SVB's collapse and continued increased lay-off of jobs in the USA could have a negative impact on consumer markets. Fortunately, China’s consumers rebounded back after the release of all covid restrictions, especially since a new government was coming into power this month, and markets are expecting incentive methods will be released to boom up the economy. Current decarbonization options for Non-LNG ship new buildings, methanol solution is in the leading position as its lower new building cost and bunker price, but subject to availability.

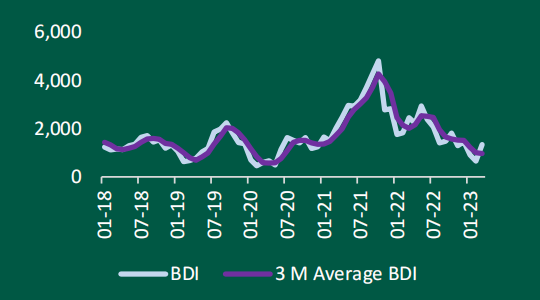

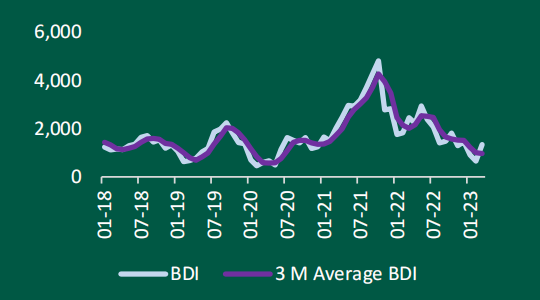

Bulk Carrier:

As the largest dry cargo importer, China’s steel output and coal consumption have shown continued growth since the beginning of 2023. To help its import resource, China has scrapped its ban on Australian coal. The increased demand from China gives support to the dry market. In the dry shipping capital market, China Qingdao ship owner Seacon Shipping Group has launched its IPO in Hong Kong and will raise over $60m from the stock market.

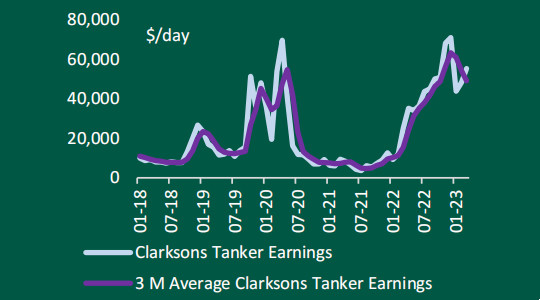

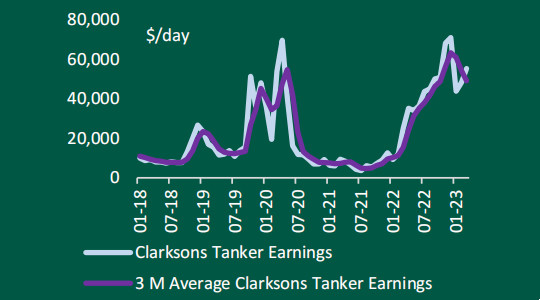

Tanker:

VLCCs charter rates are towards $100,000 a day. The tanker market is still in the up-moving. The market reacts positively; Scorpio Tankers, owner of over 110 ships, has repurchased six more ships. Nasdaq-listed Performance Shipping has signed a shipbuilding contract with Shanghai Waigaoqiao for the construction of LR2. The vessel will be LNG-ready and fitted with a scrubber, a ballast water treatment system, and a high-pressure selective catalytic reactor for Tier III compliance.

Containership:

The containership market continues to be under pressure for the moment. Meanwhile, large ships' delivery is accelerating and will further put pressure on the supply side. The market reacts with a mixed picture with increased numbers of sales recently. Fortunately, the containership is still leading the green initiative in shipping. 40% of new order books are dual-fuelled either by LNG or methanol; methanal has increased from 1% in 2022 to 12% this year.

Gas carrier:

The charter market is strong as the war between Russia, and Ukraine has made countries diversify their LNG import resource. LNG shipyards are fully booked for the next few years. It has pushed LNG's new building price from $190m in early 2022 to over $250m now, with the delivery after 2027. Greek Angelicoussis ordered two ships in DSME, and BW Epic, a Singapore-based owner with 69 ships, sold a number of old ships as new buildings joined the fleet.

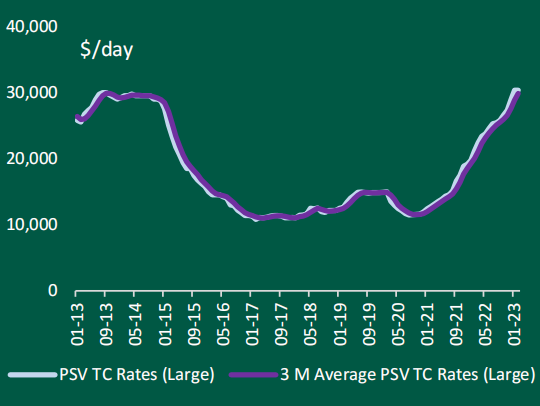

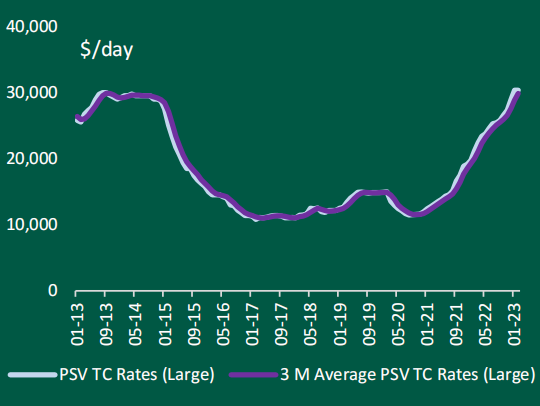

Offshore:

The offshore market is enjoying the high energy price, which makes investment in this sector more attractive. Meanwhile, many countries are continuing to develop offshore wind farms. Marine construction player Ocean Installer, has won a contract from Equinor for the installation of cables on the Hywind Tampen offshore floating wind farm in Norway. The Welsh government has granted consent for the country’s first floating wind farm being developed by Blue Gem Wind.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar