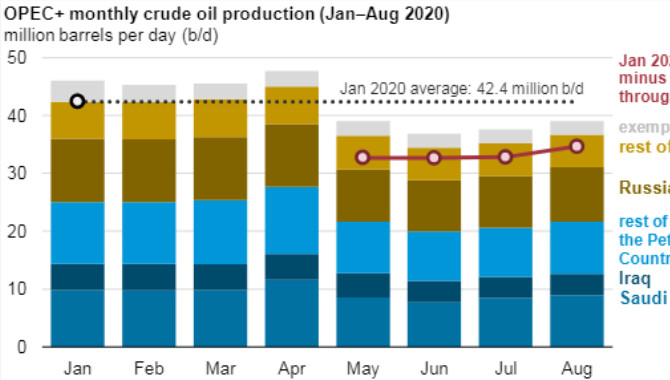

On April 15, members of the Organization of the Petroleum Exporting Countries (OPEC) and 10 non-OPEC partner countries, collectively known as OPEC+, agreed to reduce crude oil production in response to rapidly increasing global oil inventories in the first quarter of 2020. At the time, efforts to contain the spread of coronavirus resulted in a steep decline in demand for petroleum liquids and lower crude oil prices. Starting in May 2020, the OPEC+ agreement called for a decrease in crude oil output by an initial 9.7 million barrels per day (b/d) that gradually tapers through April 2022, the end of the current agreement period.

The U.S. Energy Information Administration’s (EIA) monthly data show that OPEC total crude oil production decreased by 6.0 million b/d from April to May, which was the largest monthly production decline since 1993. Compared with January 2020 total petroleum liquids production, partner countries’ output fell by an estimated 5.9 million b/d in May, 7.9 million b/d in June, 7.1 million b/d in July, and 5.6 million b/d in August. OPEC members Iran, Libya, and Venezuela were exempt from the production cut agreement because of economic sanctions or domestic political instability.

EIA estimates that the OPEC+ agreement, along with declines in production elsewhere, including the United States, brought global supply lower than the level of global demand for the first time since mid-2019. Lower supply than demand has resulted in significant global liquid fuels inventory draws since June. EIA expects inventories to continue declining in the second half of 2020 and during most of 2021, resulting in a relatively balanced market by the end of next year, according to EIA’s September 2020 Short-Term Energy Outlook.

Source:EIA

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at: