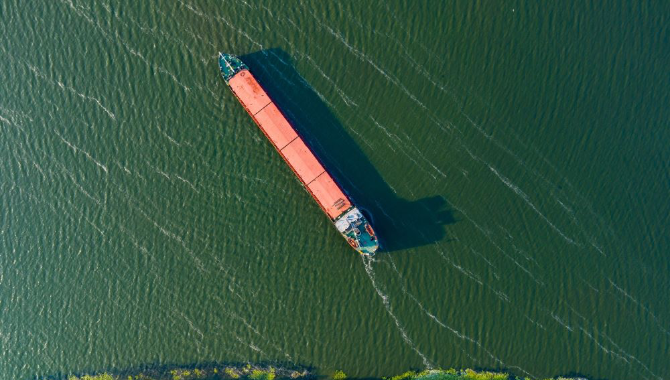

To state the obvious: Ships, being large and slow, are extremely energy efficient at carrying cargo when compared to trucks, trains and aircrafts. Therefore, comparing different modes of transportation, shipping is the most environmentally friendly. Still, progress made in the shipping industry, as one of the biggest emitting industries of greenhouse gases, can have a major impact on global emission level.

Over the past decade we have seen large changes to the ship financing landscape towards greener projects. The most obvious green financiers are the Poseidon Principles banks, the initiative launched in 2019 whose signatories manage 70% of the world’s shipping loans.

At the same time, many other banks and funds are moving away from financing ‘brown’ assets and trades. With the strictest lenders not financing vessels carrying any fossil fuels, even coal-carrying Kamsarmaxes and larger Bulk Carriers. This list of banks and funds will continue to grow. Rumours suggest that another $20bn of loans will be managed by financiers with this policy by 2024.

So, what makes a ship ‘green’ or not? There are two schools of thought amongst lenders. Most lenders focus on the vessel’s own emissions via metrics such as AER and CII ratings. On the other hand, some see the vessel’s cargo or industry as more relevant. For example, is a Newcastlemax or VLCC really ‘green’ even if it is ammonia-powered? Are Wood Pellet Carriers the greenest vessels afloat? Taking it to the absurd, could a Wind Turbine Installation Vessel burn coal and still be seen as ESG-friendly?

This last point is a real paradox in ‘green shipping thought’. Is the vessel carrying oil or oil products responsible for those cargoes being burned? And are there other effects at play?

With new reporting rules coming from the EU, the vast majority of shipping banks, not only the Poseidon Principles banks, will be forced to calculate and share their loan portfolios’ emissions. It is likely that future regulations will force a slow reduction in total emissions for each bank. Their calculated emissions are based on economic exposure – a loan of 50% of the vessel’s value means that the bank is responsible for 50% of the emissions. According to the existing regulatory structure, the ship is only responsible for the oil it burns and not for its cargo. For this reason, oil-carrying ships will remain well financed for the time being.

Erlend Sommerfelt Hauge, Managing Partner at oceanis, says:

“On pricing, commercial banks are a refuge for shipowners who have less of a green agenda. Smaller commercial banks are getting very close to Poseidon Principles banks.”

He adds:

“For many shipowners, perhaps the restrictions on vessels and trades make Poseidon Principles margins a less attractive partner than the alternatives. Due to today’s high base rates, a 50 basis point difference in margin from 2.00% to 2.50% represents only 7% of total interest costs. Will the reduced interest costs outweigh the earnings that could have been made?”

For those managers who are committed to the green transition - thank you for investing your capital into making shipping more efficient in the long term. Your additional focus on green aspects means that financing will remain available to you from a full spectrum of sources for everything from newbuilds to retrofits to second-hand purchases at market-beating prices.

Meanwhile, there is still cheap funding available for all shipowners. It’s not always with the cheapest of banks, but it still exists and at attractive terms. Keeping a fleet’s average age safely inside commercial bank limits will make sure that this remains true.

Dry Bulk

The story in Dry Bulk is much the same as in the last quarter; margins continue to decline, but without a holding company guarantee to provide additional security, vessel earnings do not provide enough cashflow for banks to offer more than around 50% of vessel values for younger ships and 40-45% for older vessels. Funds and leasing houses can provide higher leverage very quickly, in less than one month in many cases, but this comes with strings attached.

While the interest margins charged by funds have decreased over the past 3 years, the more rapid increase in base rates has made interest costs take up a much larger proportion of a vessel’s daily breakeven. This leaves less space for amortisation, making funds less able to provide the high financing amounts they are known for. Alternatively, some funds will offer financing terms with breakevens above the current FFA curve for a variety of Dry Bulk vessels with higher financing amounts. However, the risk to shipowners in this case is significant.

Chinese and Japanese leasing remains an interesting option for companies with younger tonnage, though typically only Chinese leasing is available on non-recourse basis. From experience, while the terms offered are highly attractive with margins in the 3% range this does come with several requirements. First, the shipowner must be deeply experienced with previous success in navigating downturns. Second, the vessels must be very young to ensure low breakevens as repayments are almost always according to a linear 18-year profile. Third, purchase options are often only available annually and from the third or fourth year of the financing. Bank and Fund terms are much more flexible in these areas.

Tankers

Financing availability and pricing has been generally consistent quarter-on-quarter for tankers. Banks and funds remain keen to deploy capital at around the same leverage previously seen, with minimal adjustments to repayment profiles due to roughly consistent 1 year TC rates across sectors. Heading into the winter season with its typically higher freight rates, this seems a conservative move.

The changes in repayment structures we started to see last quarter are also continuing to make their impact felt; cash sweeps from banks are the most common change to financings of one year ago. These are generally structured on top of linear repayment profiles with a cap on the total cash which can be swept during the loan term. In many ways, this provides shipowners a more flexible set of repayment terms than a more traditional fixed front-loaded repayment schedule. In extraordinary good markets, the lenders are able to bring down their risk accelerated, while the owners will preserve some buffer towards a drop in daily earnings.

Another important topic is the slow movement east of Tanker shipowners, with many recent sales seeing vessels move from European owners to Middle and Far Eastern interests. Generally speaking, these newer shipowners have aimed to take advantage of the market dislocation brought about by the Ukraine war and ensuing sanctions. Trading Russian cargoes legally under the sanctions caps for Crude and Product cargoes has proven to be a more profitable trade than avoiding such cargoes. This approach comes with its risks; it is more difficult to secure financing for these owners from Western sources, even if their trading is completely above-board and within international laws.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar