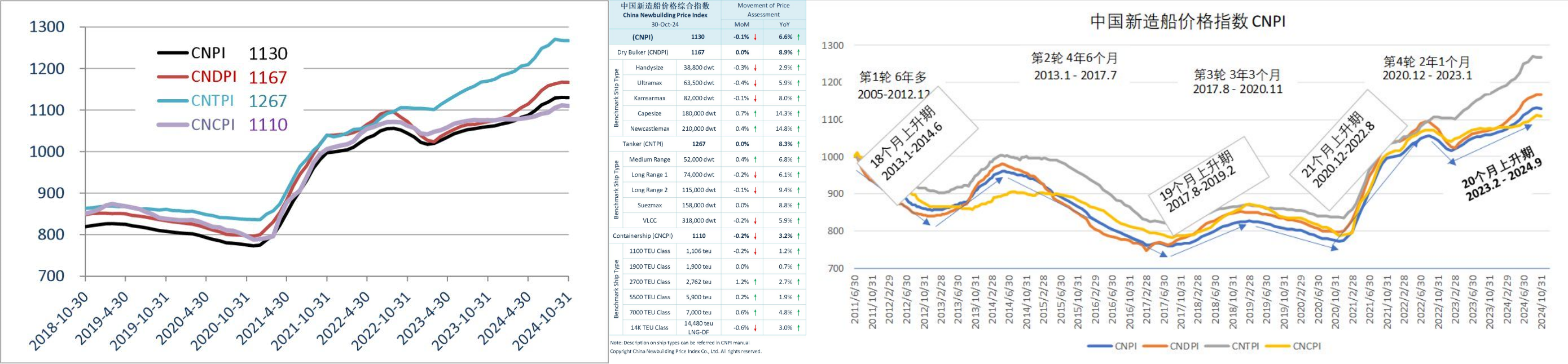

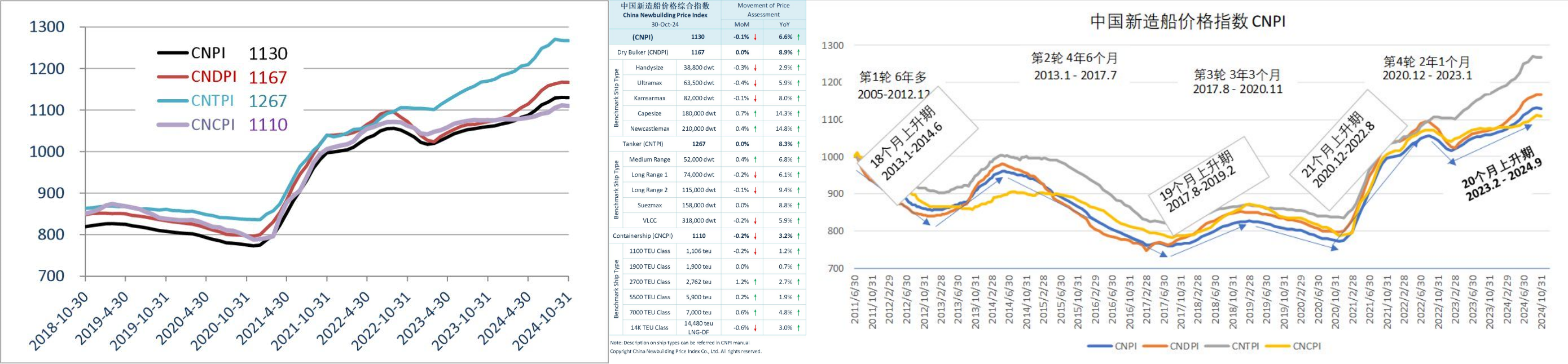

After a remarkable 20-month consecutive rise, the China Newbuilding Price Index (CNPI) has registered its first decline in October 2024, edging down by just one point to 1,130. While the drop may seem minor, it could mark a potential turning point. Historically, once the CNPI dips, it usually doesn’t rebound immediately, with previous declines lasting at least five months.

The Founder of CNPI Mr.LiuXunliang said in the CNPI monthly report:Two possible paths lie ahead: the CNPI could either enter a prolonged downtrend, similar to the period from July 2014 to July 2017, or experience a brief dip before resuming its upward trajectory, as seen from September 2022 to January 2023.

Optimists believe the fundamentals remain robust. With shipyards holding substantial order books, prices are expected to remain resilient. This recent drop, driven by a 0.2% decline in the containership price index (CNCPI) due to the decreased valuation of large container vessels, could be an isolated incident. Notably, benchmark vessels across key segments are still seeing price increases, balancing the overall market. As a result, the Dry Bulker Price Index (CNDPI) and the Tanker Price Index (CNTPI) both held steady from September to October.

While the CNCPI dip caused a slight downturn in the CNPI, there’s reason to view this as a short-term adjustment rather than a definitive shift toward a long-term decline. For those who believe we’re in a super-cycle that could last until 2040, this may just be a temporary pause.

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar