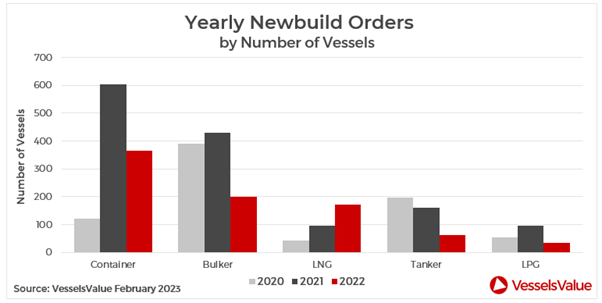

Containers remained popular in the first half of 2022 where freight rates reached an all time high, accounting for the highest number of vessels ordered by subtype, with 358 orders placed. By the second half of the year, sentiment for this sector had cooled off considerably and newbuilding activity slowed. In 2021, with an ageing fleet and after years of dwindling earnings for these assets, owner investment in newbuildings was seen as a sensible use of increased revenue. But by 2022, yard slots were becoming harder to come by, and by the second half of the year the outlook was much more muted. This is due to easing port congestion and a slowdown in the global economy, which had dulled consumer sentiment and therefore interest in Container orders.

Despite 2022 seeing a drop from the exorbitant number of vessels ordered in 2021, where 602 Container orders were placed to 364, this is still an increase of more than 200% from 2020 levels. 2022 Boxship orders amounted to USD 39 bn, 44% of the year’s total, surpassing the combined number of Tanker and Bulker for that year. Once again, Asia accounted for the majority of 2022 Containership orders with Taiwan, China, Singapore, South Korea, and Japan ordering 153 vessels between them, 43% of the global total. However, the biggest orders in this sector came from Switzerland, where Container owner and operator MSC placed 60 orders ranging from 8 to 16,000 TEU, with orders placed both in South Korean and Chinese yards.

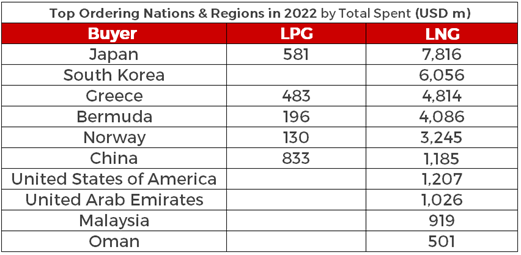

Figure 4: Top Ordering Nations & Regions in 2022 for LPG and LNG by total spend

The LNG sector saw a c.79% increase in vessels ordered YoY from 96 in 2021 to 172 in 2022, totalling USD 31 bn. Despite a marginal increase in Gas orders overall, the value of newbuilding orders in 2022 soared to USD 35 bn, over four times the value of orders placed in 2020, indicating a significant firming in newbuilding prices. Soaring demand for LNG carriers is being fuelled by a global push towards green energy alternatives. With LNG having a smaller carbon footprint compared to traditional hydrocarbons, it is seen as a promising transition energy source.

As a result, newbuilding values for large LNG carriers of 174,000 CBM are up c.26% YoY from USD 205.14 mil to USD 257.78 mil. Some of the main market participants have been MOL, NYK Line, Global Meridian and Knutsen OAS ordering up to 20 vessels each so far this year. However, high steel costs and low yard availability have also led to increased prices for LNG newbuildings this year.

Over the course of 2022, geopolitical uncertainty has also had an impact on demand for Gas carrying vessels. LNG values have continued to strengthen, spurred by skyrocketing earnings that have surpassed last year’s record breaking peaks. In November, LNG rates peaked at a record high of 466,524 USD/Day from the Baltic Exchange BLNG1g assessment, pushing up LNG values. Demand for LNG carriers has increased exponentially this year due to the energy crisis in Europe. As a result, the EU is attempting to reduce its reliance on Russian gas, following the conflict with Ukraine. Demand for seaborne LNG imports has surged as Russia steadily cuts gas flows from pipelines, forcing many countries in Europe to turn to floating storage units.

Japan led the way in terms of 2022 LNG sector investment, knocking Greece from the top spot. They take the lead for LNG orders totalling 44 vessels, worth c.USD 6.5 bn an increase of c.309% YoY in terms of value.

Headline orders:

·21st December: 2 Large LNG carriers (174,000 CBM, 2026, Hyundai Samho Heavy Ind) ordered by Asyad Shipping for USD 250.39 mil each

·10th November: 2 Large LNG carriers (174,000 CBM, 2026, Samsung) ordered by Minerva Marine for USD 215.49 mil each

·28th April: 6 Large LNG carriers (174,000 CBM, 2025-2026, Hudong Zhonghua) ordered by NYK Link for USD 200 mil each

·7th January: 6 Large LNG carriers (174,000 CBM, 2024-2026, Hudong Zhonghua) ordered by MOL for USD 196 mil each

LPG

LPG orders fell in 2022 with just 35 new orders places, compared to 97 in 2021, a decline of c.64%. China and Japan both ranked first, both with eight orders placed in 2022. Almost all Chinese orders were in the VLGC sector, whereas Japanese investment was split between VLGCs and the full press sector. Therefore, China led the way in terms of value, doubling their investment YoY to USD 870 mil and knocking South Korea off the top spot.

Almost half of 2022 LPG orders are scheduled to be built in South Korea, accounting for c.46% of orders. China followed second, accounting for c.35% of orders, the remainder of orders were placed in Japanese yards, accounting for c.19%.

Some key market players who have recently placed new orders include, Evalend Shipping who placed five orders for LPG carriers over the course of 2022, all scheduled to be built in South Korea. Exmar placed four new MGC LPG orders to be built in South Korea, and Pacific Gas, who placed four VLEC orders that will be built in China and scheduled for delivery in 2025.

·30th November: 2 VLEC carriers (99,000 CBM, 2025-2026, Hyundai Heavy Ind) ordered by Iino Lines for USD 150.17 mil each

·10th February: 2 VLEC carriers (99,000 CBM, 2025, Jiangnan Shanghai Changxing) ordered by Wanhua Chemical for USD 128 mil each

Figure 5: Newbuilding Orders by Number of Vessels from 2020-2022

Conclusion

The Gas carriers were the big winners in 2022 with a record breaking year, both in terms of the number of vessels ordered and the total value. The 2022 values were four times the value of orders placed in 2020. Environmental pressures, the ongoing energy crisis and the conflict in Ukraine have pushed up freight rates, encouraging investment in Gas carriers to sure up global energy supply chains, with a focus away from traditional dirty fossil fuels such as oil and coal. This had a negative effect on Tanker and Bulker newbuilding orders; despite sky high demand for Tankers, Gas orders have diverted newbuilding activity away from these sectors due to higher vessel values for this sector and the likes of Containerships.

It is not yet clear how vessel ordering over the last few years will impact the supply and demand balances across various markets. Whereas Bulkers and Tankers will no doubt benefit from tight vessel supply due to the limited availability to place new orders, combined with an ageing fleet, the Container and Gas sectors will see a deluge of orders hit the water, placed at a time when earnings were at record highs. It remains to be seen how this will impact these sectors as the vessels deliver over the next few years.

Source: VesselsValue

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

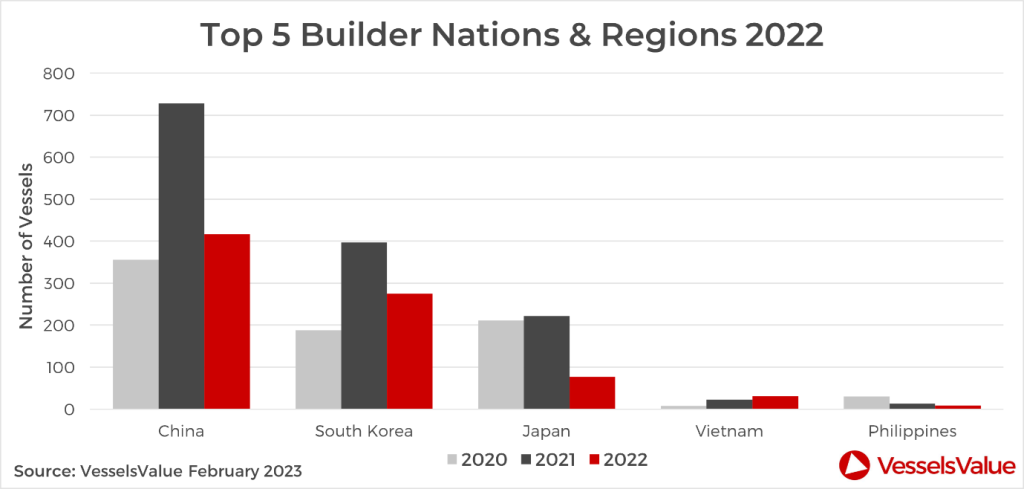

Figure 1: Top Builder Nations & Regions by Number of Vessels

Figure 1: Top Builder Nations & Regions by Number of Vessels

Figure 3: Top Bulker Ordering Nations & Regions in 2022 by Number of Vessels

Figure 3: Top Bulker Ordering Nations & Regions in 2022 by Number of Vessels

Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  BIMCO Shipping Number of the Week: Bulker newbuildi

BIMCO Shipping Number of the Week: Bulker newbuildi  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar  Ningbo Containerized Freight Index Weekly Commentar

Ningbo Containerized Freight Index Weekly Commentar