As expected, Russia did not extend the grain export corridor as their long list of demands were not met. Ukraine’s seaborne grain exports will cease until a new agreement is signed.

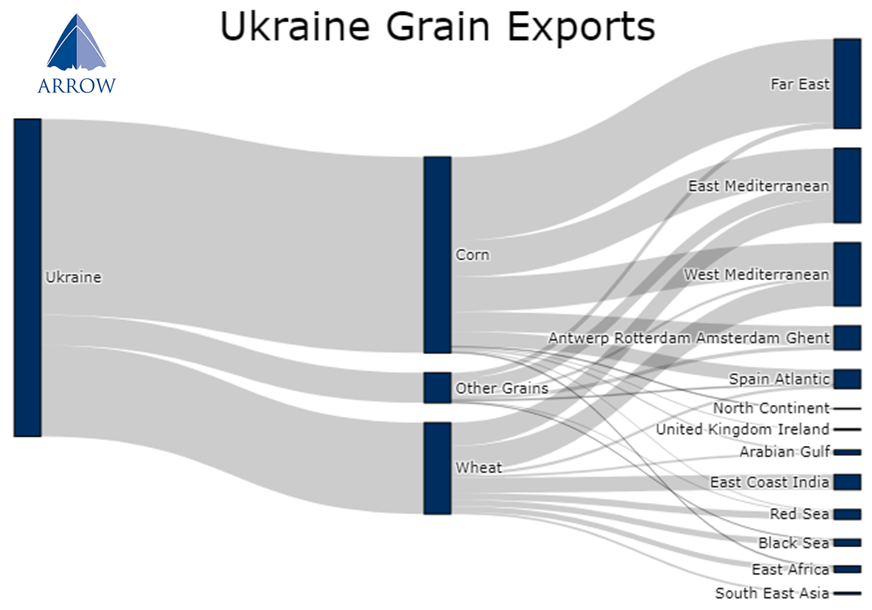

Looking at the tonne-mile demand impact for the different vessel classes, Ukrainian grains represents 1.6% of Panamax demand so far this year, 0.4% for Supramax and 0.6% for Handysize.

Whilst 1.6% may sound like a small amount for Panamax, this is a sizable chunk of demand. So far this year total Panamax tonne-mile demand is up 2.2% - so the loss of these cargoes could erode much of the Panamax demand growth we have seen year-to-date.

For Supramax and Handysizes, it's a small portion of demand, but it comes at a time when rates are already sliding lower, worsening the demand picture.

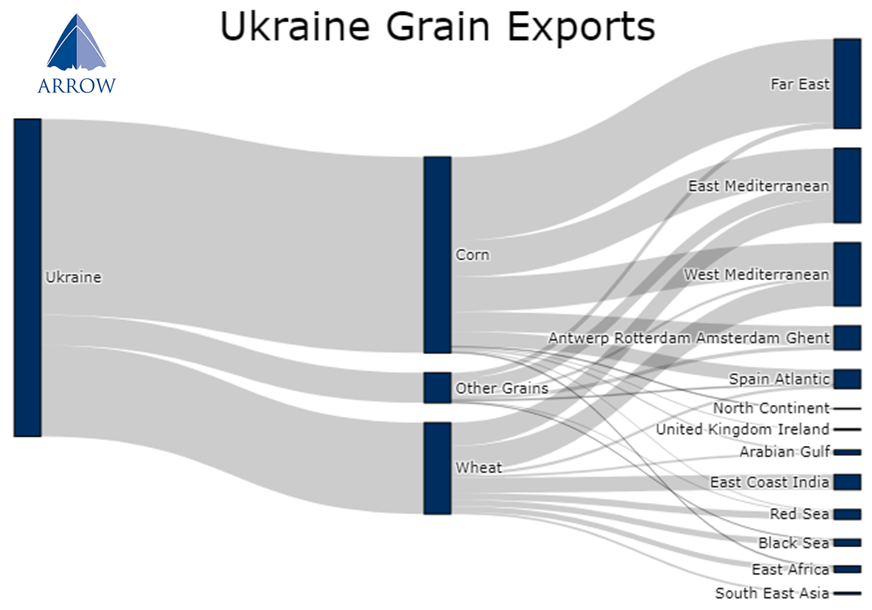

Ukraine’s key grain exports are corn and wheat, heading primarily to the Med & the Far East.

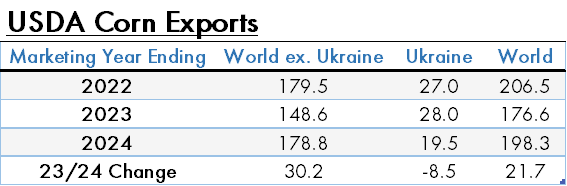

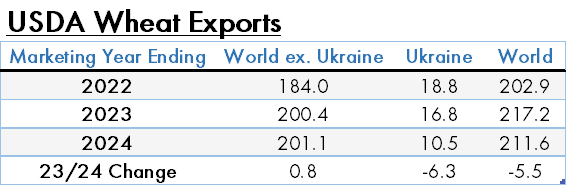

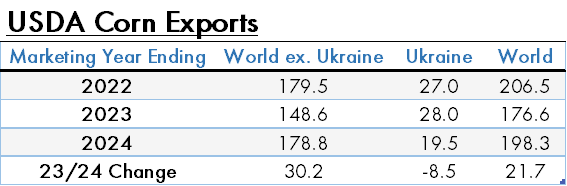

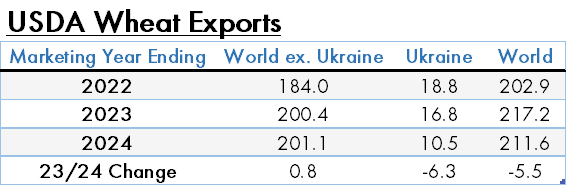

The latest USDA forecasts which were released 12th July points to Ukrainian exports dropping, but not collapsing. It’s unclear the extent to which they have factored in the grain deal ending within their forecasts. But it should have been factored in as on the date of the report being released it was highly anticipated the deal would end. We will be keeping a close eye on next month’s USDA update.

Although the loss of Ukrainian cargoes will likely reduce global volumes, the rest of the world is expected to more than make up over the coming marketing year. World corn exports are forecasted to be up 21.7mt whilst wheat down just 5.5mt.

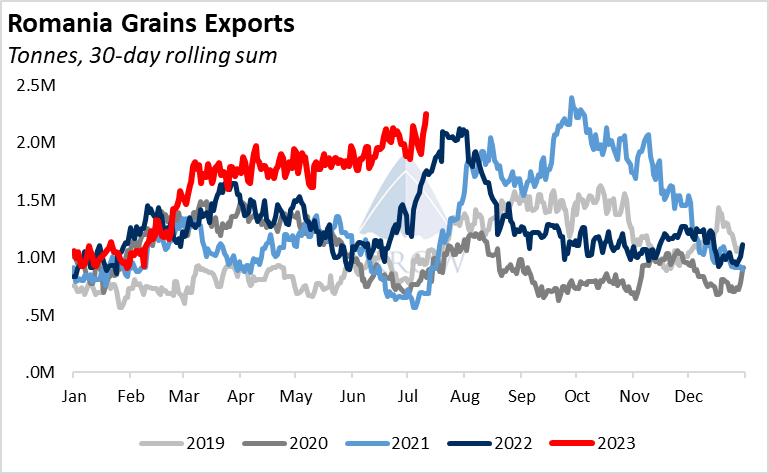

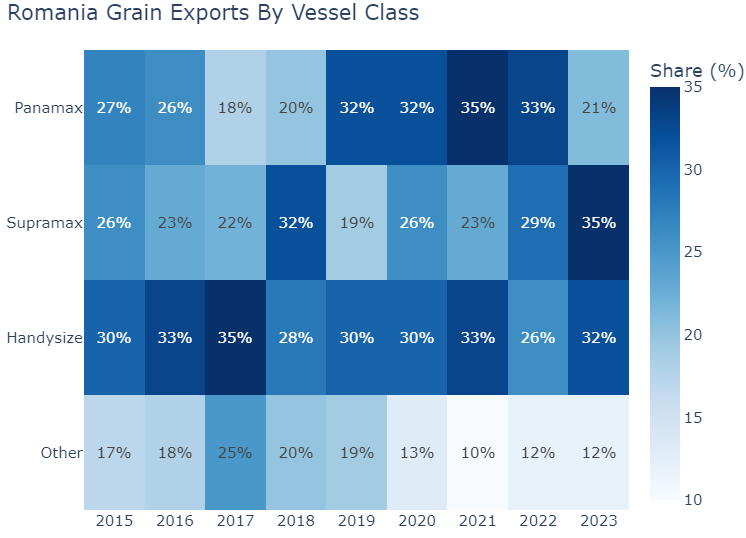

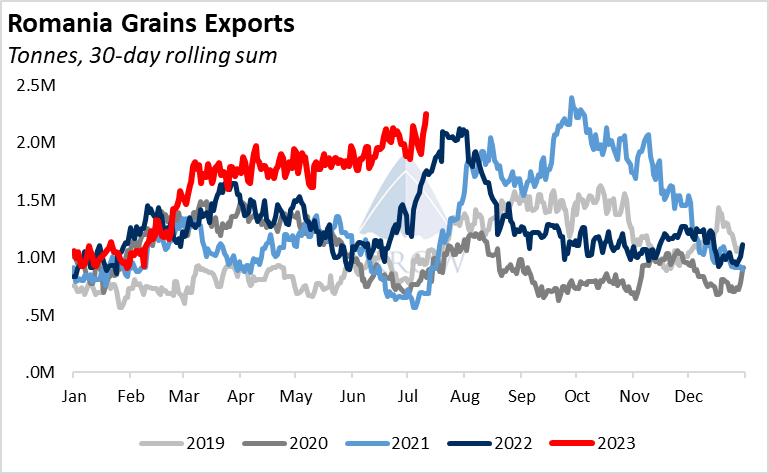

Romania has been handling about a third of Ukraine's grain exports since the war started, and it’s likely we will see many more cargoes head through this export avenue going forward.

The cost of transportation from inland Ukraine to Romania is high, which reduces the competitiveness on the global market. However, it’s clear that Ukraine will aim to export as much as possible. In the coming marketing year their corn supply is expected to be around 26 million tonnes, whilst their domestic consumption is under 6 million tonnes, which leaves a massive amount of grain they must export. FOB Ukraine Danube corn prices are currently $198/mt whilst FOB Brazil is $232/mt, and FOB Constanta is $230/mt – the economics line up and should keep the grain flowing from both the Danube and Constanta.

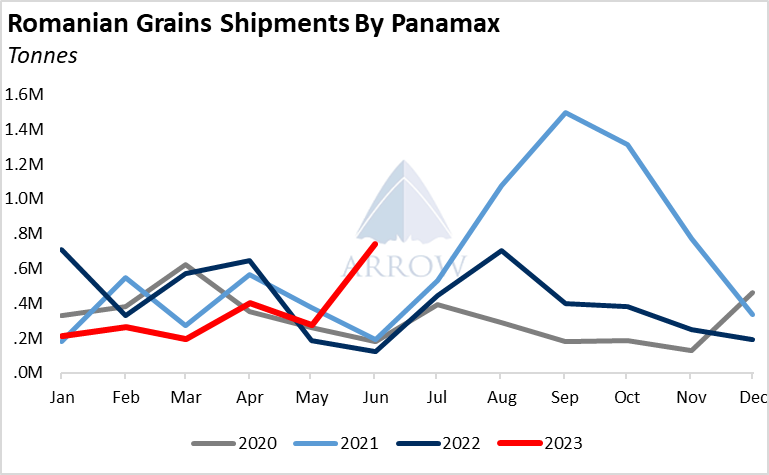

Typically at this time of the year, Romanian grain shipments dip as the last cargoes of the previous crop are shipping before the new harvest, but this year there is no dip and volumes keep climbing. It's unclear how the logistics network between Ukraine and Romania has evolved since the start of the war, but it's clearly improving.

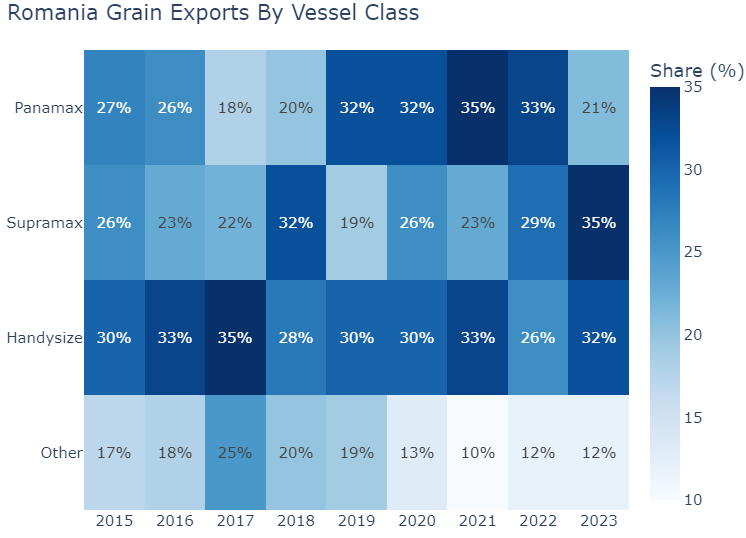

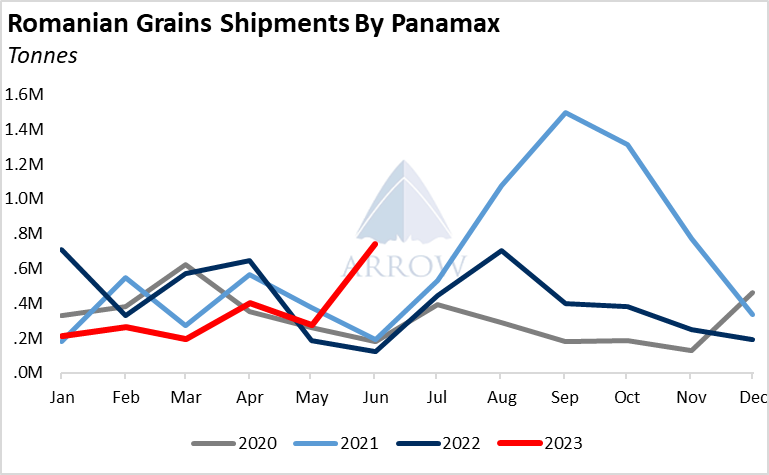

Over the first 6 months of the year, we have seen Panamaxes lose market share of the Romanian grain trade, as most of the incremental volumes have fallen to Supramax and Handysize vessels.

June data points to a surge in Panamax cargoes, however it’s not yet clear whether this is a blip or the start of a trend.

The Ukrainian grain trade is a small chunk of the overall dry bulk demand picture, however its loss will likely be felt more acutely for the Panamax segment. Global combined corn and wheat exports should rise next year as other exporters push higher, offsetting any loss from Ukraine. Depending on how the logistics networks develop, Romania may be able to further increase its handling of Ukrainian cargoes, providing a deep-sea route to market.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar