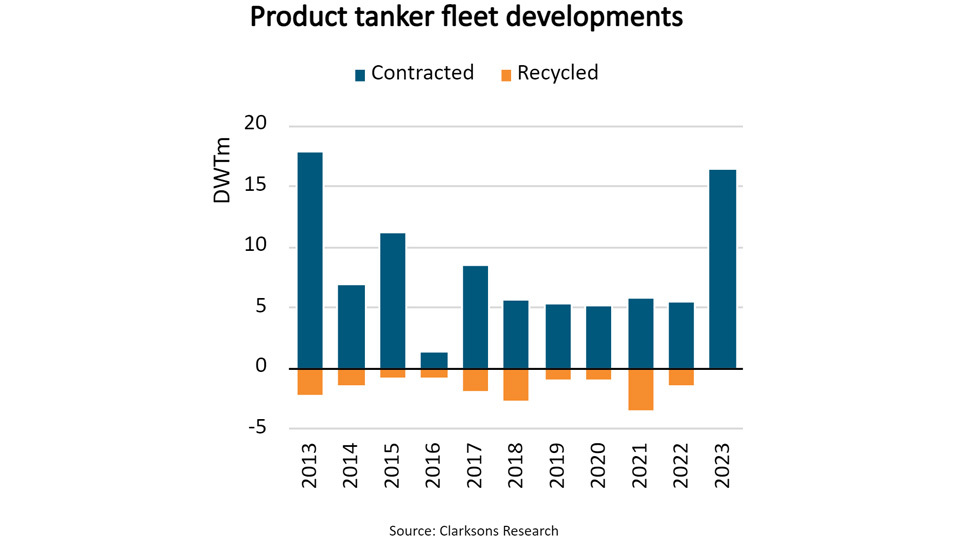

In 2023, only seven product tankers with combined deadweight tonnes (DWT) capacity of 265,000 were recycled. This was a year-on-year drop of 82% compared to 1.5 million DWT (27 product tankers) recycled in 2022. It was also the lowest level of recycling seen since records began in 1996.

Strong earnings and second-hand values, as well as a reduction in newbuilding deliveries, have likely contributed to the very low level of recycling.

Clarksons Research estimates that average annual earnings per ship fell 15% in 2023 but were still at third highest levels since the financial crisis hit in 2008. At the same time, prices for second-hand ships rose 17% to the highest levels since 2008.

2023 also saw the lowest level of newbuilding deliveries in more than 20 years and despite record low recycling activity, the fleet only grew 2.1% year-on-year.

As a result of low recycling activity and newbuilding deliveries, the average age of product tankers increased by nine months during 2023 to the highest level since 2005.

As a result, 12% and 39% of the product tanker fleet’s ships are more than respectively 20 and 15 years old, equal to 9% and 35% of the fleet’s deadweight capacity.

In 2023 the first significant steps to renew the fleet were meantime taken. Contracting of new ships rose to a 10-year high and the order book more than doubled in size, leaving the order book to fleet ratio at 12%.

As in past years, MR and LR2 product tankers dominated the contracting, and the two segments contribute respectively 33% and 56% of the order book’s DWT capacity. Most contracts were once again placed with Chinese yards which now control 70% of the deadweight capacity in the order book.

However, deliveries will only increase in 2025 when 10 million DWT capacity is scheduled for delivery. Another seven million of the order book’s 23 million DWT are scheduled for delivery in 2026. It is therefore also likely that recycling will begin to increase in 2025.

As part of the 2023 contracting, product tanker owners have also taken further steps to prepare for low carbon fuels. Currently, 97 ships are either prepared or readied for alternative fuels (3% of fleet). The order book meantime contains 60 such ships (19% of the order book).

Source:

BIMCO

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar