yuan ($163.36) a tonne.

However, iron ore on the Singapore Exchange was flat at $155.70 a tonne by 0709 GMT.

Spot iron ore prices were broadly stable on Wednesday, after Monday's sell-off triggered by worries about steel output curbs in China amid a clampdown on the industry's heavy polluters. in Australia could tighten the availability of iron ore,” commodity strategists at ANZ said in a note.

Australia has been hit by devastating floods caused by the worst downpour in more than half a century. Suez Canal blockage, meanwhile, caused “fears of supply-chain disruption, particularly on the raw commodities front”, said Howie Lee, an economist at OCBC Bank in Singapore.

Low tide has slowed efforts to dislodge a 400-metre long, 224,000-tonne container vessel that has choked traffic in both directions along the Suez Canal and created the world's largest shipping jam. Lee said any price upside for iron ore appears limited for now.

“(Top steel producer) China's demand is still the key driver from here, and we need to see stronger import numbers and crude steel production for iron ore to continue its rally,” he said.

Construction steel rebar on the Shanghai Futures Exchange SRBcv1 rose 1.3%, while hot-rolled coil SHHCcv1 edged up 0.1%. Stainless steel SHSScv1 gained 0.2%.

Dalian coking coal climbed 0.8% and coke jumped 1.9%.

Source: Reuters

Source: Reuters