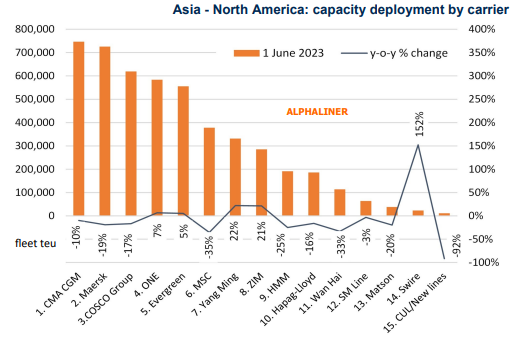

According to Alphaliner, the newest data shows that the average container slots have dramatically declined 23.3% with only 516,160 teu on average compared to the same period in 2022. However, the fleet capacity deployed between Asia and North America has only decreased 12.6% year on year, demonstrating the redeployment of the capacity from Far East - US West Coast to longer Asia - US East Coast routing which requires more ships to deliver the same amount of cargo.

Both large and relatively small companies have joined the trend. From the data, MSC obviously holds the leading position, withdrawing 35% of its capacity, followed by Wan Hai Lines with a 33% reduction. The newcomers which joined the route during the booming pandemic period will have again left it.

In June 2022, the fleet deployed by newcomers such as China United Lines (CULines), Sea Lead, Pasha, Transfar, TS Lines, BAL and Jin Jiang Shipping represented nearly 138,800 teu (or 2.5% of the total fleet), while until June this year, expect CULines which decide to remove its last 11,600 teu slots before the end of the month, no companies still engaged in the route.

Some carriers have surprisingly increased their capacity despite poor freight volumes and demand on the Pacific route, including ZIM(+21.3%), Swire Shipping (+152% as it took over the liner activities of Westwood), Evergreen (+5.3%), ONE (+6.7%) and Yang Ming (+22.2%).

Alphaliner added in the report that “more Asia-North America cargo is being routed via ports on the US East Coast”, and the Panama Canal routing remains the most popular for the headhaul leg from Asia to the East Coast, accounting for 70% of the total capacity.

Please Contact Us at:

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar