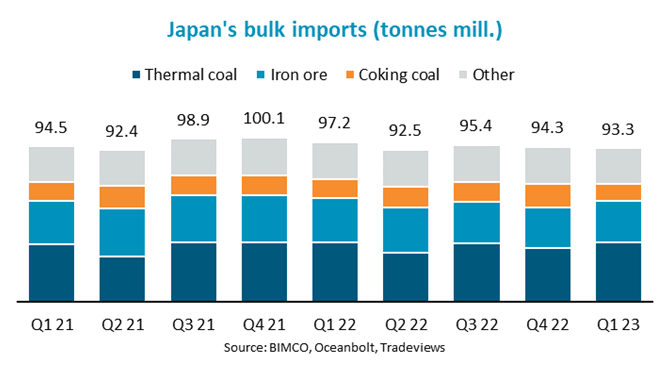

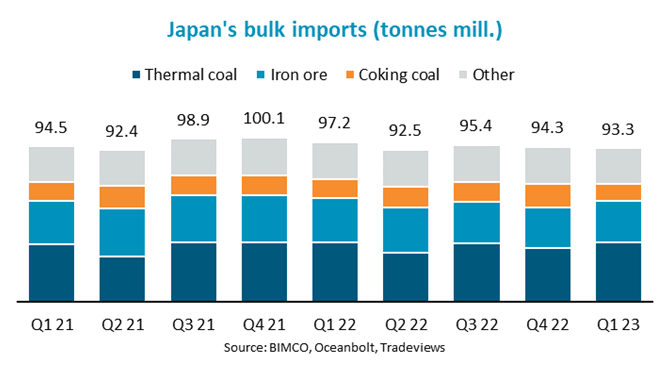

“Having narrowly avoided a recession in the fourth quarter of 2022, the Japanese economy appears to be recovering. However, Japan’s demand for steel remains weak and as a result, the country’s bulk imports are estimated to have fallen by 4% y/y in the first quarter of 2023,” says Filipe Gouveia, Shipping Analyst at BIMCO.

The steel industry in Japan relies on iron ore and coking coal imports, which combined account for 41% of the country’s bulk imports. Due to lower steel production in Japan, iron ore and coking coal imports fell respectively 6% and 9% y/y in the first quarter.

Activity in the construction and manufacturing sectors in the country declined during the quarter, causing a fall in domestic demand for steel. Japanese steel exports also declined amid weak global demand.

Accounting for 35% of import volumes, thermal coal, however, remains Japan’s largest import commodity, and combined the top three commodities make up 86% of bulk imports. Import of thermal coal remained stable in the first quarter, falling only 1% y/y. Thermal coal is mainly used for electricity production and is less sensitive to fluctuations in industrial production.

“Japan is the world’s second and third largest importer of respectively seaborne coal and iron ore. While less market defining than China, increased demand from the Japanese steel sector could still be key to further freight rate recovery in the coming quarters,” says Gouveia.

This is particularly true for the capesize and panamax segments as respectively 7% and 12% of their volumes are headed to Japan. This makes Japan the second largest destination for these ship types.

For Japanese bulk imports to recover, global economic conditions must improve. A pick-up in global economic activity would support a rebound in Japanese steel exports as well as a recovery in the Japanese manufacturing sector. Japan exports a third of its steel production while about a quarter is used in manufacturing.

“China’s economic recovery could be a catalyst for economic growth in the region. As Japan’s largest trading partner, an economic pick-up in China is likely to boost demand for Japanese manufactured products. In addition, an increase in steel exports from Japan to other Asian economies could soon follow,” says Gouveia.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar