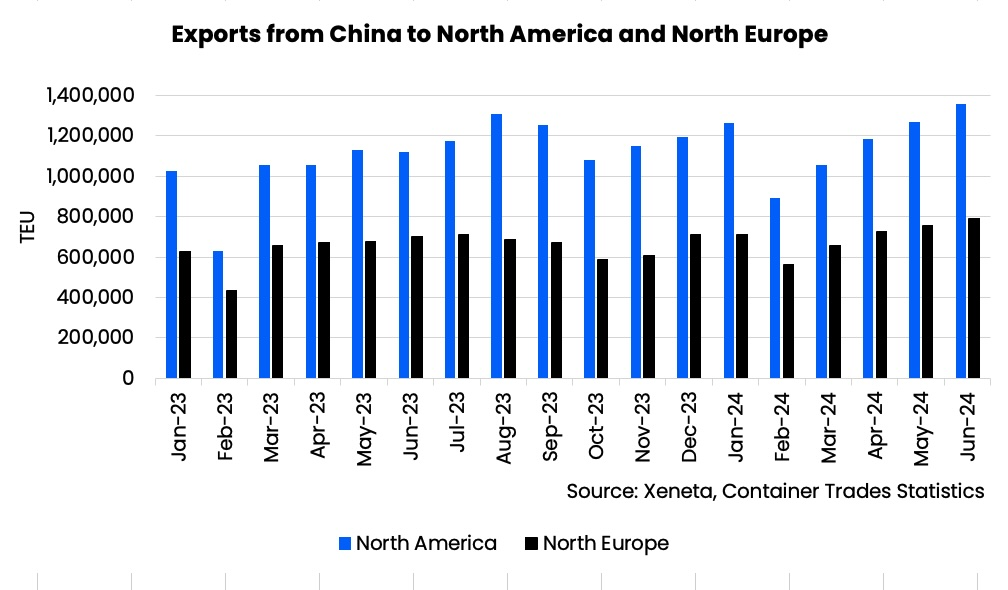

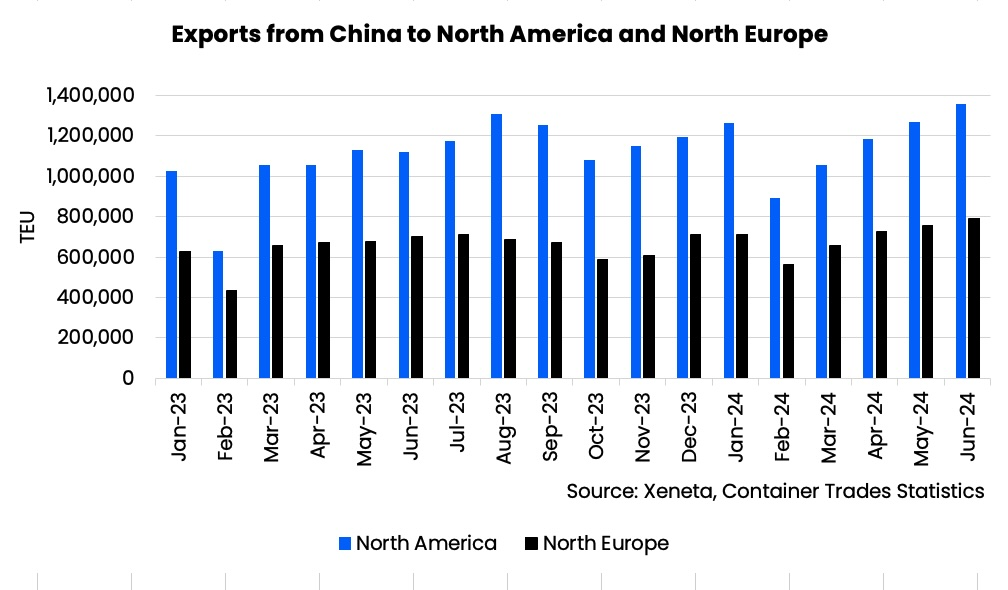

Ocean container shipping demand from China to North America and North Europe continued to break records in June as importers rushed to protect supply chains amid the global disruption caused by conflict in the Red Sea.

The latest data, released this week, shows 800 000 TEU (20ft equivalent container) were shipped from China to North Europe in June, which is the highest ever monthly figure on this trade (Source: Xeneta, Container Trades Statistics).

While the trade from China to North America did not set a new all-time high, it was still the highest volume of containers to have ever been shipped in the month of June at 1.36m TEU. This makes June 2024 the eighth highest month on record and is beaten only by the extraordinary volumes shipped at the height of Covid-19 pandemic disruption in late 2020 and 2021.

Peter Sand, Xeneta Chief Analyst, said: “Conflict in the Red Sea has brought a major shift in the traditional seasonality of ocean supply chains, with concerned shippers rushing to import as many goods as they can earlier in the year.

“Shippers assessed the impact of the Red Sea conflict on ocean supply chains and are not prepared to take the risk of repeating the chaos of the pandemic years - meaning we have seen record-breaking volumes on major fronthaul trades out of China ahead of the traditional peak season in Q3.”

Correlation between record volumes and rising freight rates

The record volumes in June coincided with spiralling average spot rates on trades from the Far East to the US and North Europe. Xeneta data shows spot rates into the US West Coast and US East Coast increased by 144% and 139% respectively between 30 April and 1 July. Spot rates increased by 166% into North Europe during the same period.

Sand said: “Shippers wanted to protect supply chains and that has come with a heavy price tag. The massive volumes shipped in May and June contributed to the severe congestion seen at ports in Asia and the dramatic spike in rates.

“Those shippers who rushed imports may have spent far more than they wanted to, but they clearly felt it was a price worth paying to lower the level of risk in their supply chains later in the year. We have seen shippers importing Christmas goods as early as May because hindsight is a luxury they do not have – they needed to take immediate action.”

Demand may have peaked

There are signs that the record-levels of demand for container shipping from China to North America and North Europe may have peaked.

Average spot rates from the Far East to US West Coast and East Coast are now softening, having fallen by 17% and 3.2% respectively since 1 July. Average spot rates from the Far East to North Europe have held a little stronger, but have now fallen slightly by 1.6% since 31 July.

Sand said: “There is a clear correlation between record-breaking volumes and spot market developments on the major trades from China to North America and North Europe.

“If we are now seeing spot rates softening in August, that would suggest we have also already seen the peak in demand for ocean container shipping and volumes should be lower in July and August during what would ordinarily have been the peak season.”

source: Xeneta

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar