For the first time in the modern era, China owns the world’s largest merchant fleet in gross tonnage (gt) terms. China’s GDP forecasts growth is below the official 5% target, and there is fear of China’s potential deflation to slow its momentum further. Globally, it is increasingly believed a recession can be avoided as inflation eases and growth persists; however, it’s far too early to declare the end of inflation. The strong US economy forces investors to rethink interest rates. Consumption data shows global efforts to cut carbon emissions could drive economic growth.

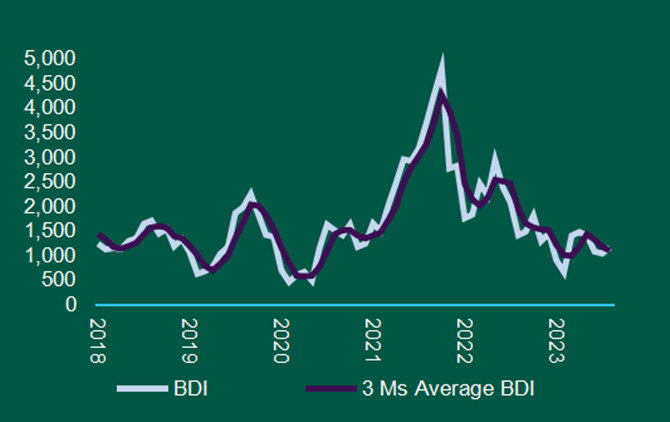

China's Investments in the real estate sector experienced – for the first time since 1997 – negative growth of 10% in 2022. China real estate is one of the biggest drivers of the seaborne iron ore trades, and it could put some potential pressure on demand. The charter rates may remain low for the time being. Until the supply side can reduce tonnage by increasing demolish. OSM Thome wins ship-management deal for six ammonia-fuelled new builds.

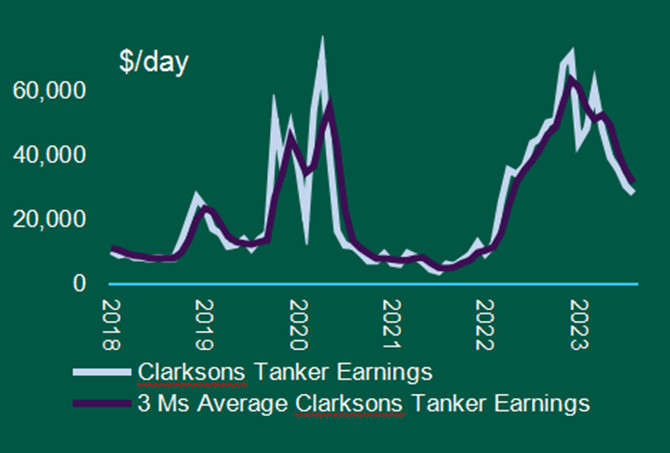

The tanker charter markets dropped down quickly as oil demand softened over concerns about China’s slow economic recovery. ESG is driving Japanese shipowner Mitsui OSK Lines (MOL) and is ordering more LNG dual-fuel VLCC new builds. Asset and refinery, Hong Kong-based owner Landbridge, has declared a purchase option on a VLCC. As earnings are low, Shipping Corp of India (SCI) has demolished its aging MR1 product tanker M/V Sampurna Swarajya.

Containership:

Blanked sailings are now ‘part of normal container shipping business life’ as heavy delivery and reduced demand hit the markets. Hapag-Lloyd shows interest in HMM takeover, as well as four other Korean firms. Meanwhile, wealthy container owner Evergreen buys into Rotterdam’s Euromax terminal. Mediterranean Shipping Co (MSC) has returned to China’s Zhoushan Changhong International Shipyard for more LNG dual-fuel containerships.

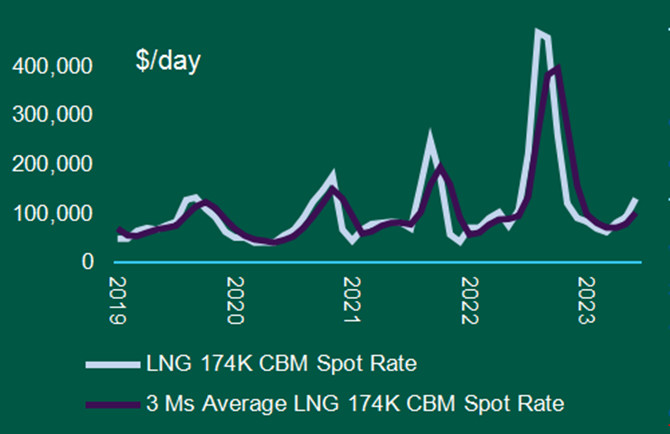

Gas carrier:

The US is set to continue to lead global liquefied natural gas (LNG) liquefaction capacity additions, contributing 46% of the total LNG liquefaction capacity additions between 2023 and 2027. China, the world’s largest LNG buyer, lays out plans to double import capacity. Jiangnan Shipbuilding, a subsidiary of China State Shipbuilding Corporation, has started construction of a new port facility to enable the construction of 175,000 cbm LNG carriers.

Offshore:

North Sea large-size PSV earnings have reached their short-term high and are moving down now. Norway’s DNB Bank has offloaded 1m shares in New York and Oslo-listed offshore driller Seadrill. Miclyn Express Offshore (MEO) has announced a new award for one of its vessels in Saudi Arabia. Golden Energy Offshore was given a six-month PSV extension. Tor Olav Trøim has brought forward the delivery of two jack-up rigs under construction in Singapore.

Disclaimer

The above product summary provides a general overview of the terms and conditions of the insurance policy. It does not necessarily address every aspect of the policy terms. It is not the intended to be, and should not be, used to replace specific advice related to individual situation and this should not been seen as legal, accounting or tax advice. The coverage is subject to full terms, conditions and exclusions of the policy.

The views and opinions expressed are those of the author and do not reflect the official position of Oneglobal. The company and its employees hold no responsibility for errors of fact, market changes and/or any losses incurred as a result of the content obtained in this document. Any forecasts and/or trends reported are based on the author’s assumption which may vary from actual situation due to volatile changes. It does not warrant its completeness or accuracy and should not be relied upon. Users are recommended to exercise judgement and discretion while using this information.

Data Resource: FT, Clarksons, Splash 247, Xinde, Hellenic Shipping News

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar