US-based agricultural trader Cargill has ramped up a bio-bunkering program for its own shipping fleet and other shipowners as part of initial decarbonization efforts amid the industry switch to a multi-fuel, low-emission future, its top maritime executive said.

Some major trading houses, such as Cargill and Trafigura, have been seeking to reduce supply-chain greenhouse gas emissions in recent years via introducing alternative fuels to their bunker usage and sales.

In a recent interview with S&P Global Commodity Insights, Cargill Ocean Transportation President Jan Dieleman said the company has taken pragmatic and real steps towards maritime decarbonization with low-, zero carbon fuels.

“We are doing already a significant amount of biofuels,” said Dieleman, whose company operates around 570 dry blk carriers. “We are actually both a user and a producer of biofuels. That is why I think we went a lot faster than many other people.”

Over the past two years, Cargill has supplied 30,000-35,000 mt of marine biofuels to its operated fleet and external customers across various shipping segments, including liner operators, according to Dieleman.

The waste-based fuels were supplied at ports including Singapore, where the B24 grade with a biofuel blending ratio of 24% was bunkered, and Rotterdam and Amsterdam, where B30 was the common type.

“I would be surprised if we are going to be much less than 50,000 mt this calendar year,” said Dieleman, referring to the accumulated volume of the bio-bunkering program.

Pure Marine Fuels, Cargill’s bunker agent business launched in partnership with Maersk Tankers in 2021, has shouldered the main responsibility of sourcing the biofuels. Its supplies have come from Cargill’s own plant in Ghent that can produce 400,000 mt/year of fatty acid methyl esters and external producers.

Looking forward, Pure Marine will aim to facilitate supplies of other green marine fuels — such as methanol — whose availability is limited, Dieleman said.

Multiple fuels

Cargill has chartered four methanol-capable Kamsarmaxes methanol-capable Kamsarmaxes due for delivery in 2025-26 on a long-term basis. Those are set to be some of the world’s first bulk carriers that can run on the alternative fuel.

Global methanol supplies are mainly produced from fossil fuels, but Dieleman said Cargill aimed to burn “green methanol” based on biomass or renewable hydrogen that can be carbon-neutral but is yet to be produced at scale.

The company went ahead with the charter project without securing any supply, as it sought to “give the demand signal and stop [just] talking about ambition,” Dieleman said.

Separately, Dieleman said ammonia also has a role to play in the future bunker mix, but that its propulsion technology “is probably a little bit further away” from being mature.

In their reference case, S&P Global Commodity Insight analysts expect methanol to make up 0.8% and ammonia 0.3% of global bunker consumption in 2030. LNG is forecast to be the most popular alternative fuel, with a 7.8% share.

But industry estimates suggest LNG can reduce CO2 emissions only by 20%-30% versus oil-based fuels, and Dieleman said ship operators could shift to bio-blends on a drop-in basis to achieve similar decarbonization effects without having to make capital investment on LNG propulsion.

“The capex and the cost involved … We could not make the numbers work,” Dieleman said.

Pricing differentials

Like many other shipping professionals, Dieleman suggested a key to maritime decarbonization would be to find companies willing to pay for ‘green’ freight services as sustainable fuels cost more.

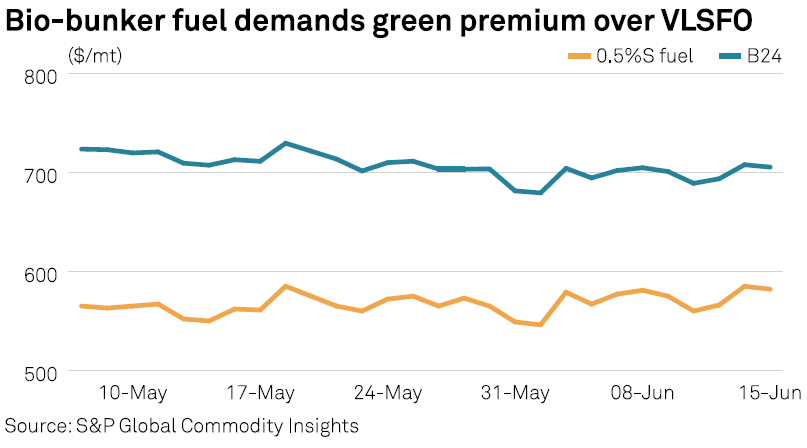

Platts, part of S&P Global, assessed the B24 bio-bunker fuel price at $705.24/mt in Singapore June 15. The 0.5%S marine fuel, the prevalent bunker fuel also known as very low sulfur fuel oil, was assessed at $582/mt.

“We are trying to find some of the smaller segments in the market … [that are willing] to pay green premiums,” said Dieleman, citing green steel as an example.

Regulators can also put a cost on GHG emissions to close the pricing gap. The EU will extend its Emissions Trading System to cover shipping from 2024, which “is helping a little bit”, Dieleman said.

Having traded EU emissions allowances for over 15 years, Cargill hopes to use its capability to help its freight customers and other shipowners to manage the regulatory risk, according to Dieleman.

“A lot of people do not really understand the price volatility on the ETS, which is actually quite substantial.”

Having hit an all-time high Eur100.23/mtCO2e ($108/mtCO2e) on Feb. 27, the nearest-December EUA price fell to Eur78.72/mtCO2e on June 1 before recovering to Eur93.26/mtCO2e on June 15, according to assessment by Platts.

In early July, the International Maritime Organization is set to finalize new emissions targets and regulatory frameworks, which could include a global carbon levy on bunker consumption. Dieleman said a $100/mtCO2 levy could be required to accelerate decarbonization.

“But I do not think you need to be there from day one … I hope that we are coming out of MEPC 80 with a raised ambition and a clear regulatory pathway,” Dieleman said.

“If we have a global regulation, I think it will be a lot easier to bridge the gap on the green premium.”

Source:

Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar