This analytical piece provides an in-depth examination of current trends in blank sailings across major shipping routes, encompassing the Transpacific, Transatlantic, and Asia-North Europe & Mediterranean trades.

Shipping firms cancel or exclude planned journeys for various reasons, including seasonal demand shifts, trade imbalances, port congestion, labor disputes, adverse weather, or unforeseen events like the COVID-19 pandemic. In 2021-2022, carriers added extra voyages to meet rising demand, but supply chain issues caused ships to get stuck in port queues, resulting in numerous cancellations despite increased capacity. Nevertheless, blank sailings have been crucial in preventing further drops in spot rates and keeping freight rates above carriers' break-even point. Although they are more organized than last year's sporadic cancellations, blank sailings are still used to stabilize market rates and exert upward pressure on specific trade routes, fueled by surging market demand and carrier actions.

Looking ahead, it appears that ocean carriers are taking a cautious approach. Global forwarders are cautioning about a notable rise in blank sailings anticipated for the fourth quarter on the trade routes from Asia to North Europe and the Mediterranean. The continuous expansion of shipping capacity, driven by the introduction of new mega-vessels, is outstripping the existing demand, leading to considerable strain on already oversupplied trade lanes.

Blank sailing trends

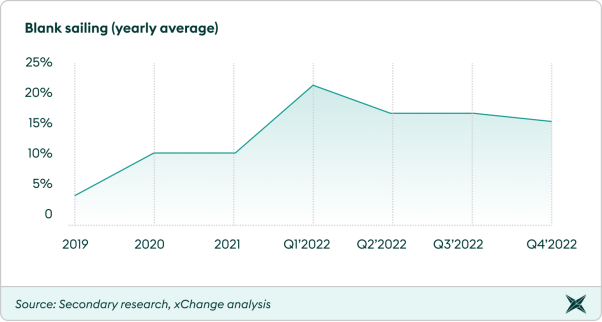

The annual average of blanked sailings showed significant fluctuations in the past three years. It was 7% in 2019, reflecting industry stability. However, in 2020, due to the global COVID-19 pandemic, it surged to 12%, signaling major disruptions. Surprisingly, in 2021, the rate remained at 12%, highlighting the industry's adaptability amid ongoing pandemic challenges.

Blank sailing reached a post-pandemic low in August 2021, but it increased again in 2022 as carriers adjusted their capacity to match the market conditions. Additionally, the Suez Canal blockage in March 2022, courtesy of the Ever Given container ship, caused widespread vessel delays and rippled through the shipping industry. Simultaneously, the Chinese New Year holiday in February 2022 reduced China's export volumes, leading carriers to cancel sailings for capacity adjustments. Furthermore, U.S. West Coast ports faced congestion, low productivity, high import volumes, labor disputes, and equipment shortages, prompting carriers to alter sailings to avoid delays and extra costs.

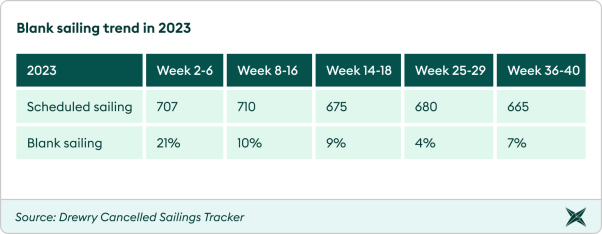

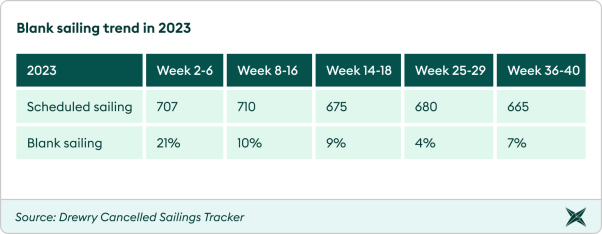

In 2023, there have been significant fluctuations in blank sailings across major shipping routes, reflecting the dynamic global shipping industry influenced by factors such as market conditions, disruptions, and demand patterns. Blank sailings peaked at 21% early in the year but dropped to 10% in weeks 8 to 12, indicating industry stabilization. Throughout the year, blank sailings remained low, reaching 4% in weeks 25 to 29, signifying a more consistent schedule.

Multiple blank sailings announced during Chinese Golden Week in early October:

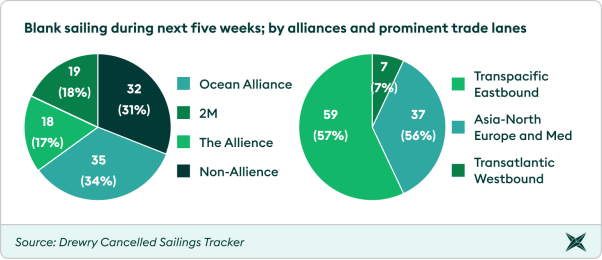

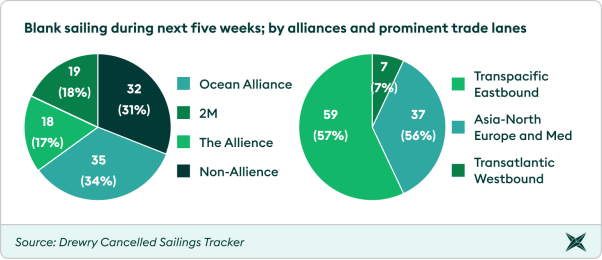

Members of the three alliances have recently declared several canceled sailings in both North Europe and the Mediterranean regions. These cancellations are scheduled from the beginning of October during the Chinese Golden Week holiday and will continue throughout the entire month. It is expected to increase to 16% in weeks 38 to 42 (Sep 18 to Oct 22), likely due to the holiday season. As spot rates keep dropping and demand stays weak before China's Golden Week holiday (October 1-7), which typically sees a surge in bookings before factory closures, ocean carriers are being forced to take drastic measures like adding more blank sailings.

Hapag-Lloyd, the leading line of THE Alliance, recently issued a customer advisory stating that the sailings scheduled for week 40, including the FE2, FE3, and FE4 loops to North Europe, which employ vessels with a capacity of 24,000 TEU, have been canceled due to anticipated decreases in demand. In the Asia-Mediterranean trade sector, THE Alliance (THEA) partners have decided to align with the 2M alliance and MSC's independent services by implementing significant capacity reductions on the route during the period spanning from weeks 40 to 43.

The extensive cancellations of sailings during the Golden Week holiday by all three major alliances on the prominent trade routes may result in challenges for shippers and forwarders trying to secure shipping space for exports from China to Europe in the upcoming month.

Future outlook

Looking at the broader picture, the global order book capacity nears 30% of the active fleet, surpassing 7 million TEUs. As per Drewry projections, 2.5 million TEUs of capacity will be delivered by the end of this year, with an additional 3 million TEUs expected in 2024. Hapag-Lloyd's CEO, Rolf Habben Jansen, anticipates that supply will exceed demand for the next 18 months, with analysts forecasting a 2% growth in global demand this year compared to a 4% increase in supply. In 2024, they foresee a 7% rise in capacity versus a 3% growth in demand.

It's worth noting that a substantial portion (~65%) of the ordered capacity comprises vessels with capacities exceeding 15,000 TEUs, primarily destined for the Asia-Europe trade lanes. The industry is witnessing the delivery of these megaships, such as OOCL's 24,188 TEU vessels and Ocean Network Express's 24,136 TEU ships. Even the 2M Alliance of Maersk and Mediterranean Shipping Co. has added two megaships to their service in early June.

To manage the oversupply of container ship capacity, carriers are likely to employ a combination of strategies, including slow steaming, scrapping older vessels, and blanking sailings. Slow steaming involves reducing vessel speeds to optimize fuel consumption, which can help balance capacity with demand. Scrapping older and less efficient vessels can permanently reduce excess capacity from the market. Blank sailings, a tactic commonly used during periods of low demand, involve canceling scheduled voyages to avoid flooding the market with excess capacity. These strategies, along with network and route adjustments, are essential tools that carriers can leverage to adapt to changing market conditions and maintain profitability in the face of oversupply.

Impacts on stakeholders

Blank sailing poses significant challenges for businesses reliant on maritime shipping. It disrupts product deliveries, potentially causing stock shortages, production delays, and customer dissatisfaction. The unpredictability complicates inventory management, and the lack of clear information about skipped ports and canceled schedules increases shipping companies' costs, highlighting the broad impacts on supply chain processes.

Shippers: Blank sailings, beyond causing shipment delays, also erode schedule reliability for shippers. This unpredictability forces shippers to adapt by either ordering goods further in advance or maintaining higher inventory levels, as the just-in-time supply chain model becomes less dependable. These adjustments inevitably lead to increased operational costs, which can contribute to inflationary pressures in the broader economy.

Furthermore, the consequences of blank sailings extend to the backhaul trade. When sailings are blanked on the headhaul, vessels and containers that would typically return with goods are missing. This unanticipated disruption in trade, which was not initially the focus of the blanking decision, introduces a new layer of complexity and uncertainty for shippers, compounding the challenges they face in maintaining a smooth and efficient supply chain.

Using shipper-owned SOC containers during blank sailings can have benefits compared to carrier-owned COC containers as SOCs increase control over container schedules, reducing demurrage and detention charges that often accrue during delays at ports. SOC containers offer flexibility for rerouting and reprioritizing shipments, optimizing logistics, minimizing rerouting costs, and reducing overall container leasing expenses, ultimately improving container turnaround times.

Port operators: Blank sailing directly affects port operations by altering the ship volume, impacting port personnel workload, disrupting planned sailings, potentially causing cargo flow interruptions, and having financial implications tied to port fee revenue linked to vessel frequency. Moreover, it leads to higher waiting times for shippers due to the "start-stop" scenario similar in a traffic jam, as the absence of a constant flow of vessels intensifies congestion issues at the port.

Container suppliers: Blank sailings disrupt container turnaround times and can lead to container imbalances (i.e., shortages in one location, surplus inventory in others). To address these challenges, companies may need to maintain a larger fleet to compensate for unpredictable disruptions, incurring higher operational costs and increased expenses associated with repositioning containers to balance inventory levels. Additionally, lower fleet utilization rates can lead to reduced revenue generation and potential financial strain for shipping companies, making it imperative to carefully manage and adapt to the impacts of blank sailings within the container shipping industry.

To sum up, blank sailings have far-reaching repercussions across the maritime shipping industry. They challenge businesses, shippers, port operators, and container suppliers alike, leading to increased costs, disrupted schedules, and supply chain complexities. To mitigate these effects, adopting strategies like using shipper-owned SOC containers and careful inventory management is crucial for maintaining resilience and efficiency in an ever-changing shipping landscape.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar