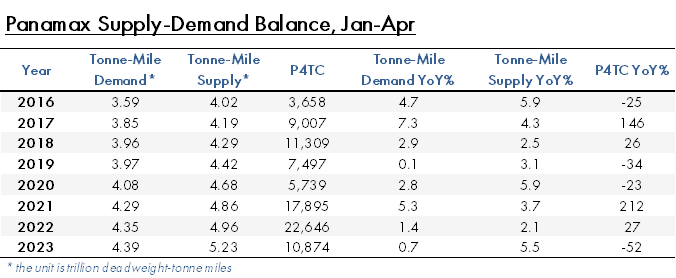

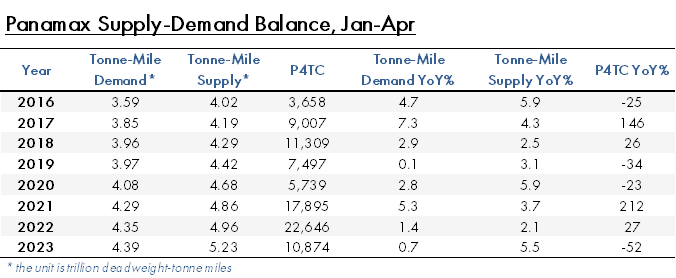

2023 has seen a much more cautious start for the dry bulk market than what we have experienced over the past 2 years. Cargo volumes have held up surprisingly well overall, but the net increase in tonnage supply has surpassed demand. While demand measured in tonne-miles was up by 5.8%, tonne-mile supply was up by 6.3% on average during the first four months of the year.

Each dry bulk segment is being affected by different factors, and the Panamaxes are seemingly facing the strongest headwinds.

Over Jan-Apr this year, we estimate Panamax tonne-mile demand has increased 0.7% versus last year, whilst tonne-mile supply is up 5.5%: this weakening of the fundamentals is driving rates lower.

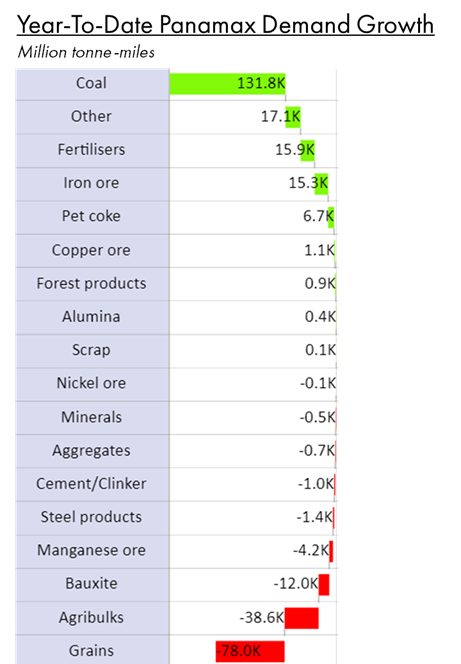

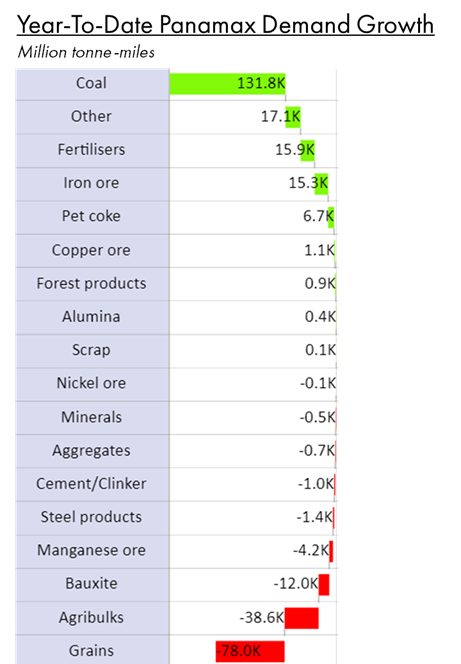

Coal tonne-mile demand has leapt higher this year, driven primarily by Indonesia, the Baltic and South Africa. However, it’s worth noting that most of the growth in Indonesia is due to base effects from the coal export ban in Jan 2022.

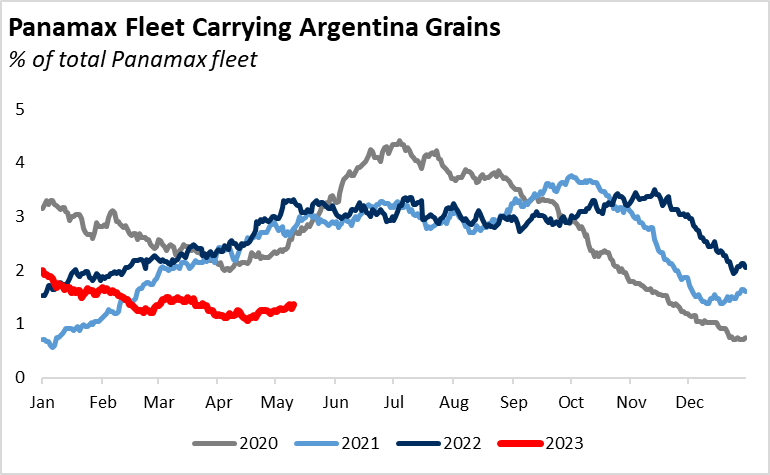

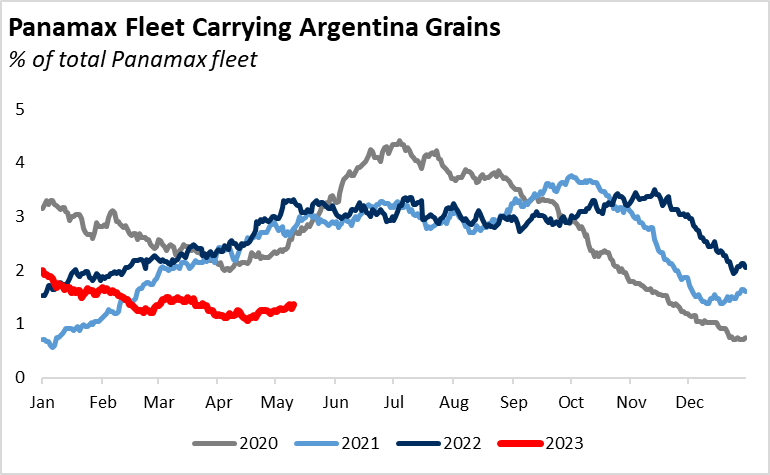

By contrast, grain tonne-miles took a big hit primarily due to the sharp drop in volumes out of Argentina. The drought earlier in the year has destroyed almost 50 million tonnes of grain. Considering about 48% of grain tonnes and over 60% of grain tonnes-miles out of Argentina is carried by Panamaxes, the impact on demand has been outsized. At this point in the year, typically around 3% of Panamaxes are carrying grains loaded in Argentina. That has dropped to just 1% this year.

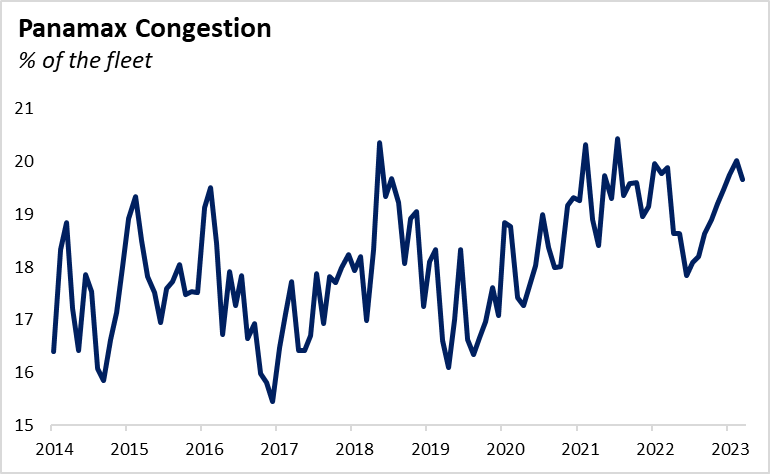

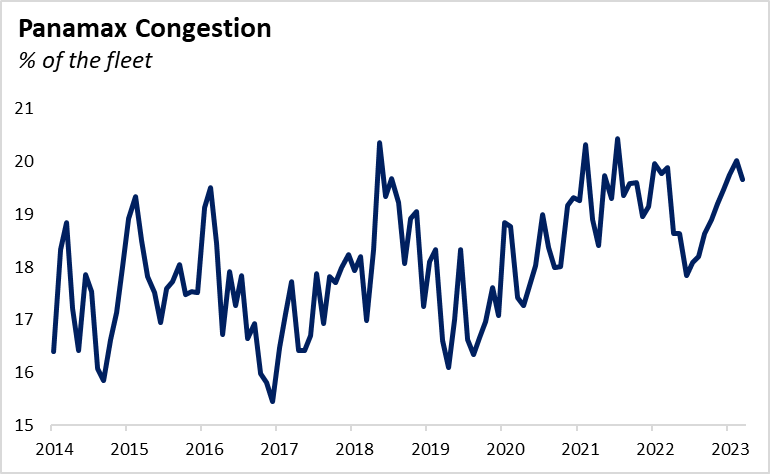

On the supply side, Panamax congestion has eased off the highs, however remains on the higher end of the typical range. We don’t have a strong view on how congestion will play out this year, however a return to more normal levels could see an extra percent or two of supply return to the market.

The FFA market is pricing Q3 around $12.5k, which is ahead of the 2011-2020 average. Looking forward, we agree with the cautious direction that the futures market points to.

We think that some headwinds will likely persist and act as a drag, primarily due to an anticipated slowdown in the western world.

While we are not expecting much growth in grain trades on an aggregate basis year-on-year, most of the weakness in shipments is now behind us and volumes should recover sequentially.

On the coal side, volume growth should remain solid whilst average distances have inched up due to reshuffling trade routes since the Ukraine conflict.

Fertiliser volumes should also remain firm as Russia has seemingly found new outlets for its products in China, India, Brazil and in the Middle East. Russia’s Panamax fertiliser shipments were up more than five-fold, although from a low base of 0.5mt in Jan-Apr last year to 2.9mt the same period in 2023.

And finally, strong iron ore volumes, particularly out of Australia which saw a 27% increase in Panamax shipments to China during the first four months of the year are set to support demand.

All in all, it is difficult to predict how the Panamax market will develop going forward in the coming months, as it will not only depend on the economic conditions in China and the West, but also the geopolitics and weather conditions in major grain producers. A strong Capesize market poses some upside potential to Panamaxes, whilst a further easing of congestion maintains a downside risk.

We think the slowdown in Panamax demand is largely behind us, however don’t envision any large tonne-mile demand growth on the horizon. Our outlook is cautious and aligns with the FFA curve towards the $13k level over the second half of the year.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar