Shipowners can now access accurate estimations of financing terms in an instant thanks to the upgraded tool released by oceanis, the Hamburg-based ship finance company.

This industry-first tool, developed by oceanis, automatically predicts the loan terms available to Dry Bulk, Tanker, and Container vessels, providing shipowners with valuable insights into their financing options.

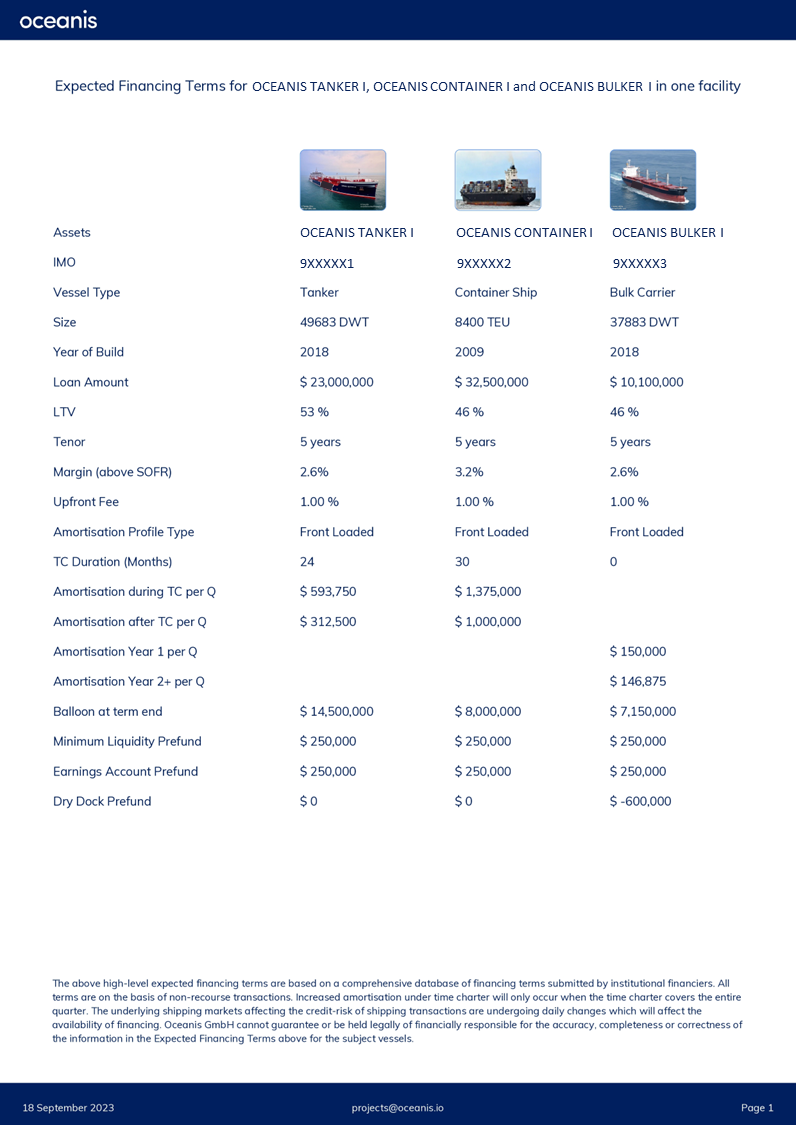

The upgraded version of the tool requires as few as five inputs to generate a reliable estimation of loan terms. Shipowners simply need to provide the vessel's (IMO) number, Fair Market Value, the requested Loan-to-Value (LTV) ratio, employment status, and specify whether the loan is for an acquisition or a refinancing. By inputting additional information such as charter rates and durations or operating costs, shipowners can further enhance the accuracy of the predictions provided.

“We are thrilled to introduce this product to the maritime community,” stated Erlend Sommerfelt Hauge, co-founder of oceanis. “Our aim is to streamline ship finance by providing shipowners with the most relevant information available; this simple and efficient tool does exactly that. With the support of oceanis, shipowners can make better-informed decisions, optimise their financing strategies, and ultimately unlock new opportunities for growth.”

Sommerfelt Hauge added, "A common theme in the financing markets are shipowners looking to benchmark their financing terms, to either confirm they sit with a strong offer, or to seek an improvement. Having a simple validation tool providing guidance on this, we hope is appreciated by the market."

The new prediction tool uses extensive data analysis of the more than $6bn in terms submitted via the oceanis platform, estimating terms based on available cashflows to deliver remarkable accuracy. While the results generated by oceanis will perfectly match the exact loan terms available from any individual bank, they have proven to be pleasingly accurate during extensive testing.

“The loan margin calculation has shown itself to have a lower difference to the market-best than the margins offered by lenders on an individual financing,” explained Will Robinson, Investment Associate and one of the designers of the tool. "This feature sets oceanis apart, making our tool potentially more informative than simply asking one banker for what their best loan terms in the market are."

By providing shipowners with reliable predictions of loan terms, oceanis aims to increase transparency in ship finance markets and ensure that shipowners are finding the best possible financing terms for their fleet.

Given the outputs provided, shipowners can now explore various scenarios and evaluate the financial implications of different loan terms, empowering them to negotiate with greater confidence and secure financing arrangements that best suit their needs.

The introduction of oceanis' prediction tool comes at a critical time when shipowners face numerous challenges in the global shipping markets. With volatile freight rates, regulatory complexities, and increasing environmental considerations, access to accurate and timely information is paramount for successful financial planning and strategic decision making.

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar